The goals of China's 'Made in China 2025' program cannot be achieved, according to a report by DigiTimes that cites Wei Shaojun, a professor at Tsinghua University and Deputy Chairman of the China Semiconductor Industry Association. Not only will Chinese chipmakers not be able to satisfy 70% of the local IC demand in 2025, but their profitability, capitalization, and ability to invest in development are greatly behind those of their rivals.

In a recent address at the China Nansha International IC Industry Forum, Wei Shaojun pointed out that despite a rise in the value share of domestically produced chips from 13% in 2013 to 41.4% in 2022, the ambitious goal of reaching a 70% self-reliance rate for semiconductors, a key objective of the "Made in China 2025" initiative, seems nearly unattainable. That's due to the current global shifts that made both U.S. and Europe fund their semiconductor sectors from the governments' pocket.

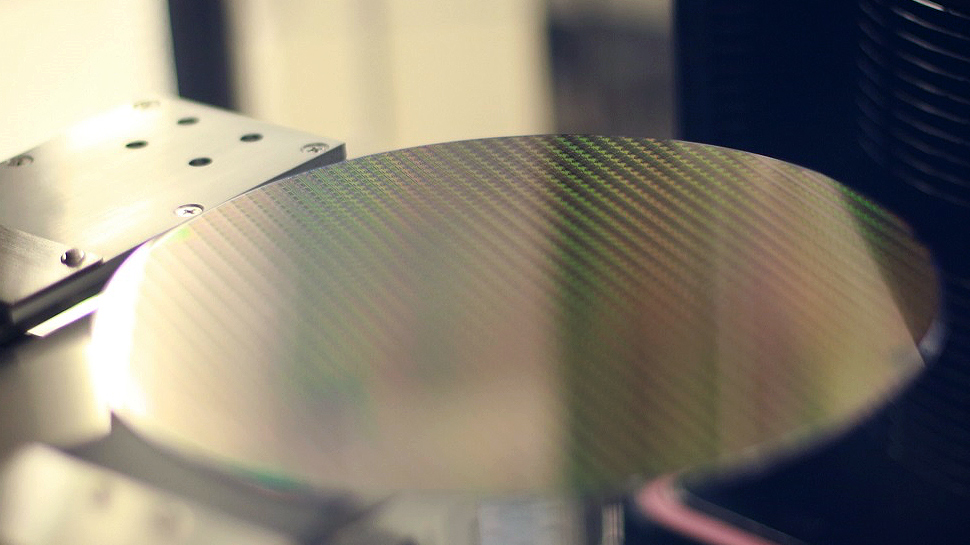

Wei highlighted an imbalance between supply and demand in China's IC design sector, pointing out that while the monthly demand of the country is about 1.5 million 300mm wafer starts per month (WSPM), domestically owned Chinese semiconductor producers can only provide a monthly output of 440,000 WSPMs.

The professor from Tsinghua University, an organization that has been particularly instrumental in the development of the local IC sector, underscored a critical misapprehension regarding the advancement of China's chip fabrication sector over the last ten years.

The accelerated growth of China's semiconductor production industry was largely due to foreign companies operating within the country. From 2016 onward, Chinese investor-owned semiconductor companies have experienced an average compounded annual growth rate (CAGR) of 14.7%. Yet, non-Chinese wafer fabrication enterprises from Taiwan, South Korea, and elsewhere, have seen a higher CAGR of 30%. This not only doubles the expansion pace of Chinese-owned businesses but also underlines the continued reliance on external assistance in China's semiconductor manufacturing industry.

The highly ranked executive of the China Semiconductor Industry Association also noted that the Chinese publicly traded semiconductor companies are currently underperforming, marked by the IC design sector's low gross profit margins.

Amid the AI boom that skyrocketed Nvidia's market value to over $1 trillion, Wei Shaojun pointed out that 135 Chinese semiconductor firms on China's STAR and ChiNext markets have a combined value of less than half of Nvidia's. Moreover, these firms' average gross profit margin of 39.1% in 2022, particularly 34.2% for the STAR-listed IC design companies, is significantly lower than the over 60% enjoyed by U.S. chip developers indicating that Chinese companies are still operating at lower profitability levels.

Judging by what we've seen from China's domestic CPU and GPU efforts, there's a lot of work remaining before it will close the gap.