/Franklin%20Resources%2C%20Inc_%20logo%20and%20site-by%20Wirestock%20Creators%20via%20Shutterstock.jpg)

Valued at a market cap of $11.7 billion, Franklin Resources, Inc. (BEN) is an asset management company based in San Mateo, California. It offers a broad range of investment solutions, including equities, fixed income, multi-asset, and alternative strategies, to individual, institutional and sovereign clients across more than 150 countries.

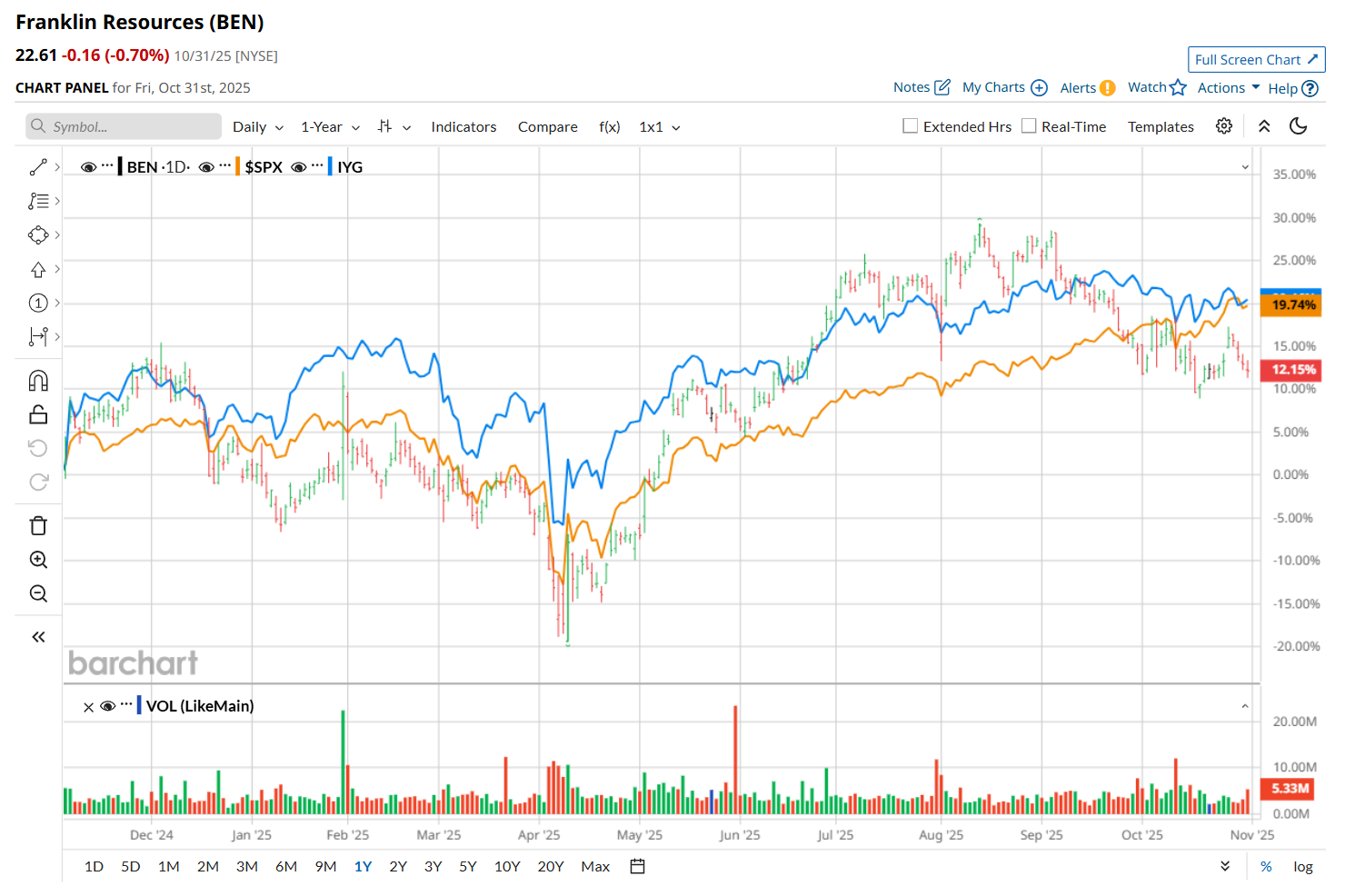

This asset management company has underperformed the broader market over the past 52 weeks. Shares of BEN have gained 8.3% over this time frame, while the broader S&P 500 Index ($SPX) has surged 17.7%. Moreover, on a YTD basis, the stock is up 11.2%, compared to SPX’s 16.6% uptick.

Narrowing the focus, BEN has also lagged behind the iShares U.S. Financial Services ETF’s (IYG) 19.3% return over the past 52 weeks and 13.2% rise on a YTD basis.

On Aug. 1, shares of BEN declined marginally after its Q3 earnings release, despite reporting better-than-expected performance. The company reported operating revenue of $2.1 billion and adjusted EPS of $0.49, both ahead of analyst estimates. However, due to lower investment management fees, its overall top line declined 2.8% year-over-year, while its adjusted EPS fell by an even more notable 18.3% from the year-ago quarter, which might have overshadowed the positives.

For the current fiscal year, ending in September, analysts expect BEN’s EPS to decline 11.3% year over year to $2.12. The company’s earnings surprise history is mixed. It exceeded or met the consensus estimates in three of the last four quarters, while missing on another occasion.

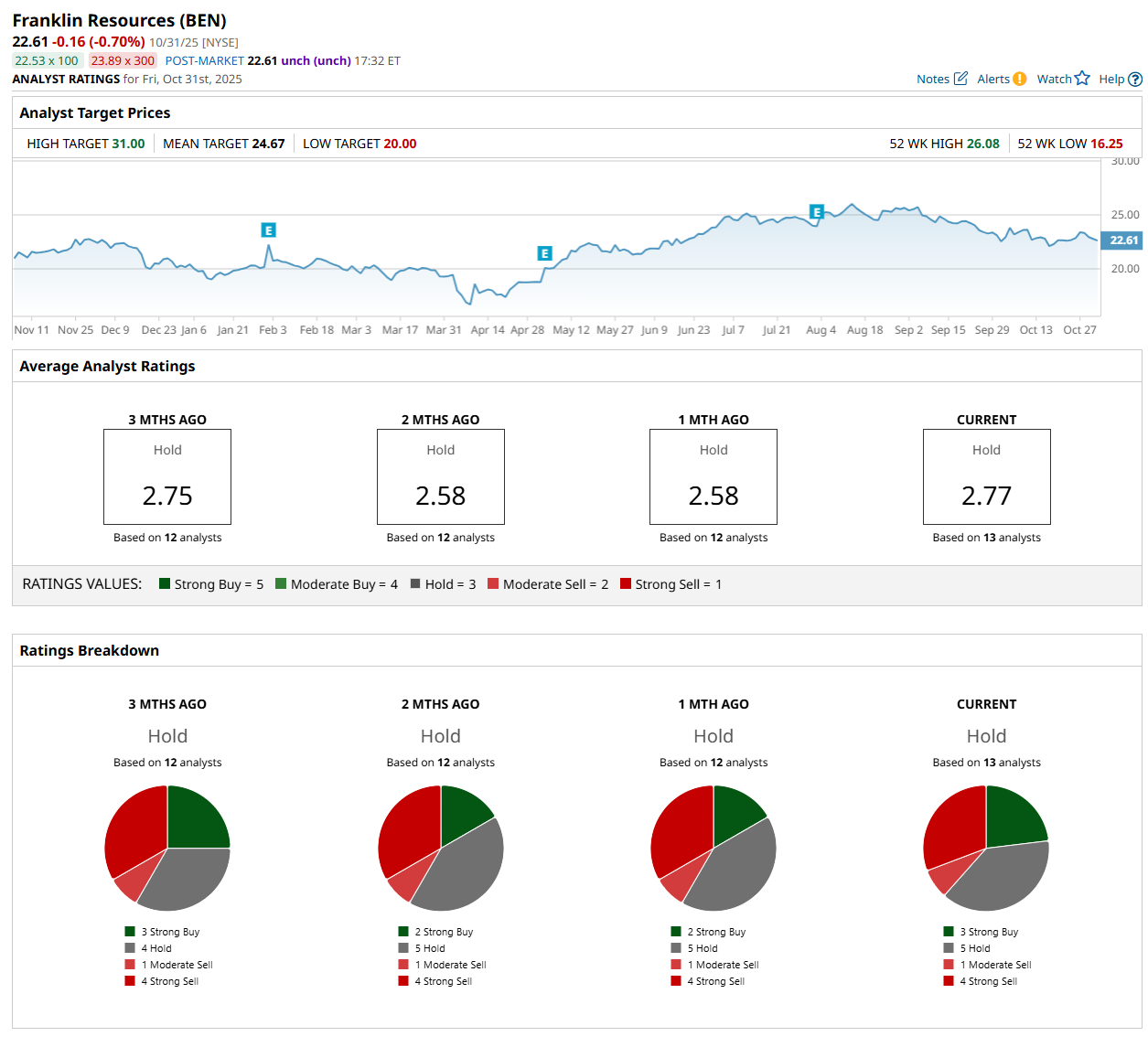

Among the 13 analysts covering the stock, the consensus rating is a "Hold,” which is based on three “Strong Buy,” five "Hold,” one “Moderate Sell,” and four "Strong Sell” ratings.

This configuration is slightly more bullish than a month ago, with two analysts suggesting a “Strong Buy” rating.

On Oct. 21, Barclays maintained an "Underweight" rating on BEN, and lowered its price target to $20.

The mean price target of $24.67 represents a 9.1% premium from BEN’s current price levels, while the Street-high price target of $31 suggests an upside potential of 37.1%.