Nvidia shares edged higher in late Thursday trading after the world's biggest company posted another impressive set of quarterly earnings figures, tied to what it called "staggering" demand for its AI-powering chips, that were somewhat offset by a muted near-term revenue outlook.

Wall Street analysts, however, are largely in agreement that Nvidia (NVDA) will continue to dominate the market for so-called AI accelerators, which drive the advance of the massive datasets at the heart of the world's hottest technology, even as supply-chain snarls tame its ability to meet that demand.

Nvidia estimated revenue for its fiscal fourth quarter, which ends in January, in the region of $37.5 billion, only modestly ahead of Wall Street's $37.1 billion forecast and a figure that would represent the slowest pace of growth in nearly two years.

Finance chief Colette Kress said shipments of the group's new Blackwell line of chips and processors were scheduled to begin soon, but she warned that supply constraints would likely linger well into the coming year.

"We will be shipping both Hopper and Blackwell systems in the fourth quarter of fiscal 2025 and beyond," Kress said in her commentary letter released alongside the earnings report.

"Both Hopper and Blackwell systems have certain supply constraints, and the demand for Blackwell is expected to exceed supply for several quarters in fiscal 2026."

That caution clouded the group's fiscal-third-quarter update, which included a 94% surge in overall revenue to a Wall-Street-beating $35.1 billion and net income of just over $19.3 billion.

Data center revenue, which includes the group's main AI effort, rose 112% from a year earlier to a record $30.8 billion thanks to the ongoing demand for its legacy Hopper chips and the shipment of 13,000 new Blackwell chips.

Blackwell 'in full steam'

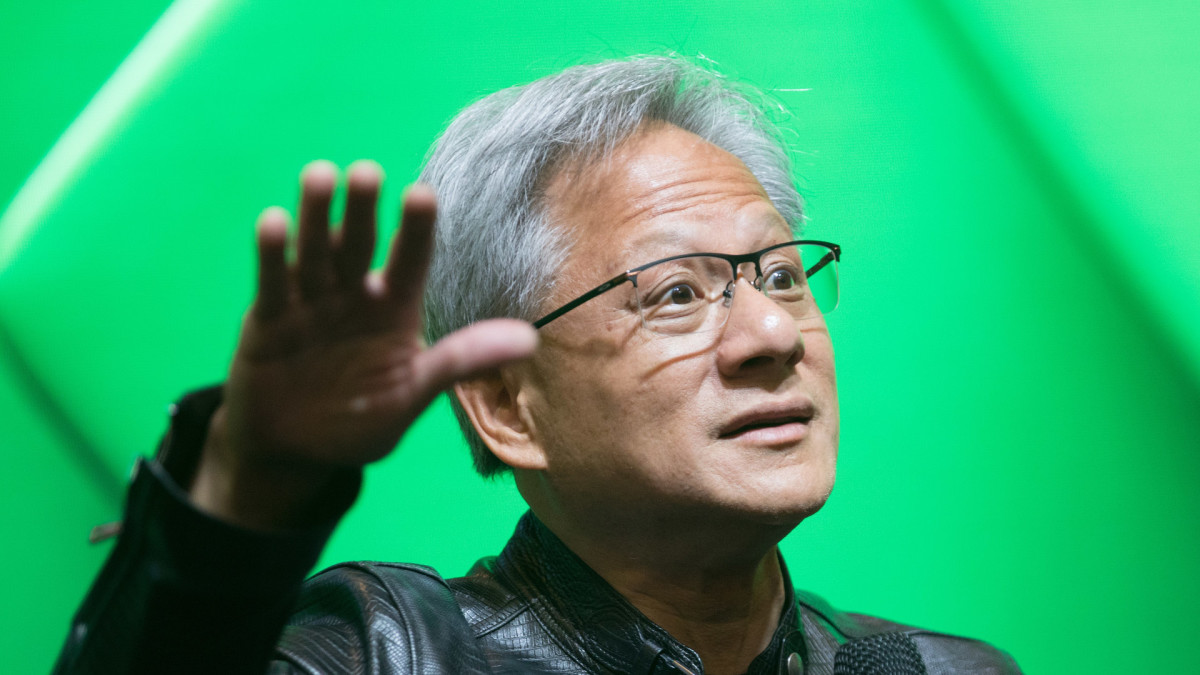

CEO Jensen Huang, however, told investors on a conference call late Wednesday that "Blackwell production is in full steam (and) in fact we will deliver this quarter more Blackwells than we had previously estimated" even with the supply constraints.

"The supply chain team is doing an incredible job working with our supply partners to increase Blackwell, and we're going to continue to work hard to increase Blackwell through next year," he added. "It is the case that demand exceeds our supply (and) Blackwell demand is very strong."

That longer-term confidence appears to be underpinning a host of price target changes from analysts on Wall Street Thursday, including from Toshiya Hari at Goldman Sachs, who lifted his by $15 to $165 per share following last night's update.

Related: Nvidia stock slides as outlook clouds massive Q3 earnings surge

Hari said that Goldman expected "growing demand for AI infrastructure across all customer groups (i.e. cloud service providers, consumer internet companies, enterprises, sovereign states), improving supply and gross margin normalization in [the second half of next year] and beyond."

Jefferies analyst Blayne Curtis, who added $35 to his Nvidia price target, taking it to $185 per share, also noted the group's positive commentary on both Blackwell demand and its ability to overcome supply constraints.

"This was never the quarter that Nvidia was going to blow out numbers, and we are not overly concerned with any of the issues on this call, as we see increasing beats as Blackwell ramps and still a path above $5 of EPS next year," Curtis said.

"The name will always struggle with elevated expectations, but business momentum should accelerate from here as Blackwell ramps and that has historically been the time to own the stock," he added.

Data centers in focus

Cantor Fitzgerald analyst C.J. Muse, who reiterated his $175 price target on Nvidia stock after last night's update, sees Blackwell shipments contributing more than the original assumption of $3 billion in current-quarter revenue. He added that it's "expected to accelerate much more meaningfully throughout [2025] and beyond.

"While not guided, we do anticipate April-quarter revenues to accelerate more meaningfully on a sequential [basis. And] this, combined with bottoming gross margins and accelerating back to the 75% in [the second half of next year], continue to support the bull-case vision for $200 billion-plus in data center revenues and EPS tracking to $5.50+ in [2025] when all is said and done."

Related: Nvidia earnings on deck as AI kingpin tightens grip against rivals

CFRA's Angelo Zino, who took his Nvidia price target $5 higher to $165 per share, said the Blackwell ramp would likely mean revenue from the new line overtakes that from legacy Hopper chips by the end of the April quarter.

"Geopolitical uncertainties remain a headwind, but we think Nvidia is better positioned under a Trump administration," Zino said. "We note net cash of $30 billion and see the annual [free cash flow] run rate eclipsing $100 billion by end-[2025], which we think supports more aggressive buybacks and potentially M&A."

AI transforming every industry

Other price target changes include Mizuho's Vijay Rakesh, who lifted it by $10 to $175 per share, and Needham analyst Rajvindra Gill, who took his $15 higher to $160.

"The age of AI is in full steam. Generative AI is not just a new software capability but a new industry with AI factories manufacturing digital intelligence, a new industrial revolution that can create a multitrillion-dollar AI industry," Huang told investors late Wednesday.

More AI Stocks:

- Analysts revamp Cisco stock price targets after earnings

- Analysts adjust Dell stock price target on AI momentum

- Shopify stock skyrockets ahead of the holiday season

"AI is transforming every industry, company and country, and demand for Hopper and anticipation for Blackwell, which is now in full production, is incredible," he added.

Nvidia shares were marked 0.66% higher in mid-afternoon Thursday trading to change hands at $146.85 each, a move would still leave the stock up more than 195% for the year and at a market value of around $3.5 trillion.

Related: Veteran fund manager sees world of pain coming for stocks