With a market cap of $24.9 billion, Equity Residential (EQR) is a publicly traded real estate investment trust (REIT) that owns, develops, and manages high-quality apartment communities across major U.S. metropolitan markets. Headquartered in Chicago, the company focuses primarily on urban and high-density suburban locations with strong employment growth, high household incomes, and limited housing supply.

The real estate major has significantly underperformed the broader market over the past year. EQR stock prices have plunged 9.5% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.4% gains. However, in 2026, the stock is up 2.6%, surpassing SPX’s 1.4% rise.

Narrowing the focus, Equity Residential has also lagged behind the industry-focused iShares Global REIT ETF’s (REET) 8.7% gains over the past 52 weeks and 7.3% rally in 2026.

On Feb. 5, EQR released its fiscal 2025 Q4, and its shares initially dipped 2.1% before rebounding 3.4% in the next trading session. It posted rental revenue of $781.9 million and NFFO of 1.03. Same-store revenue rose 2.5%, same-store expenses increased 2.9%, and same-store NOI grew 2.3% year over year. Physical occupancy was 96.2%, compared with 96% in the prior-year quarter.

For the current year, ending in December, analysts expect EQR to deliver an NFFO of $4.10 per share, up 2.8% year over year. Meanwhile, the company has a mixed NFFO surprise history. It has met or surpassed the Street NFFO projections in three of the past four quarters, while missing on another occasion.

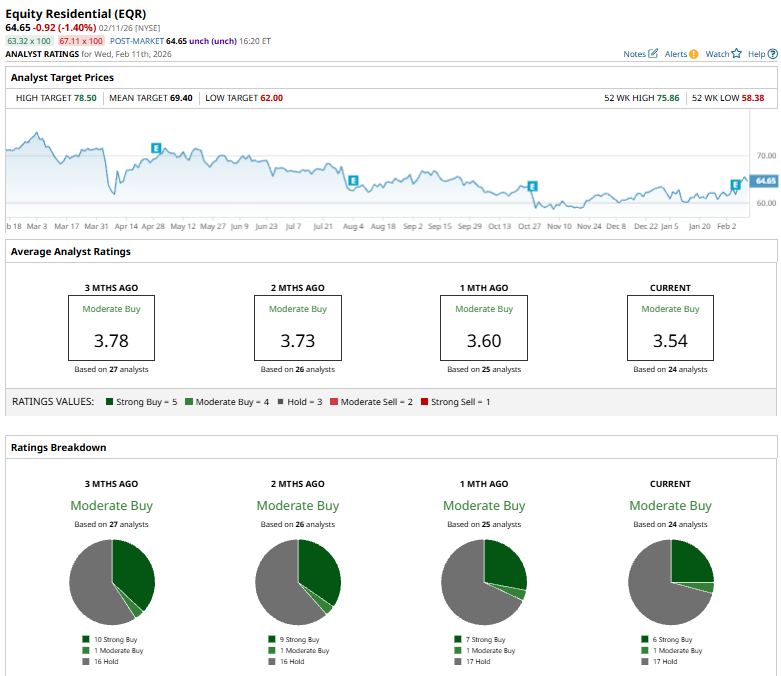

Among the 24 analysts covering the EQR stock, the consensus rating is a “Moderate Buy.” That’s based on six “Strong Buys,” one “Moderate Buy,” and 17 “Holds.”

This configuration is slightly less optimistic than one month ago, when seven analysts gave “Strong Buy” recommendations.

On Feb. 9, Cantor Fitzgerald increased its price target on Equity Residential to $64 from $61 while maintaining a “Neutral” rating. Although the five multifamily REITs it covers reported Q4 results below consensus, the firm noted that investors should focus on new lease rate growth heading into the spring and summer leasing season.

EQR’s mean price target of $69.40 represents a 7.3% premium from current price levels. Meanwhile, the street-high target of $78.50 suggests a 21.4% potential upside.