Electric vehicle and allied stocks extended their losses in the week ending April 22, with market leader Tesla, Inc. (NASDAQ:TSLA) bucking the downtrend and closing above the key $1,000 psychological level. Meanwhile, the U.S.-listed Chinese EV trio plunged steeply amid delisting woes and the COVID disruptions in China.

Here are the key events that happened in the EV space during the week:

Tesla's Stellar Earnings, Shanghai Resumption And More: Despite the supply chain challenges, Tesla reported first-quarter results that comfortably exceeded expectations. Automotive margin rose to a record, partly supported by an unexpected increase in regulatory credits.

Tesla's management led by chief executive officer Elon Musk sounded upbeat and affirmed the 50% deliveries growth forecast. Musk suggested on the call that he expects the Tesla bot to be worth more than the company's full-self driving business. He also said Robotaxi will likely reach volume production in 2024 and be a massive driver of Tesla's growth.

Following the stellar results, S&P said it is considering upgrading the company's rating to investment grade later this year.

Related Link: Why This Analyst Thinks Tesla's Growth Can 'Shock Wall Street' For Several Years

In another positive catalyst, Tesla restarted its Giga Shanghai after a protracted shutdown, although the ramp is expected to be gradual. The Chinese factory is reportedly operating at 72% of its capacity and is expected to become fully functional in May.

Unrelated to Tesla's EV venture, Musk is proceeding swiftly to lap up social media platform Twitter, Inc. (NYSE:TWTR). In an updated 13D filing, the Tesla CEO suggested he has commitments of about $46.5 billion for the proposed Twitter buyout.

Li Auto Added to SEC's Potential Delisting List: Li Auto, Inc. (NASDAQ:LI) was named in the SEC's identified list under the Holdings Foreign Companies Accountable Act. The inclusion was due to the company's accounting firm not opening its books to the U.S. Public Company Accounting Oversight Board.

If the company continues to be identified for three years for the same issue, it faces the prospect of delisting from the U.S. exchanges.

Related Link: Elon Musk's Starlink Inks Deal With First Aviation Customer: What You Need to Know

Ford Announces Lincoln Star EV: Ford Motor Company's (NYSE:F) luxury brand Lincoln unveiled the Lincoln Star EV SUV globally this week. The company said three new Lincoln-branded EVs will be introduced by 2025. More than half of Lincoln's global volume will be all-electric by this period, the company said. A fourth model will be added by 2026.

Renault Considering EV Spin-off: French automaker Renault SA (OTC:RNLSY) is reportedly considering a spin-off of its EV business, with a possible IPO in 2023. The proposed plan, however, is subject to the concurrence of its alliance partner Nissan Motor Co., Limited (OTC:NSANY).

Lexus Launches RZ SUV: Toyota Motor Corporation's (NYSE:TM) Lexus luxury brand debuted its RZ globally-available BEV model. The first trim to be launched will be the 2023 RZ 450e, as Lexus plots for full electrification by 2035.

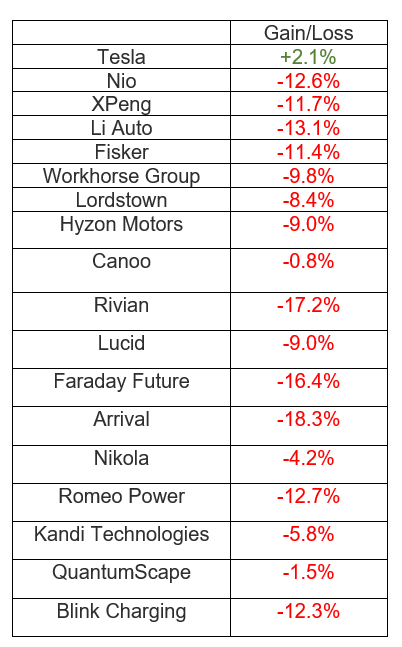

EV Stock Performances for The Week: