Sustainable finance has grown sharply in recent years, with the number of Environmental, Social and Governance (ESG)-linked funds reportedly growing by 80% in 2021. Now, global asset managers are working to meet clients’ growing demand for ESG derivatives.

Sweden-based Lynx Asset Management, for instance, recently rolled out CME Group’s E-mini ESG S&P 500 futures contract to its sustainability-linked suite as part of a strategy to meet growing institutional client demand for sustainability-linked investments.

The contract has helped the $6.5 billion investment manager boost trade in the nascent market as “it’s the most liquid of all the ESG ones we are monitoring,” said Sustainability and Business Development Director Despina Xanthopoulou.“

The S&P 500 is the most traded futures contract in the world so when you launch an ESG version of it, you are going to get traction,” said Xanthopoulou, adding that the Stockholm-based firm, which has many international clients ranging from U.S. pension funds to Middle East Sovereign wealth funds, has been stepping up its sustainability agenda for several years.“

We are very aware [of the industry’s growth] and have been monitoring the emergence of ESG equity indices since 2018 and onwards,” she added. “We currently have 40 equity indices in our monitoring list compared to zero three to four years ago.”

‘Meeting of the Minds’

The profile of firms looking for ESG index exposure varies widely, from institutional size to regional demands.“

Our clients have many requirements, and they bring different nuances,” said Xanthopoulou. “In the Nordics region, for instance, fossil fuels and controversial weapons are a very sensitive area whereas, in the U.S., we don't see similar concerns. From there, we get more questions relating to diversity and inclusion efforts on our [business] links.”

For Joe Kelly, Managing Director of Chicago-based Campbell Asset Management, offering the S&P 500 ESG contract to clients came as a two-way street. “We started offering it with a meeting of the minds,” Kelly said.

“We have very large clients that came to us and said, ‘Hey, we want you to make an effort to ensure that when these contracts meet certain parameters [i.e., liquidity thresholds], they become part of our portfolio.’ Simultaneously, in the background, we were saying, ‘it looks like there are more and more people making these contracts more liquid so there is an ability to express our firm values which are very aligned with ESG, make our clients happy and make them some money at the same time.’"

Campbell offers the contract as part of its Absolute Return Multi-Strategy Fund which trades 120 diverse ESG contracts.

Growing Futures Trade

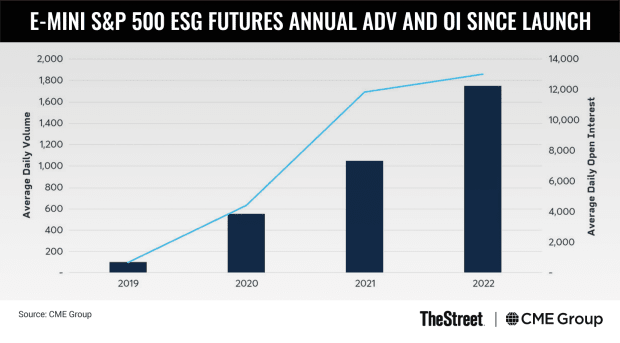

Lynx and Campbell’s move comes as CME Group continues to witness robust trading growth for its E-mini S&P 500 ESG and E-mini S&P Europe 350 ESG futures contracts.

“We have seen many clients start to trade these products this year including hedge funds and CTAs (commodity trading advisers) which has bolstered intraday liquidity,” said Paul Woolman, head of EMEA equity products & alternative investments at CME Group. “There is growing interest from clients and we are looking to develop new products where there is demand.”

CME Group’s E-mini futures track the S&P 500 ESG Index, which updated eligibility requirements in April. According to Woolman, trading volumes involving 837 accounts are up 50% this year.

Campbell hopes to double its sustainability-linked futures business eventually, said Kelly.

He notes an uneven regulatory field for ESG. “We can have a really strong opinion on a certain ESG data set while another firm can use another set and come up with other results,” Kelly said.

Vanessa Battaglia, senior counsel at Travers Smith, a UK-based law firm that advises clients on ESG regulatory matters, explained further.

“In the ESG space, especially when it comes to derivatives linked to sustainability, the key (challenge) is KPIs, such as what kind of metrics apply to these transactions and how the parties should be thinking about them,” she noted.

Standardized index construction may not check all ESG boxes the way an individual stock might, says Woolman. However, the futures contract provides a liquid market and S&P offers a defined ESG methodology to help with portfolio management.

“When it comes to an ESG index derivative such as S&P 500 ESG, the key criteria for clients are liquidity, and is the ESG methodology good enough,” said Woolman. “Market participants acknowledge the need for standardization with a future in order to benefit from a common pool of users that build liquidity.”

ESG Poised for More Growth

Why are more traders moving to ESG futures? In the long term, the real benefit will come from a liquidity build-up that will make ESG trades increasingly profitable for sustainability-minded investors, says Kelly.

“If I am a futures investor and have a social angle to how I want my money to be invested, I am going to want to be in these contracts,” added Kelly. “If more investors are like-minded, then liquidity is going to grow, and you will make money based on this groundswell of values being expressed in the ESG market.”

Xanthapoulou agreed that additional regulatory clarity is needed to properly and legally structure ESG derivatives to bolster future growth.

The industry should overcome its growing pains, however, and expand significantly in the medium-to-long-term horizon. A January Bloomberg Intelligence report noted global sustainability-linked assets could reach $50 trillion by 2025, up from $40 trillion this year.

“In the next five years, I can see people moving portfolios to more ESG-friendly assets and contracts, significantly boosting trade,” Xanthapoulou added.