Financial giants have made a conspicuous bullish move on Foot Locker. Our analysis of options history for Foot Locker (NYSE:FL) revealed 12 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $689,698, and 2 were calls, valued at $82,650.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $20.5 to $32.0 for Foot Locker over the last 3 months.

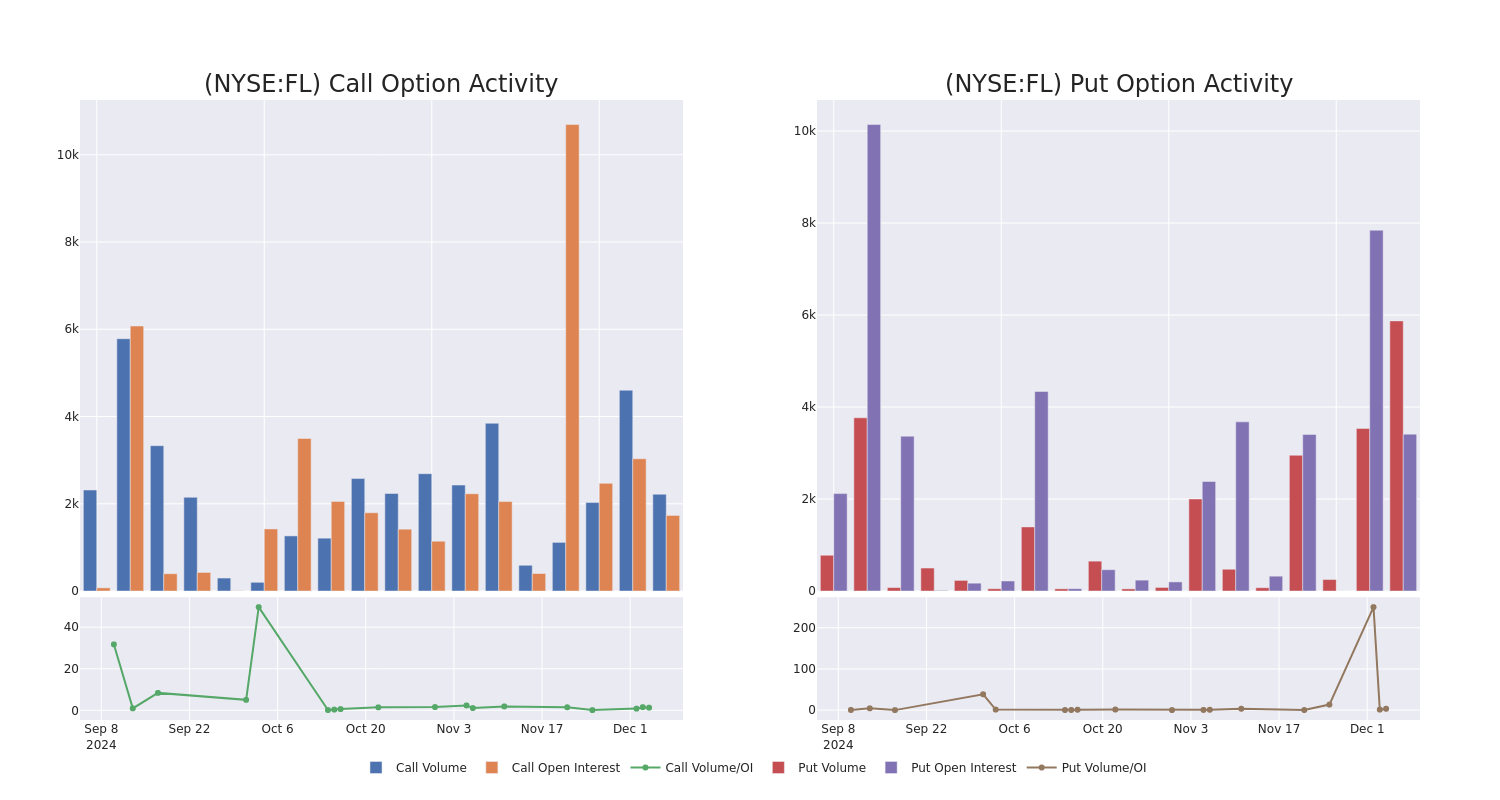

Volume & Open Interest Development

In today's trading context, the average open interest for options of Foot Locker stands at 1029.0, with a total volume reaching 8,092.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Foot Locker, situated within the strike price corridor from $20.5 to $32.0, throughout the last 30 days.

Foot Locker Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FL | PUT | SWEEP | BULLISH | 12/06/24 | $6.2 | $6.1 | $6.2 | $26.00 | $328.8K | 3.1K | 694 |

| FL | PUT | SWEEP | BULLISH | 12/06/24 | $6.5 | $6.2 | $6.2 | $26.00 | $73.7K | 3.1K | 1.1K |

| FL | PUT | SWEEP | BULLISH | 12/06/24 | $7.1 | $6.2 | $6.2 | $26.00 | $66.3K | 3.1K | 842 |

| FL | CALL | SWEEP | BULLISH | 03/21/25 | $1.2 | $1.0 | $1.2 | $25.00 | $57.3K | 1.7K | 1.5K |

| FL | PUT | TRADE | NEUTRAL | 12/06/24 | $4.4 | $4.2 | $4.3 | $24.50 | $43.0K | 276 | 135 |

About Foot Locker

Foot Locker Inc operates thousands of retail stores throughout the United States, Canada, Europe, Asia, Australia, and New Zealand. It also has a presence in the Middle East. The company mainly sells athletically inspired shoes and apparel. Foot Locker's merchandise comes from only a few suppliers, with Nike providing the majority. Its portfolio of brands, includes Foot Locker, Kids Foot Locker, Champs Sports, WSS, and atmos. The company has omnichannel capabilities to bridge the digital world and physical stores, including order-in-store, buy online and pickup-in-store, and buy online and ship-from-store, as well as e-commerce. It has three operating segments, North America, EMEA, and Asia Pacific.

Current Position of Foot Locker

- Trading volume stands at 4,608,241, with FL's price down by -18.87%, positioned at $19.61.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 0 days.

Expert Opinions on Foot Locker

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $27.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Evercore ISI Group persists with their Outperform rating on Foot Locker, maintaining a target price of $32. * In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $27. * Consistent in their evaluation, an analyst from Piper Sandler keeps a Neutral rating on Foot Locker with a target price of $28. * An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $27. * An analyst from Williams Trading upgraded its action to Hold with a price target of $21.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Foot Locker options trades with real-time alerts from Benzinga Pro.