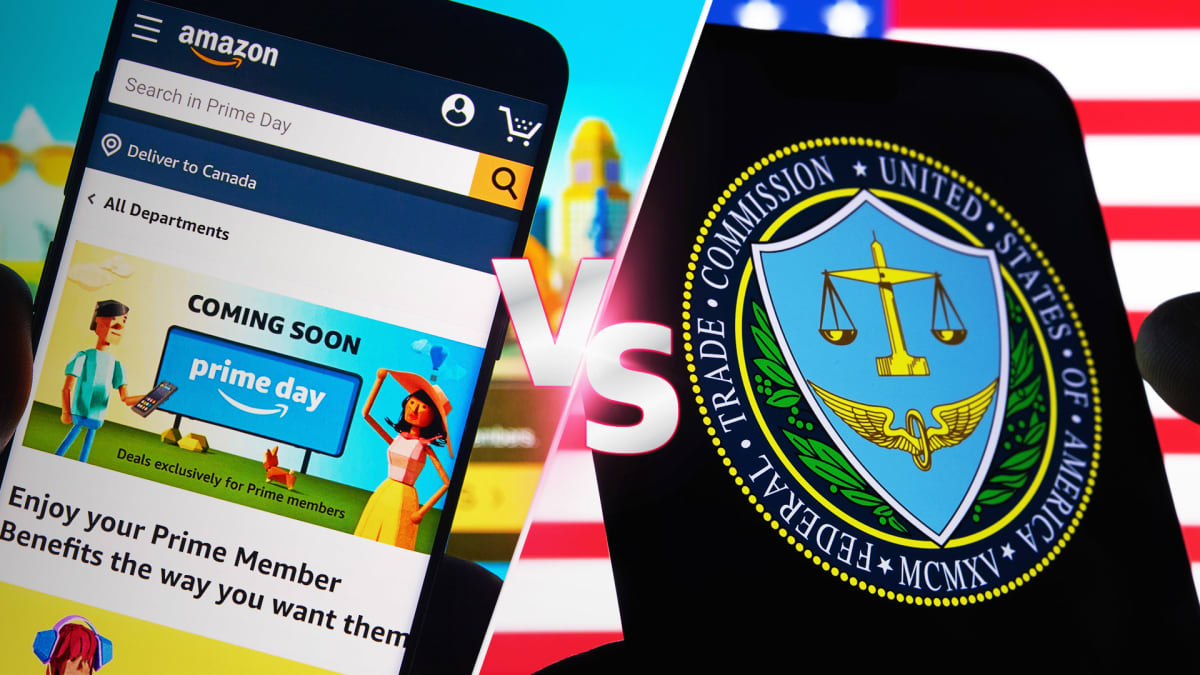

From Microsoft (MSFT) to now Amazon (AMZN), the Federal Trade Commission under the Biden administration has approached big tech with greater scrutiny.

On Wednesday, the FTC announced it is suing Amazon for violating the Restore Online Shoppers’ Confidence Act. The FTC alleged Amazon used deceptive practices to manipulate consumers into signing up for its Prime offerings and then "sabotaged" attempts to cancel their accounts.

“Amazon tricked and trapped people into recurring subscriptions without their consent, not only frustrating users but also costing them significant money,” FTC chair Lina Khan said in a statement.

However, Action Alerts PLUS portfolio manager Chris Versace said the lawsuit may have more bark than bite. "Our thinking is this is largely going to be noise. And it may result in some procedural changes for Amazon, maybe even a fine. But candidly, on its face, we find this simply silly, if not insulting to think that, quote, "Amazon duped millions of consumers into unknowingly enrolling in Amazon Prime," Versace said.

Catch his full take on the FTC's case and what it means for Amazon's stock in the video above.

Full Video Transcript Below:

CHRIS VERSACE: The FTC is suing Amazon.

The regulator alleges Amazon misled millions of consumers into signing up for its Prime Services and then made cancellation difficult. Now, these are headlines that we simply can't ignore. But our thinking is this is largely going to be noise. And it may result in some procedural changes for Amazon, maybe even a fine. But candidly, on its face, we find this simply silly, if not insulting to think that, quote, "Amazon duped millions of consumers into unknowingly enrolling in Amazon Prime".

Maybe the FTC should consider that consumers wanted fast, free shipping, discounts, and other benefits associated with Prime, including Prime Video. To us, when it comes to Amazon shares, the bigger issues to watch will be the upcoming 2023 Prime Day, as well as cost-cutting efforts and their impact on margins across Amazon's businesses.