When markets move faster than expected — or stall in tight ranges — it’s often because of something most traders can’t see: Gamma Exposure.

In his latest video, “Gamma Trading Secrets: Transform the Way You Trade Options,” options expert Gavin McMaster breaks down how gamma exposure (GEX) shapes volatility, creates invisible support and resistance levels, and impacts how market makers hedge positions.

What Is Gamma Exposure (GEX)?

Gamma exposure, often shortened to GEX, measures how market makers and options dealers adjust their hedges as prices change.

When the market has positive gamma, dealers are typically short options — meaning they must hedge by buying when prices fall and selling when prices rise. This creates a stabilizing effect, dampening volatility.

“Positive gamma acts like a shock absorber,” Gavin explains. “Dealers buy into weakness and sell into strength, keeping price swings contained.”

However, when gamma flips to negative, everything reverses.

Negative Gamma: When Volatility Explodes

When gamma exposure turns negative, dealers hedge in the same direction as the price move — selling into selloffs and buying into rallies.

That amplifies volatility, says Gavin:

”When the market starts dropping, dealers have to keep selling to stay hedged — and that’s how small pullbacks can suddenly snowball.”

This feedback loop can lead to the kind of rapid market drops and “melt-ups” traders have seen more frequently in recent years.

Understanding whether the market is in positive or negative gamma can help traders anticipate whether volatility is likely to stay quiet or spike violently.

Put & Call Walls: Invisible Barriers in the Market

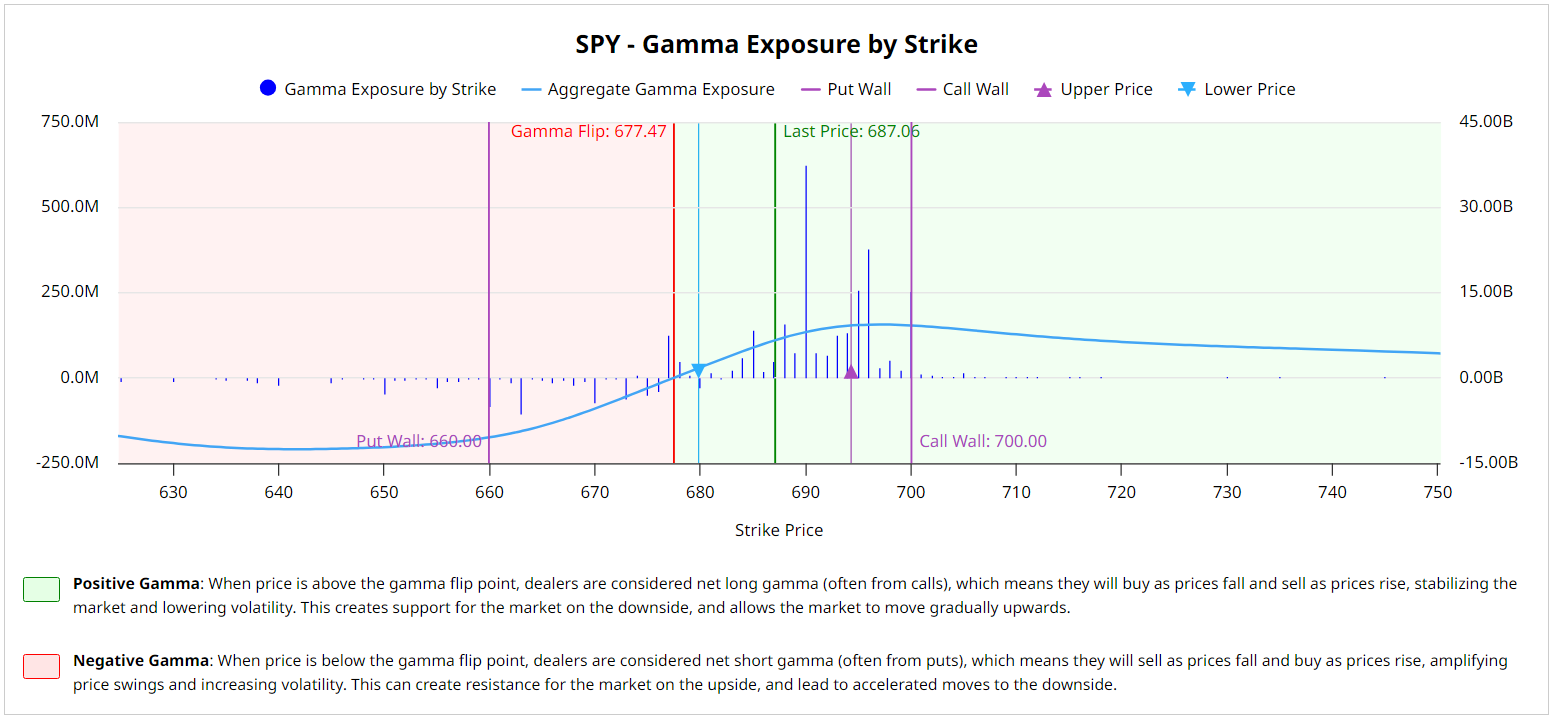

Alongside gamma exposure, Put Walls and Call Walls are key tools for understanding market structure:

- A Put Wall is a strike price with a large concentration of put open interest. This can often act as a support level, since dealers may need to buy stock to hedge at those levels.

- A Call Wall is a strike price with heavy call open interest. This can often act as resistance, as dealers sell stock to stay delta-neutral.

“When price approaches these walls,” Gavin explains, “it can stall or reverse because hedging flows kick in. That’s why they’re often referred to as magnetic levels in the market.”

These price “walls” are visible on Barchart’s Gamma Exposure tool, which displays both positive and negative GEX levels along with put and call concentrations.

How Traders Can Use Gamma Exposure

Traders can use gamma exposure to identify volatility conditions and plan strategies around them:

- Above the gamma flip (positive gamma): Markets are stable, creating favorable conditions for options selling or credit spreads.

- Below the gamma flip (negative gamma): Markets are unstable, creating favorable conditions for long options, straddles, or momentum plays.

- Near put or call walls: Expect stalling, reversals, or sharp breaks if those walls are breached.

“When you know where dealers are forced to hedge, you gain insight into where the market might accelerate or calm down,” Gavin explains.

How to Track Gamma Exposure on Barchart

You can visualize gamma levels and hedging zones directly and develop a strategy using these tools:

These indicators help traders identify the gamma flip level, monitor support/resistance “walls,” and track options positioning that may influence short-term volatility.

The Takeaway

Understanding Gamma Exposure is like reading the market’s internal wiring.

When gamma is positive, volatility is contained. When it turns negative, price swings accelerate. Combine that with awareness of put and call walls, and you can start anticipating where key market turning points might occur before they happen.

Watch this quick breakdown from Gavin:

- Watch the Full Video: Gamma Trading Secrets: Transform the Way You Trade Options

- Start tracking Gamma Exposure today on Barchart