Employees are expected to bear the brunt of higher tax costs on businesses, with an increase to employer national insurance “highly likely” to hit jobs and feed through in lower wages, according to the Government’s official forecaster.

Chancellor Rachel Reeves announced the changes to the UK’s second-biggest tax in her autumn Budget statement on Wednesday.

She said some businesses would face a greater tax burden but that the Government was protecting “working people” who will “not see higher taxes in their payslips” as a result of the decisions.

Analysis from the Office for Budget Responsibility (OBR) found that greater employer national insurance (NI) contributions are forecast to have an indirect impact on jobs and wages.

The OBR said it assumes that firms will “pass on most but not all of their higher tax costs to employees”.

In the 2025 to 2026 tax year, the year the changes are introduced, it estimates that businesses will pass on 60% of the higher costs to workers and consumers, via lower wages and higher prices.

The remaining 40% will be absorbed by the employer in lower pre-tax profits, according to its analysis.

By the following year, it expects 76% of the total cost to be passed on through lower real wages.

It seems highly likely that most of it will feed through in real wages

David Miles, a member of the OBR, said it expects the tax hike to “have an impact on the level of wages that firms who are facing higher taxes on employing people will pay”.

“It seems highly likely that most of it will feed through in real wages,” he said.

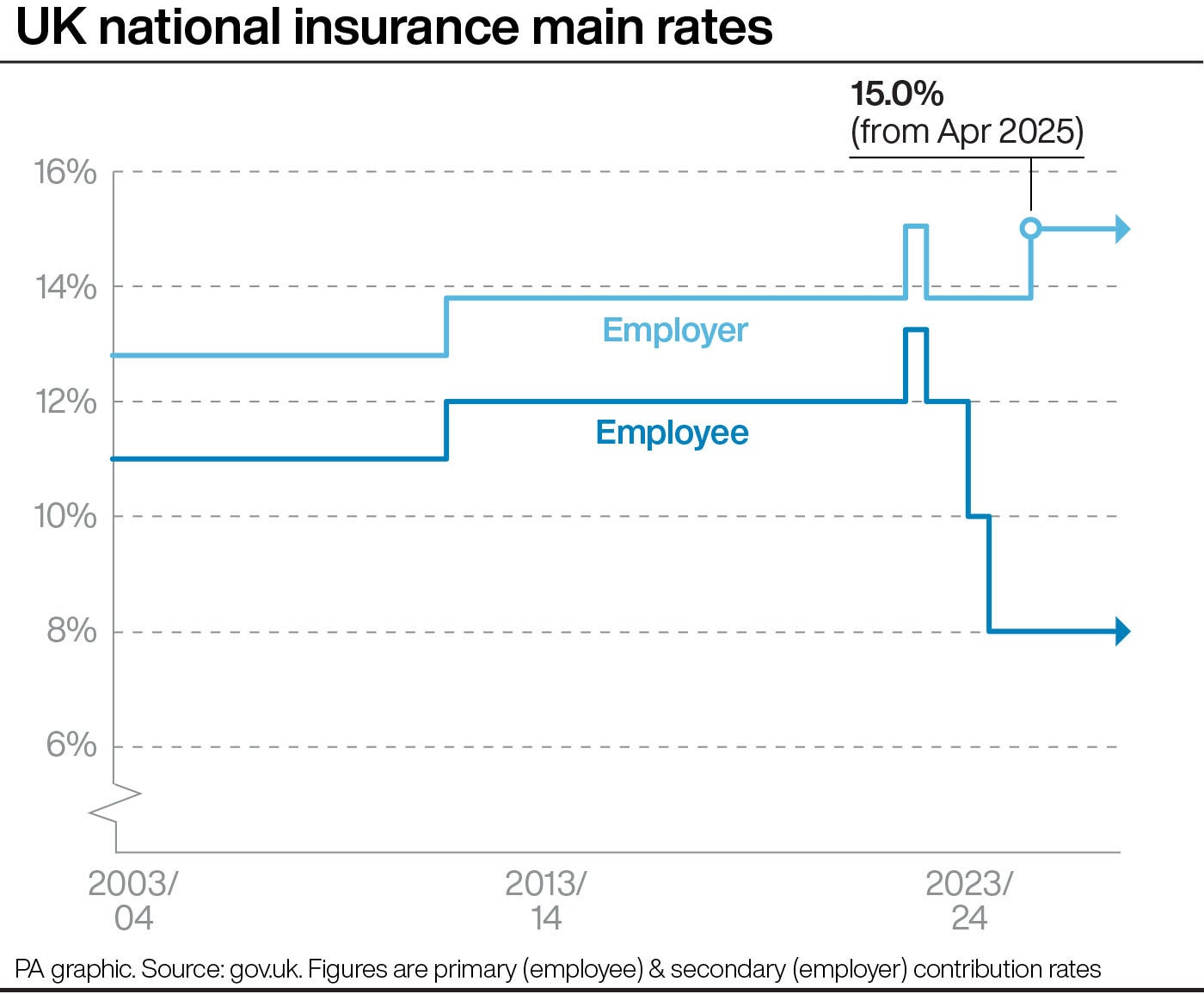

Ms Reeves said the rate of employers’ NI will rise by 1.2 percentage points, from 13.8% to 15% from April next year.

The secondary threshold – meaning the level at which employers start paying the tax on each employee’s salary – will also be reduced from £9,100 a year to £5,000.

Ms Reeves said it was a “difficult choice” for the Government, but that the measure would raise £25 billion per year to help fund public services.

Furthermore, forecasting from the OBR showed that the tax hike will lead to firms reducing labour supply in response to lower wages and higher employer costs.

“We expect the measure to reduce labour supply by around 0.2%, or a little over 50,000 on an average-hours equivalent (AHE) basis, by 2029-30,” it said.

This will come through both fewer jobs and a reduction in hours for those who stay in work.

Money saving expert Martin Lewis said the measure was “certainly not a direct tax on working people” but that it will “likely have an indirect effect”.

This is especially the case for industries such as hospitality, which will also be impacted by the national minimum wage rising by 6.7% next year, he said.

Mr Lewis said it was “unlikely” that the higher costs would come out of firms’ profits, and it was “possible” that they will be passed on through consumer prices, or “decreasing future benefits and salaries for employees”.

Analysis from consulting firm Alvarez and Marsal (A&M) estimates that the additional tax burden from the changes to employer NI will be £43,000 for a business with 50 employees, and about £173,000 for a business with 200 employees.

Louise Jenkins, managing director for A&M, said: “While changes to national insurance were perhaps not as bad as feared, when combined with increases to the national living wage it represents a significant burden for businesses, particularly SMEs.

“Faced with difficult choices, some employers may need to consider cost-saving measures such as raising prices, which could contribute to inflation, or reducing their wage bills through cuts to jobs or hours.”