Twenty-five years ago, Exxon and Mobil partied like it was 1999.

In fact, it was 1999, and the two oil companies were coming in an $81 billion deal to form ExxonMobil (XOM) , creating the third largest company in the world at the time.

“This is not a combination based on desperation, it's one based on opportunity,” Mobil’s then-CEO Lucio Noto said when the deal was first announced. “But we need to face some facts. The world has changed. The easy things are behind us. The easy oil, the easy cost savings, they're done. Both our organizations have pursued internal efficiencies to the extent that they could.”

And the world has changed so much since those final days of the 20th Century.

The tech sector has grown exponentially since that time, and the rise of artificial intelligence is creating a staggering demand for electricity.

Worldwide, demand from data centers accounts for about 0.5%, according to Columbia University’s Center on Global Energy Policy.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

AI data centers specifically could require roughly 14 gigawatts of additional new power capacity by 2030.

Houston Chronicle/Hearst Newspapers via Getty Images/Getty Images

Exxon Mobil working on gas-powered plant

“If the United States follows a similar data center growth trajectory as Ireland, a path setter whose data centers are projected to consume as much as 32% of the country’s total annual electricity generation by 2026, it could face a significant increase in energy demand, strain on infrastructure, increased emissions, and a host of new regulatory challenges," the center said in a July report.

Exxon Mobil, the largest oil and gas company in the U.S., is designing a natural gas power plant outfitted with carbon capture technology to meet tech sector demand, The New York Times reported on Dec. 11.

Related: Analyst reviews BlackRock rating after AI partnership with Microsoft

The plant will be fitted with technology that can capture more than 90% of the facility's carbon dioxide emissions.

The project is in the early stages of development, and it would be the first time that Exxon built a power plant that did not supply electricity to its own operations

Exxon, which has secured land and is talking with potential customers, aims to have the power plant running within the next five years.

“We're being driven by the market demand here,” Dan Ammann, who leads the company's low-carbon business, said. “It's low carbon, it's available on an accelerated timeline and it avoids all the grid interconnection challenges.”

Meanwhile, Exxon Mobil unveiled its corporate plan to 2030, where the energy giant expects to deliver incremental growth potential of $20 billion in earnings and $30 billion in cash flow.

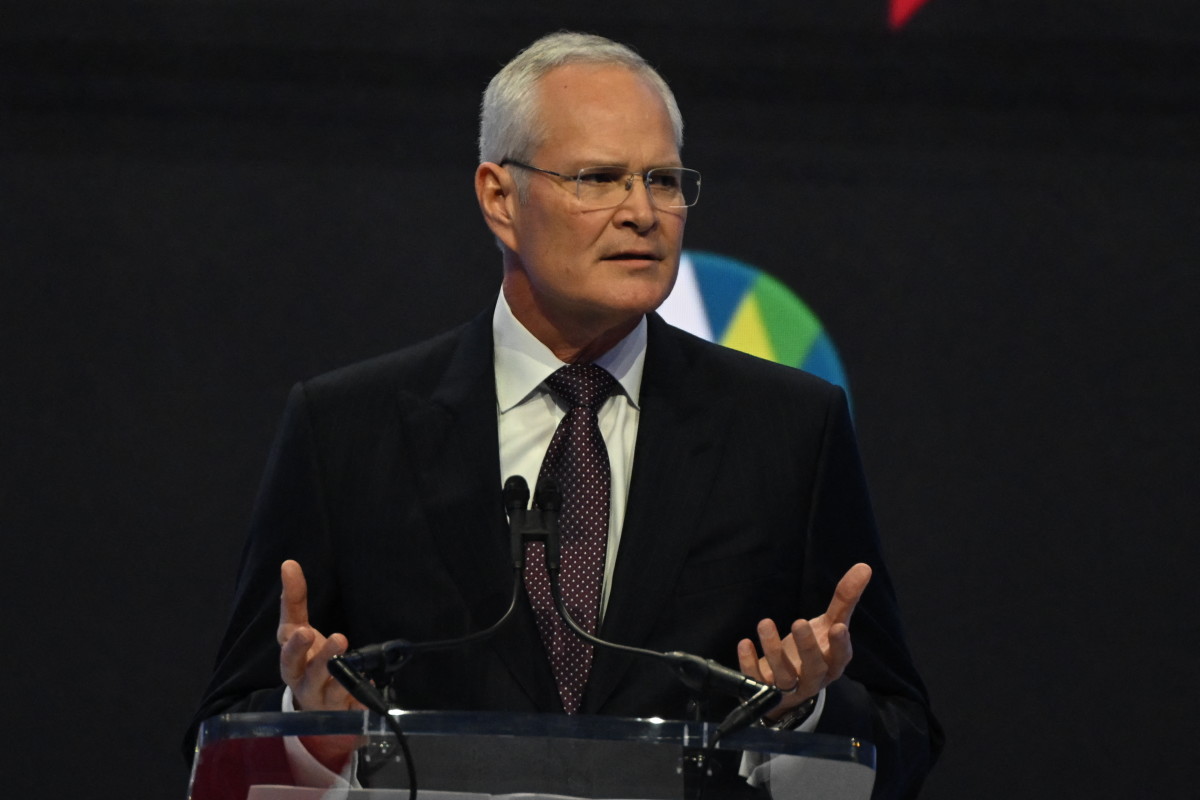

“ExxonMobil has a unique set of highly valuable competitive advantages that equip us to do what few companies have ever done – create world-scale solutions to society’s biggest challenges, decade after decade,” Darren Woods, ExxonMobil Chairman and CEO said in a statement.

ExxonMobil wants raise its overall production from the current 4.58 million barrels of oil per day to 5.4 million bpd.

Oil prices have been falling. As of Dec. 4, the average price of crude oil was down 11.14% from the previous year, at $72.29 per barrel.

On a constant price and margin basis, the company is generating more than $15 billion in earnings and more than $20 billion in cash flow compared to 2019. It has delivered structural cost savings of more than $11 billion year-to-date compared with 2019.

Cash flow has grown faster than that of any other integrated oil company over the past three- and five-year periods, the company said.

Exxon Mobil has increased its annual dividend per share for 42 consecutive years and recently increased its quarterly dividend by 4 cents per share, effective this quarter.

Exxon Mobil pursing low emission opportunities

The company said it is pursuing up to $30 billion of low-emission opportunities between 2025 and 2030, with almost 65% spent on reducing emissions for third-party customers.

Related: Holiday season could see cheapest gas prices since 2020

Exxon Mobil said it expects cash capital expenditures to be in the range of $27 billion to $29 billion in 2025, reflecting the first full year of Pioneer Natural Resources in the portfolio and investment to build new businesses with base capital expenditures remaining flat.

More Economic Analysis:

- Trump Trade puts stocks at record. Where do we go from here?

- Fed inflation gauge higher in October amid consumer spending boost

- Goldman Sachs analyst sees starting point for year-end S&P 500 rally

The company completed its $64.5 billion acquisition of Pioneer in May, and, as a result, ExxonMobil has the largest contiguous acreage position in the most active and prolific oil-producing basin in the Permian Basin in West Texas “with double the number of low-cost net drilling locations versus the next closest competitor.”

The acquisition sparked controversy when the Federal Trade Commission said it would not sue to block the takeover provided that former Pioneer CEO Scott Sheffield was barred from gaining a seat on Exxon’s board of directors or serving in an advisory capacity after the acquisition.

The FTC said Sheffield had colluded with OPEC and OPEC+ representatives to reduce oil and gas output, “which would result in Americans paying higher prices at the pump, inflating profits for his company.”

Sheffield filed a request to vacate the proposed consent order, saying that the FTC “was wrong to imply that I ever engaged in, promoted or even suggested any form of anti-competitive behavior.”

Exxon Mobil shares are up nearly 12% since the start of 2024.

In November, the company reported third-quarter earnings of $1.92 per share, down 15% from a year ago. Revenue totaled $90.02 billion, down about 1% from the year-ago tally.

Analysts had expected the company to earn $1.88 per share on revenue of $93.98 billion.

"In 2024, year-to-date earnings are roughly double what they were in the same period of 2019 on a constant margin basis," Woods said during the company’s earnings call.

"For all of our businesses, we've been focused on reduced cost, high-return investments, and selected divestments to improve profitability, particularly in bottom-of-cycle conditions," he added.

Related: Veteran fund manager delivers alarming S&P 500 forecast