Families across the land are tightening their belts amid the ongoing cost of living crisis.

And households are constantly trying to come up with ways to save cash and budget more effectively. Now experts have shared four golden rules for parents to make sure their finances are in good shape in 2023.

Price comparison site idealo.co.uk has teamed up with mortgage and protection broker Clementine Palmer at Bright Money Independent to provide some guidance for families. From budgeting to diarising key dates, here are four money-managing tips to consider for an organised year.

Read More: Child Benefit payments to rise by 10.1% from April, here is what parents will get

Create a family budget

One of the easiest ways families can manage their finances is by creating a family budget. This will be essential in helping to establish where and when they can spend each month.

Clementine says: "Start with your total income, deduct essential fixed expenditures such as mortgage or rent payments, insurance, utility costs, council tax and childcare costs, then use an average of four weeks fuel, travel and food, and household costs to work out your disposable income. This will give you an idea of how much you need to save, try to set aside 20% of your income towards savings as this will ensure your family is covered in the case of emergencies like boiler replacement or car repairs."

Diarise key dates

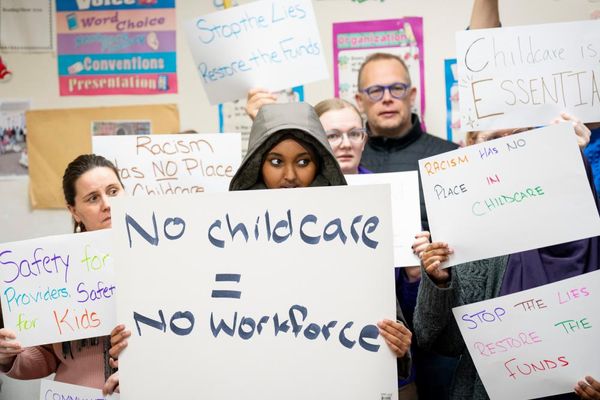

It is important to consider key dates like term start dates, school holidays, and Christmas as these can often be expensive for families. Clementine adds: "The summer holidays for school-age children are always a challenge for working parents scrambling to arrange childcare, which often adds up especially if the support of family members isn’t an option. Reaching out to other parents in your child’s class to set up play dates where you can share the load works well for many.

"There are also charity-run holiday clubs for a low cost or voluntary contribution care. Other clubs often have early booking discounts you can take advantage of if you plan ahead."

Cut back where you can

Cutting back where you can as a family will help to leave room for the occasional treat. "Schools often have PTA-run second-hand uniform where you might be able to get items for a fraction of the cost and sometimes the proceeds go towards your child’s school as a bonus," the expert added.

"Schools are still offering free school meals for children in key stage one which should be a huge help to reduce your food bill during term time."

Find alternative ways to keep the kids entertained

Finding ways to keep children entertained especially during the summer holidays can often be a costly job but with a few tactical tips like making the most of deals available to children, parents can save a lot of money.

Clementine said: "There are several businesses that offer reduced cost meals for kids, for example, kids eat for £1 at Asda during some parts of the year, M&S, Tesco, Dunelm, Toby Carvery all have similar offers. During half term breaks Pizza Express and Zizzi often have offers on kid’s menus too.

"As well as that buying items during 'off seasons' will ensure you get the same products when they’re usually on sale, for example, purchasing paddling pools in winter will likely save you money. The same goes for summer and winter clothes which often go into sale during the off season."

Katy Phillips, senior brand and communications manager at idealo, added: "We’re expecting that spending habits will be greatly affected by the cost-of-living crisis but with these four golden finance fit checks parents will find it easier to spread out and organise costs effectively.

"Remember that comparing prices across a range of products can truly help you get the best deal too. At a time where saving is essential to many families, being able to check multiple retailer costings at once can prove a hugely helpful resource."

Read Next:

The age at which a child can come home from school alone - What safety experts and parents say

The viral TikTok money saving rule helping students to keep their finances on track

Parents on DWP Universal Credit forced to turn down work due to huge childcare costs

Top 10 alternatives to pocket money that parents are using to reward children

From pocket money apps to first bank accounts - the best ways to teach children value of money