Finance experts have branded Deliveroo’s addition of buy-now-pay-later (BNPL) service Klarna to its payment options as “irresponsible”.

The popular takeaway delivery service launched its partnership with Klarna, which allows customers to pay in full upfront or to delay their payment for a period of time, on Tuesday (11 October).

But some Deliveroo users began noticing the additional payment method last week and have criticised it as a “dreadful idea”.

Personal finance expert Tara Flynn of Choosewisely.co.uk said: “If you’re considering buying your takeaway now and paying for it later… don’t.

“Getting yourself into debt over a meal that’s gone in 15 minutes isn’t worth it.

“Having fast food delivered should be considered a treat for now and again, and if you can’t afford to do it, you shouldn’t.”

She added: “I think it’s irresponsible of Deliveroo to offer this as an option and need to seriously reconsider this move ASAP.”

Michelle Highman, chief executive of The Money Charity, added: “Put simply, the BNPL model is an alternative method of accessing credit and in theory gives consumers greater freedom and choice in their purchasing power, which is broadly a good thing for increasing people’s financial wellbeing.

“But as with any credit-based option, we would always recommend people only ever use them as payment options if that’s their preferred method of managing their finances, with a clear and sustainable plan to pay off their balance in full.

“If you find yourself needing to turn to BNPL to get through the month then this should raise a concern; while racking up debts on takeaways, an expenditure which would almost certainly always go into the ‘wants’ rather than ‘needs’ list, is clearly to be avoided.”

The move has also been condemned by Rosie Parry, Labour councillor for Deptford in southeast London, who called both brands “gross predators” for encouraging customers to use BNPL services amid the cost of living crisis.

“Klarna and Deliveroo are really showing their colours with BNPL options for FOOD,” she tweeted. “If people can’t afford to eat without going into debt, society is failing. If people are being encouraged to buy extra takeaways they can’t really afford, the brands involved are gross predators.”

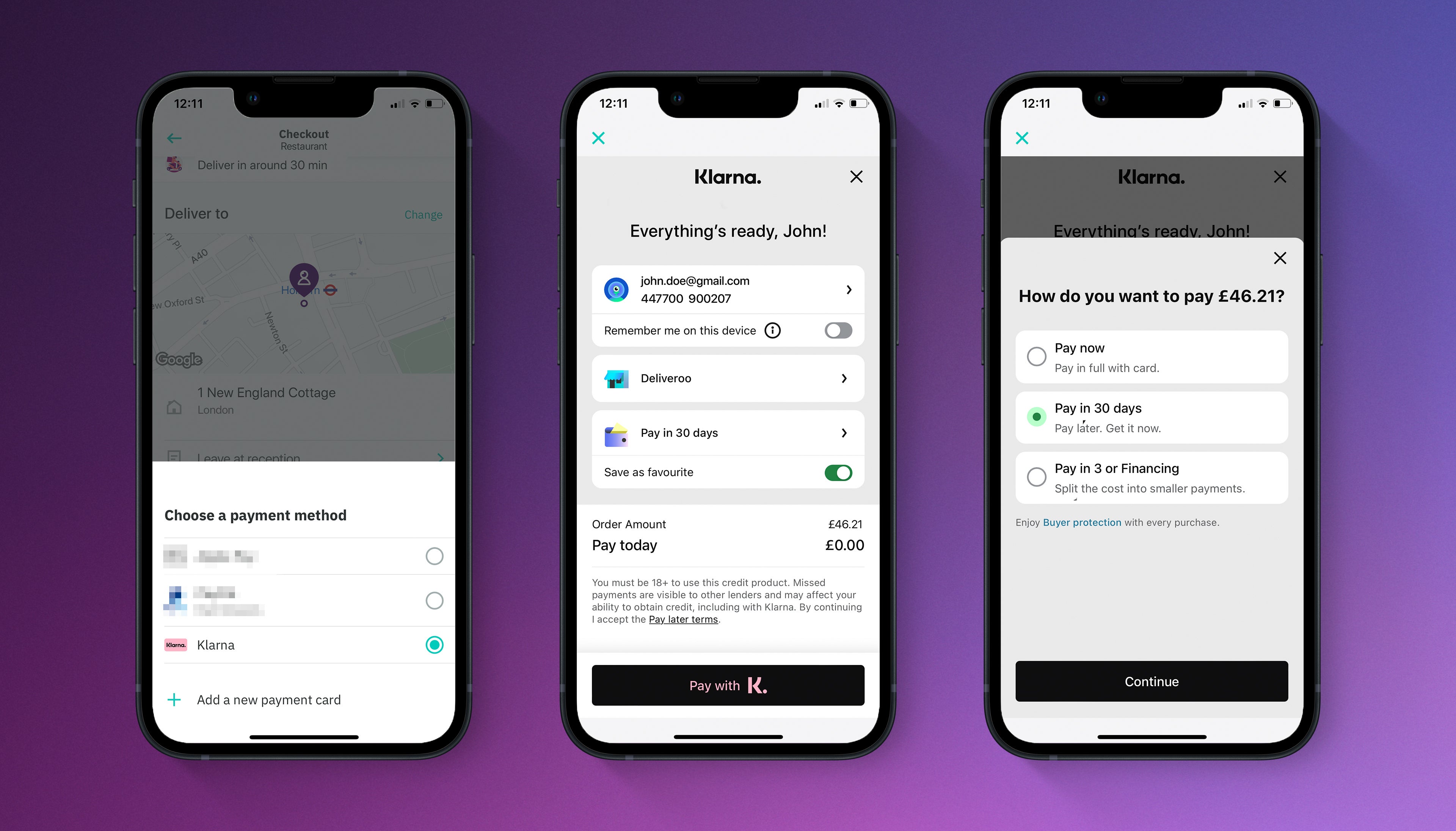

Deliveroo offers three options to pay via Klarna. Customers can choose to pay the full amount immediately by clicking “Pay Now”, or choose between two other options to delay their payment.

They can either choose to “Pay in 30”, which means they must pay the full amount within 30 days of the purchase, or “Pay in 3”, where customers can split the payment into three equal instalments, spread over a 60-day period.

A spokesperson for Klarna told The Independent: “People have been paying for food deliveries with credit cards and overdrafts for decades but they’ve been stung by rip-off fees and extortionate interest, so it’s time consumers had the choice of a healthier alternative where they only ever pay the original cost of the purchase.”

Deliveroo also insisted it is providing customers with “more choice and more flexibility with a safe, secure way to pay online”.

But experts are still concerned that people may be tempted to land themselves in debt to keep up with spiraling costs, which have impacted the prices of food, goods, rent and mortgages, fuel, and energy.

BNPL services such as Klarna and Clearpay have been criticised in the past for sidestepping regulation. A study released in October 2021 found that British consumers amassed for than £4 billion worth of debt using such services.

There have been calls from consumer watchdogs and groups to introduce tougher regulations on the BNPL industry to stop people from falling further into debt, but reports indicate that no action will be taken until 2024.

Sue Anderson, head of media at debt charity StepChange, told The Independent: “It’s a worrying development to see mainstream food delivery providers offering BNPL, especially at a time of such financial uncertainty for households.

“Our research shows those using BNPL are often in financial difficulty, with a quarter of BNPL users having to turn to borrowing to keep up with their essential costs.

“Because BNPL is not yet regulated, providers may not carry out effective affordability checks or prevent users from taking out multiple BNPL loans from different retailers they are unable to repay. The convenience and ease of BNPL can also causes those with less financial experience to make impulse purchases and access credit without realising there can be serious financial consequences if they fall behind on repayments.”

“Unregulated BNPL is putting consumers at risk of financial difficulty and problem debt and we urge the government to act as soon as possible.”

If you’re struggling with your financial situation or debt, you can get in touch with StepChange or any of the charities and groups mentioned above. StepChange offers debt advice onine, or you can call them at 0800 1381111 from Monday to Friday, 8am to 8pm, and Saturday, 8am to 4pm.