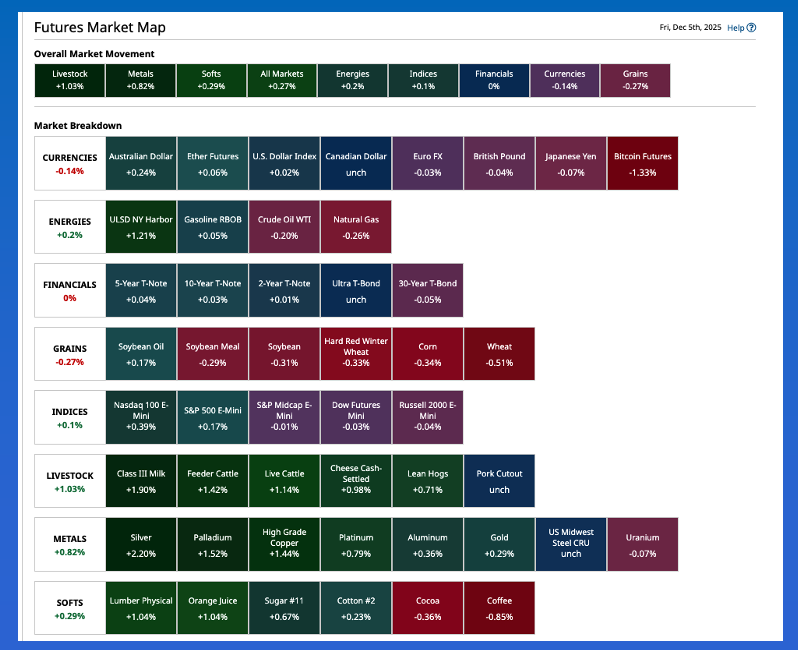

As another weekend grows larger on the horizon, many markets have shrugged off the chaos of this past week.

-

Silver has climbed back within sight of its recent record high while WTI crude oil has hardly budged this week.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis. The spotlight remains on next week's US FOMC meeting and expected 25-basis point rate cut.

Does anyone remember Venezuela? It was less than a week ago when the US president was rattling his saber, threatening to sick Secretary of “War” Hegseth on the South American country. (And according to some reports, depending on what news source one chooses to believe, the modern-day Ares did or did not order the sinking of a civilian boat in the Caribbean.) While all this was going on, the WTI crude oil market barely moved. A look at the daily close only chart shows the spot-month contract (CLF26) is priced near $59.60 Friday morning, up about $1.00 from last week’s settlement. The lack of activity in crude oil is made more interesting by the US president’s move to roll back the previous administration’s fuel economy standards, taking the US back to gasoline driven vehicles while the rest of the world pushes forward with electric and other “green” technologies. As expected, March silver (SIH26) initially lost $1.651 (2.8%) but has since moved back to within sight of its all-time high daily close of $59.142 (December 1). How about this administration’s beef with beef prices? Thursday afternoon brought reports of cash prices $10 to $15 higher than last week while USDA continues to tell us boxed beef prices are coming down. The stage is now set for the next piece of government data on inflation, Friday’s release of the September personal consumption expenditures index (PCE), reportedly “the Fed’s preferred inflation gauge”. The pre-release average guess is a 0.3% monthly increase with the year-over-year expected to climb 2.9%. Will this affect next week’s US Federal Open Market Committee meeting? No. It’s old news, and the Fed has already made its decision, with the Fed fund futures forward curve still showing a 25-basis point rate cut is coming. Still, the US dollar index is showing a small gain pre-dawn Friday.