Gold dominated 2025's performance among traditional financial assets with an annual return of roughly 60%, the highest in nearly 50 years, surpassed only by silver and palladium.

2025 YTD Returns (as of December 20):

- Silver: +114% ($62/oz), all-time high broken

- Platinum: +96%

- Gold: +60%

- Palladium: +45%

- Bitcoin: +42% (for the first time since 2018, it underperformed gold in percentage terms)

- Copper: +32%

- S&P 500: +12%

- Nasdaq: +15%

- US 10Y bonds: -8%

- US Dollar Index: -5%

If we looked at the following chart without knowing it shows the monthly history of gold and silver, we'd think it was tracking some cryptocurrency bubble or exotic derivative.

This isn't the first time precious metals have shown extraordinary returns. As the chart shows, the price of gold, along with the silver price, accelerated sharply around 1979 and 2011, reaching exceptional levels quickly. In both cases, prices subsequently crashed, though the long-term uptrend remained intact. However, it took 30 years to return to the peaks touched in 1979.

Today, in real terms — adjusted for inflation — gold has never been this expensive. Is it destined to crash like any asset that climbs rapidly above its long-term trend, as happened in 1979 and 2011, or are we witnessing a paradigm shift?

It became conventional wisdom that gold moved inversely to long-term real interest rates. Its value collapsed in 2022 when central banks tightened monetary policy to fight post-COVID inflation, and bond yields rose. In the months that followed, though, even as inflation declined and bond yields increased, gold began growing exponentially.

Then, U.S. President Joe Biden's decision to freeze Russian currency reserves following the invasion of Ukraine in February 2022 shook the foundations of the international monetary system. It set a dangerous precedent: any country could have its foreign-currency-denominated assets digitally confiscated in the event of conflict. Central banks began searching for an asset that couldn't be seized, settling on the safe-haven asset par excellence: gold.

Over the past three years, central banks have purchased thousands of tonnes of bullion. Despite this, many central banks still hold relatively modest amounts of gold. JP Morgan believes the purchases will continue at least through 2026.

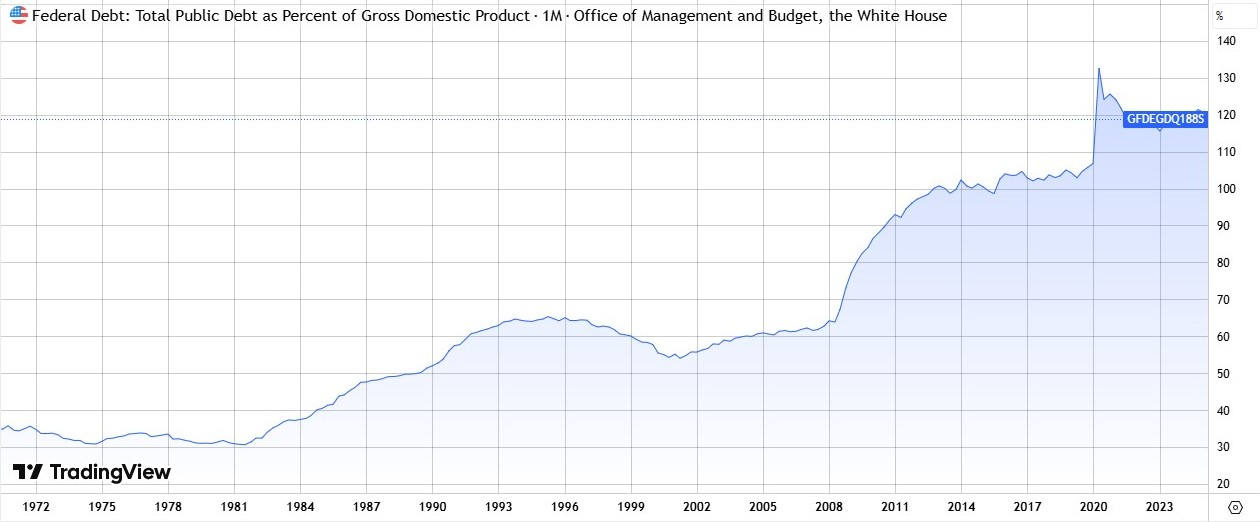

Moreover, the United States is now the world's largest debtor, with a triple-digit debt-to-GDP ratio and a fiscal deficit of 6% of GDP in recent years — roughly four times the size of the 1979 budget deficit. Following the COVID-19 pandemic, inflation has remained structurally above the Fed's 2% target. Despite this, the Fed cut rates three times in 2025, signaling that a higher inflation rate is now considered acceptable in the current economic context compared to past years.

The graph illustrates the significant rise in US public debt as a percentage of GDP from 1970 to the present.

So, it's not a single shock that has driven gold prices to explode — like the 1980 oil crisis or the Lehman Brothers collapse that sparked the 2011 peaks — but rather a convergence of factors.

Geopolitical tensions, wars, tariffs, the Fed crisis, U.S public debt, and the non-trivial demand for precious metals from AI chip manufacturers — all these elements paint a clear picture of a paradigm shift in the global economy and gold's role within it.

It's therefore simplistic to reduce gold's current price dynamics to a mere financial bubble, even though the exponential price acceleration looks like classic behavior of one.

That said, currently over 80% of surveys are bullish, and Google Trends searches for gold price forecasts are at all-time highs. ETF inflows in 2025 have been enormous (+$38b Q1 2025), and other precious metals, such as silver, palladium, and platinum, have also seen massive upward spikes.

The rally contains risk elements, such as retail FOMO and sentiment extremes, with likely downside and consolidation periods in 2026. However, without the vertical crashes seen in 1980. Sustainable support from central banks and other structural factors, as we have seen, would prevent a collapse.