Analysts at Bankless put together financial results for the world-leading smart contract platform Ethereum (CRYPTO: ETH).

What Happened: In a report titled “State of Ethereum – Q1 2022”, Bankless’ Ben Giove presented a picture of Ethereum’s performance for the first quarter.

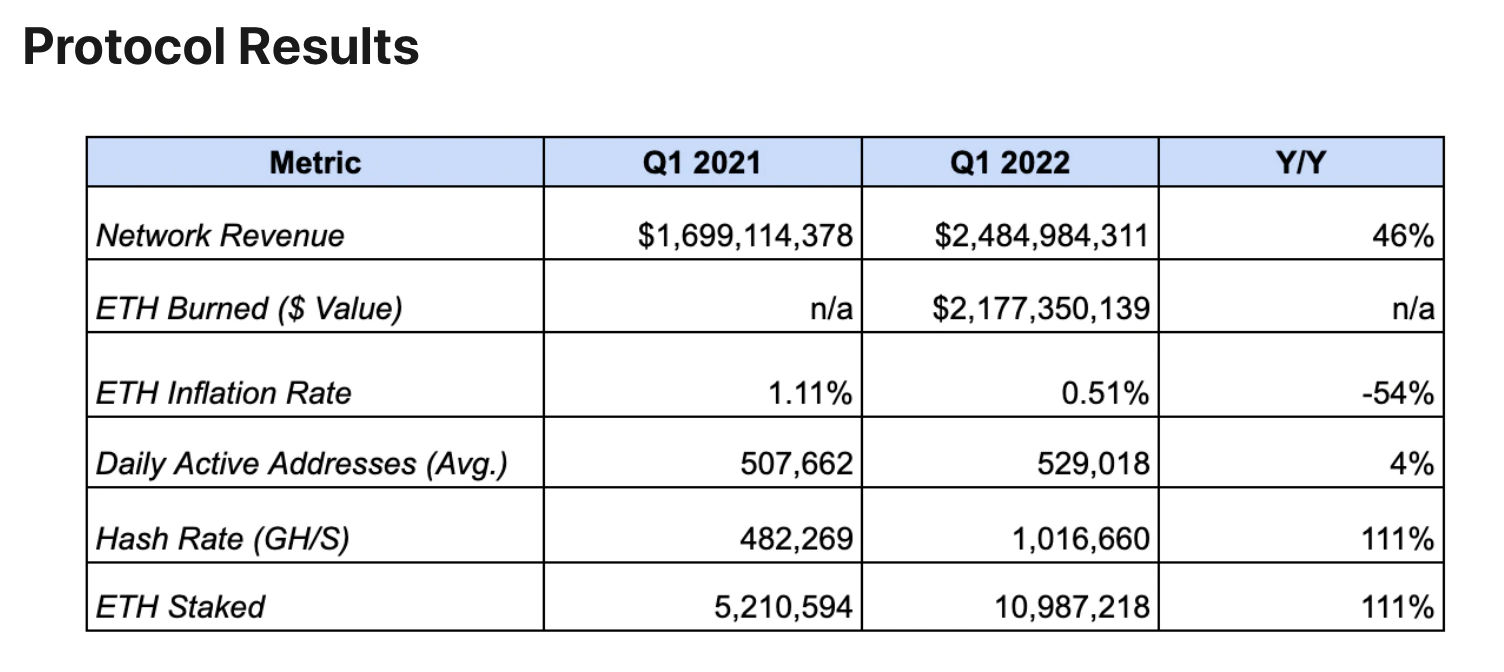

Ethereum’s network revenue was up 46% from $1.6 billion last year to $2.4 billion. In this case, network revenue is measured by the value of transaction fees paid by ETH users.

$2.1 billion of this network revenue was “burned” or removed from circulation, thanks to the implementation of EIP-1559 in August. This upgrade also saw the ETH inflation rate decrease by 54% from 1.1% to 0.51% in the first quarter.

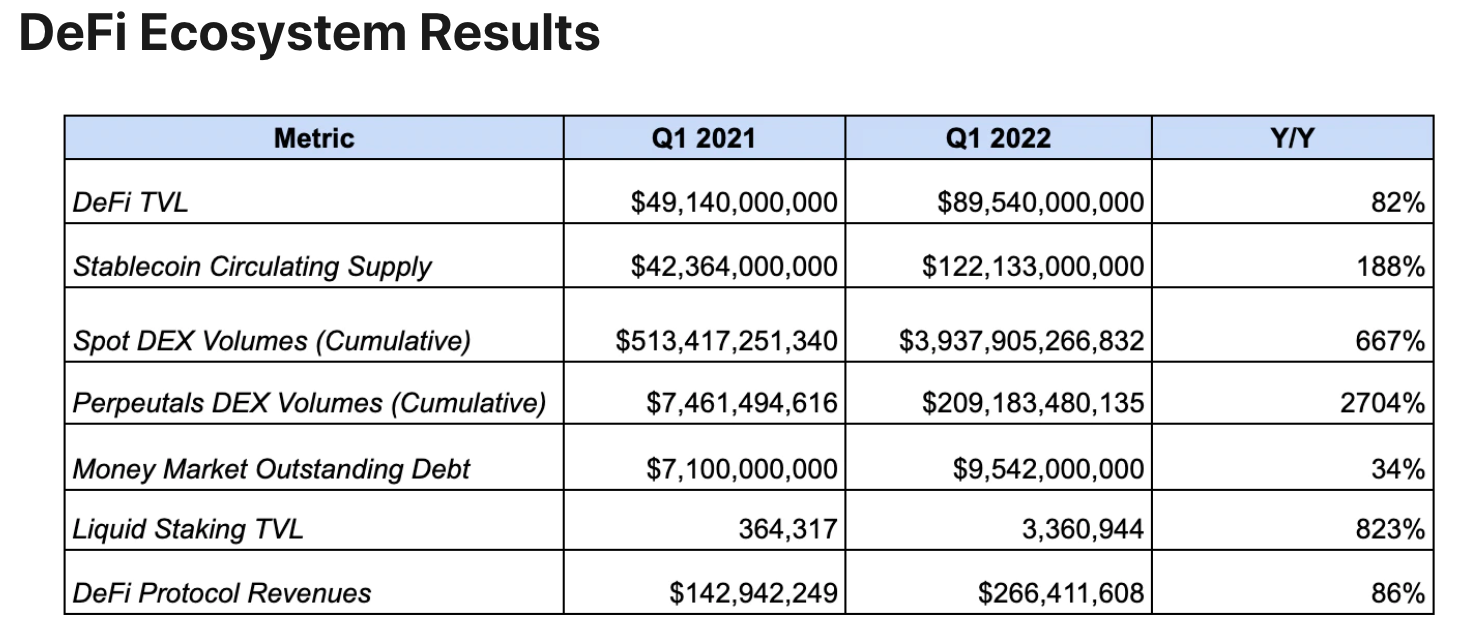

Other notable metrics measuring the network’s growth were those related to Ethereum’s DeFi ecosystem. Total value locked (TVL) across protocols rose 82% to $89.5 billion from $49.1 billion the previous year.

Trading volumes on decentralized exchanges (DEXes) saw a significant uptick over the past year. Spot DEX volumes grew 667% to $3.9 trillion while perpetual DEX volumes saw a whopping 2,704% increase from $7.4 billion to $209.1 billion.

Aside from DeFi, NFT trading was also a significant contributor to Ethereum’s growth. Analysts estimated that NFT marketplace volumes surged 19,290% from $606.3 million to $116.4 billion.

See Also: HOW TO BUY ETHEREUM (ETH)

“While markets face a maelstrom of macro headwinds, there are several catalysts on Ethereum’s horizon that seem posed to strengthen its fundamentals, competitive positioning, and token economics,” said Giove, pointing to the upcoming Merge and the launch of Layer 2 tokens later this year.

Price Action: According to data from Benzinga Pro, ETH was trading at $2,850, up just 0.09% over the last 24 hours.