Excitement over generative artificial intelligence is fueling heavy investments by tech companies in semiconductors, computer hardware and software. Generative AI also is driving a supercycle in cloud computing and AI stocks, says a Wall Street analyst.

"Gen-AI is driving the next supercycle of cloud adoption that accelerates mass market migration over the next few years, since the new technology can only be efficiently deployed in the cloud," Mizuho Securities analyst James Lee said in a note to clients Thursday.

Lee based his conclusion on a survey of chief information officers that his firm conducted recently. The survey showed that key sales channel indicators had "accelerated across the board" due to demand for generative AI, he said.

Generative AI can create content — including written articles, images, videos and music — from simple descriptive phrases. Artificial intelligence systems analyze and digest vast amounts of data to create new works. Generative AI also can write computer programming code.

Amazon Seen As Winner In AI Stocks

Among AI stocks, Lee cited Amazon as a top pick for the second half of 2023. Also, the company's Amazon Web Services could see an inflection in the third quarter thanks to generative AI, he said.

Year to date, Amazon stock is up 54.5%. On Friday, AMZN stock climbed 1.1% to close at 129.78. Meanwhile, Lee rates Amazon stock as buy with a price target of 160.

On June 22, Amazon Web Services announced that it is investing $100 million in a new generative AI program. Amazon said its AWS Generative AI Innovation Center will help customers successfully build and deploy generative artificial intelligence solutions.

Mizuho's survey showed that Amazon Web Services' Bedrock AI service is resonating with customers, Lee said.

"Our survey shows that Bedrock continues to gain traction given its product differentiation, encouraging case studies and established ecosystem," Lee said.

He added, "We estimate that AWS already has 200 enterprises on the waiting list with proof of concepts to train and launch Gen-AI apps on the platform."

Generative AI Seen Boosting Productivity

Investment bank Goldman Sachs says generative AI could have a large impact on productivity growth. Meanwhile, that "could translate into significant upside for U.S. equities over the medium-to-longer term," the firm said in a report Wednesday.

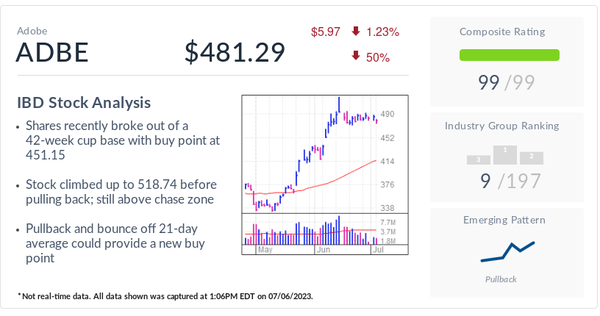

The generative AI craze has lifted shares of companies deemed "AI stocks." They include Adobe, AMD, C3.ai, Microsoft and Nvidia.

Follow Patrick Seitz on Twitter at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.