Hon Hai Precision Industry Co., the world's largest electronics contract manufacturer, better known as Foxconn Technology, is set to expand its server production capacity in Mexico to meet 'crazy' demand for Nvidia's next-generation Blackwell GPUs and servers on its base, reports Bloomberg. The company's move indicates a strong belief that AI-related investments will continue to rise.

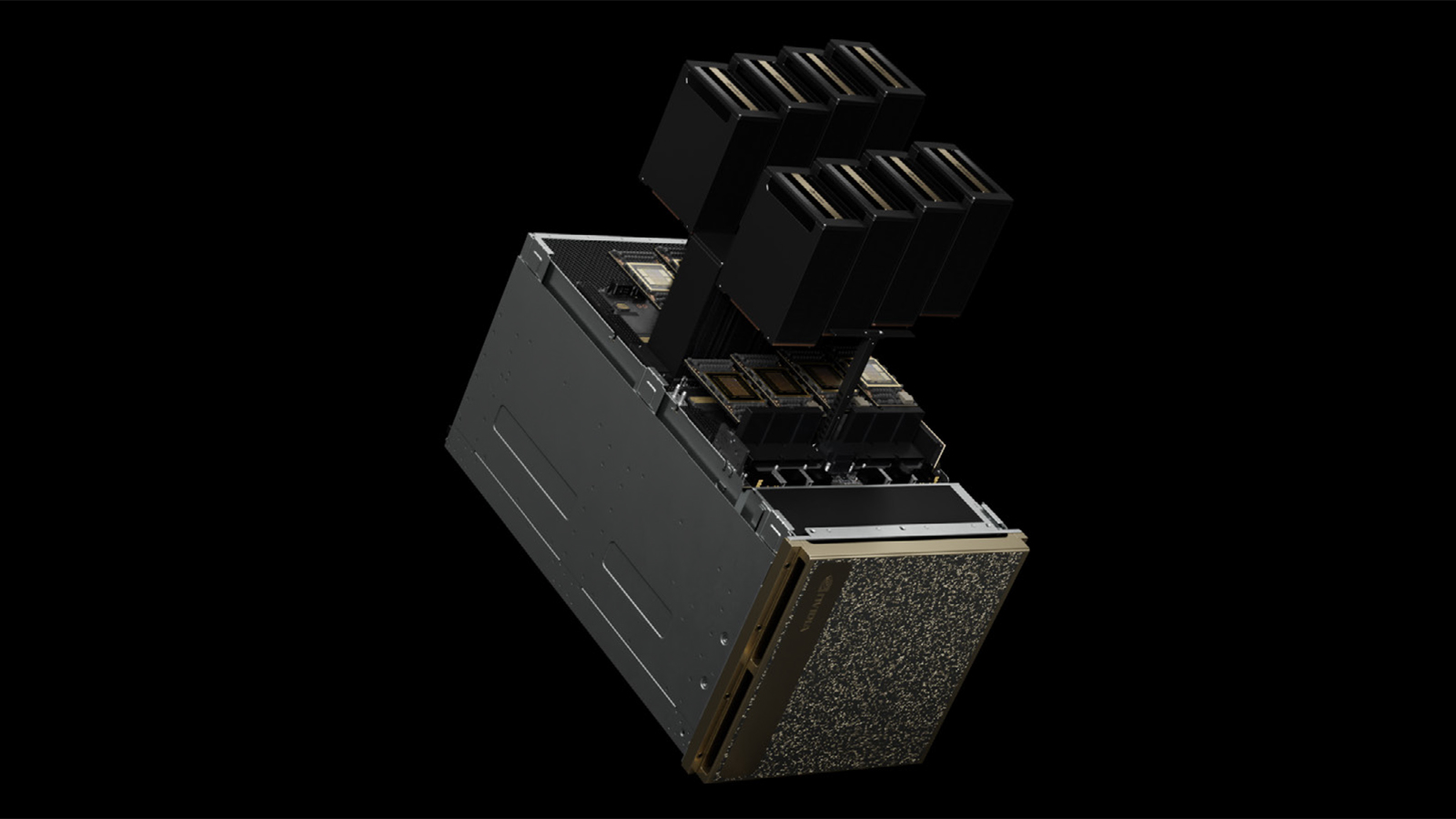

Young Liu, chairman of Foxconn, told Bloomberg Television that demand for GB200-based NVL72 servers with 72 B200 GPUs for AI and HPC workloads had exceeded initial expectations and was 'crazy.' To that end, Foxconn is building one of the world's largest server assembly plants in Mexico, which will produce machines for companies in North America without relying on capacities in China, Taiwan, or Southeast Asia. The Taiwanese company has already invested over $500 million in its Mexican operations in Chihuahua, reports the South China Morning Post.

Building an 'enormous' facility in Mexico (outside China, Taiwan, India, Malaysia, and Vietnam, where the company operates today) is primarily a strategic move for Foxconn. On the one hand, the company reduces its reliance on China (yet its largest plants where it builds iPhones remain in Tianxia). On the other hand, it expands its presence in North America, enabling it to build machines for the U.S. government and other customers who prefer not to use systems constructed in China.

Once operational in 2025, the facility is expected to become the largest in the world for assembling motherboards and servers for Nvidia Blackwell-based servers. The plant's planned capacity is 20,000 servers, presumably per month, which means 240,000 machines per year. Because Nvidia's B200-based machines require liquid cooling, their assembly is more complex than an assembly of traditional servers, which is why both Foxconn and Supercmicro invented datacenter-scale liquid cooling solutions.

Foxconn has reportedly been the only maker of Nvidia's compute GPU modules, such as the A100, H100, and H200. It is also a significant producer of HGX boards used by Nvidia and its server assembly partners. The company also produces AI server boards for other companies, including Amazon Web Services and Google, two large cloud service providers (CSPs) that develop their own AI processors. With additional capacity in Mexico, Foxconn will grab an even larger chunk of the AI server market.

The Foxconn chairman acknowledged a production setback affecting Nvidia B200-based servers. Originally slated for launch in the early fourth quarter, shipments are now delayed to later in the quarter due to the necessity of redesigning the packaging of B100 and B200 processors.

Young Liu addressed market concerns about potential saturation in AI computing needs, stating that current demand trends have surpassed Foxcoon's initial projections. This suggests that expectations for AI-related growth remain robust, with no signs of slowing down soon.

Foxconn has been operating in Mexico for many years. The company has plants in San Jerónimo, Chihuahua, where it assembles computers. Juárez has two more facilities: one that previously belonged to Motorola, which now produces mobile phones and another set-top box factory obtained from Cisco Systems. Additionally, in Tijuana, Foxconn manufactures LCD televisions at a facility that Sony once owned.