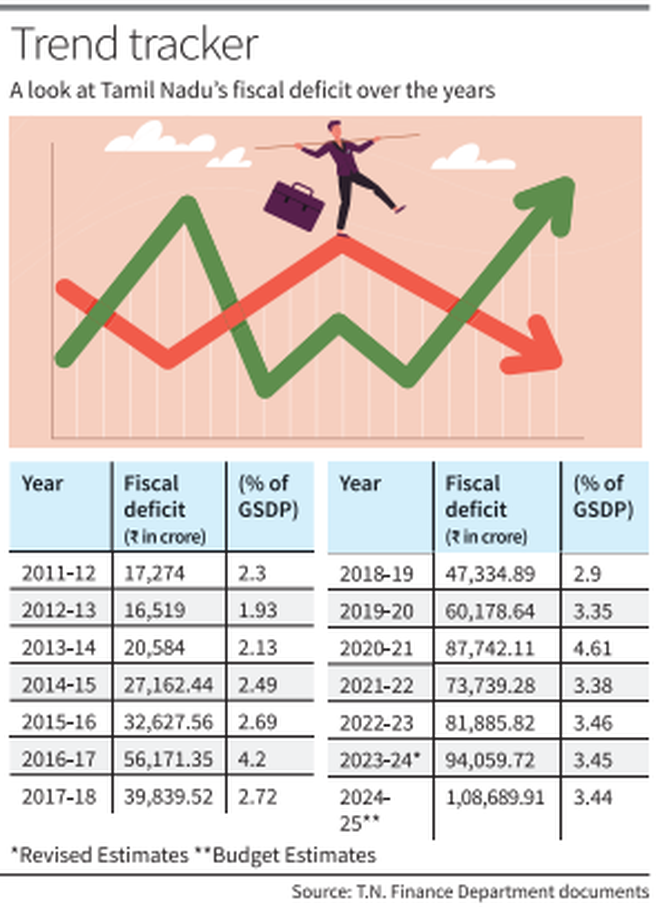

With Tamil Nadu’s fiscal deficit (FD) likely to exceed ₹1 lakh crore during 2024-25, the question arises whether the State will be able to bring down FD in terms of absolute value.

There is a view that a reduction in FD [the difference between total expenditure and total revenue receipts and non-debt capital receipts] is unlikely as the deficit is measured in relation to, or in proportion to, the Gross State Domestic Product (GSDP), the value of which goes up every year. What is more important than a mere reduction in the value of FD is that norms of fiscal responsibility have to be implemented in letter and in spirit.

A senior official explains that the proposed figures of revenue deficit and FD for 2023-24 and 2024-25 would have been lower than they are, if the State government does not have to factor in certain “extraneous elements”. The reference is to an additional expenditure of ₹9,000 crore for the current year and ₹12,000 crore for next year, all under the Chennai Metro Rail project, on account of what Finance Minister Thangam Thennarasu described as an inordinate delay by the Centre in approving the project. Also, it relates to a large-scale absorption of losses of Tangedco — ₹17,117 crore for the current year and ₹14,442 crore next year. The progressive assumption of responsibility for losses is a commitment given by the State government as part of the Centre’s COVID-19 package for additional borrowing. If the Centre accepts the request of the State government to exclude the amount from FD and the borrowing ceiling of the State, as was done in respect of the Ujwal Discom Assurance Yojana [a scheme to facilitate operational and financial turnaround of State-owned power distribution companies] about seven years ago, there will be a perceptible improvement in the fiscal position, the policymaker observes.

Referring to the conventional norms of fiscal responsibility — 3% for FD and nil for revenue deficit, K.R. Shanmugam, veteran economist, says the State’s performance should be such that it has to pass the test sans relaxations that may be in force from time to time.