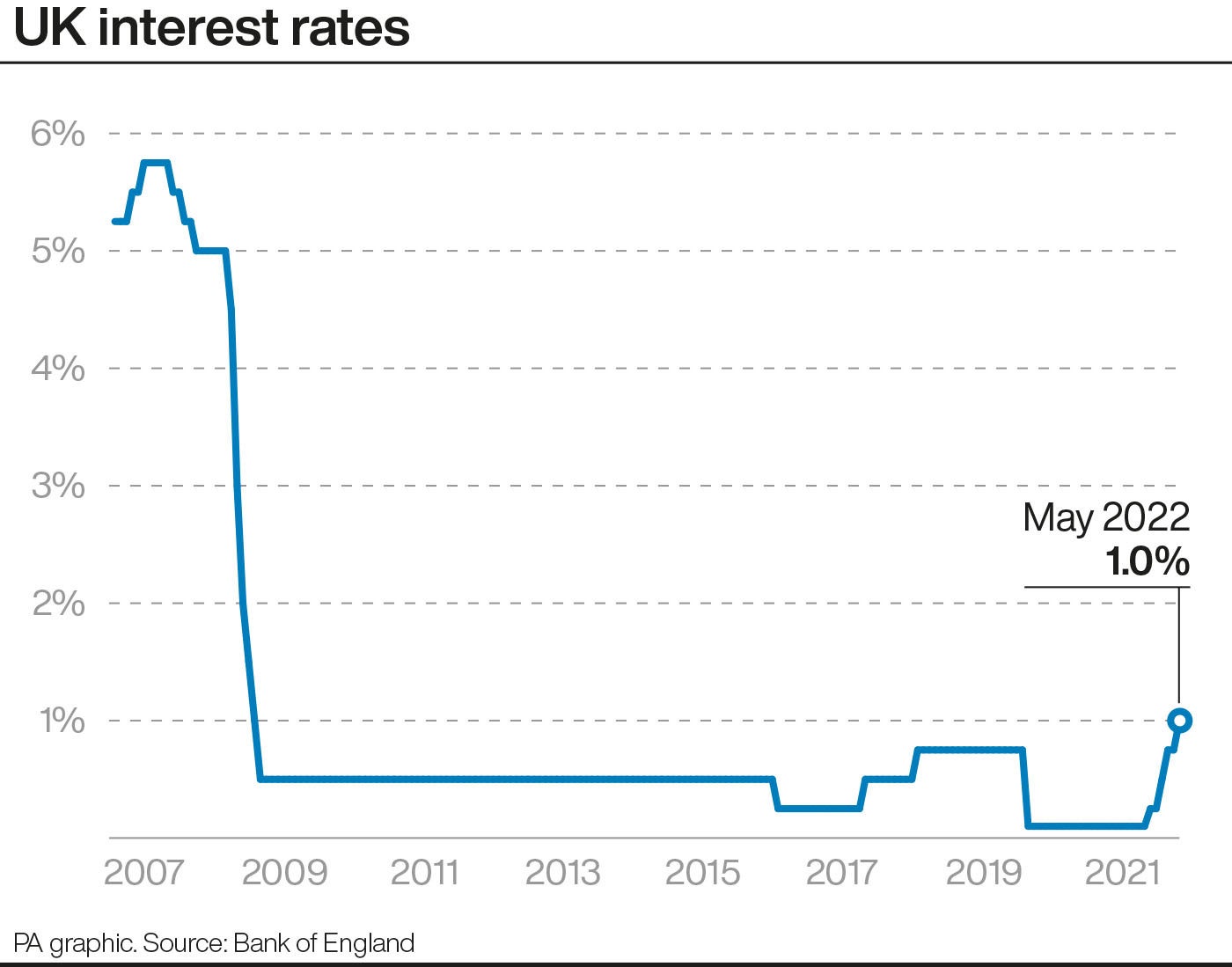

Economists had predicted the Bank of England would announce a rise in interest rates on Thursday – the fourth in a row.

But few had expected the Governor Andrew Bailey to reveal the central bank’s interest rate-setting committee – the Monetary Policy Committee (MPC) – would say the UK economy was set to turn negative.

Digesting the news, economists agreed that the messaging from the Bank suggested it was calming expectations of interest rate hikes next month.

But there was disagreement over whether that meant future rate rises were on the cards to deal with soaring inflation.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said: “The rhetoric here isn’t strong enough to support markets’ view that the Bank Rate will rise to 2.50% early next year, which would represent the largest increase over an 18-month period since 1989. The new forecasts reinforce this message.

“We continue to expect the committee to keep Bank Rate at 1.00% at next month’s meeting, before raising it to 1.25% in August and then keeping it at that level well into 2023.”

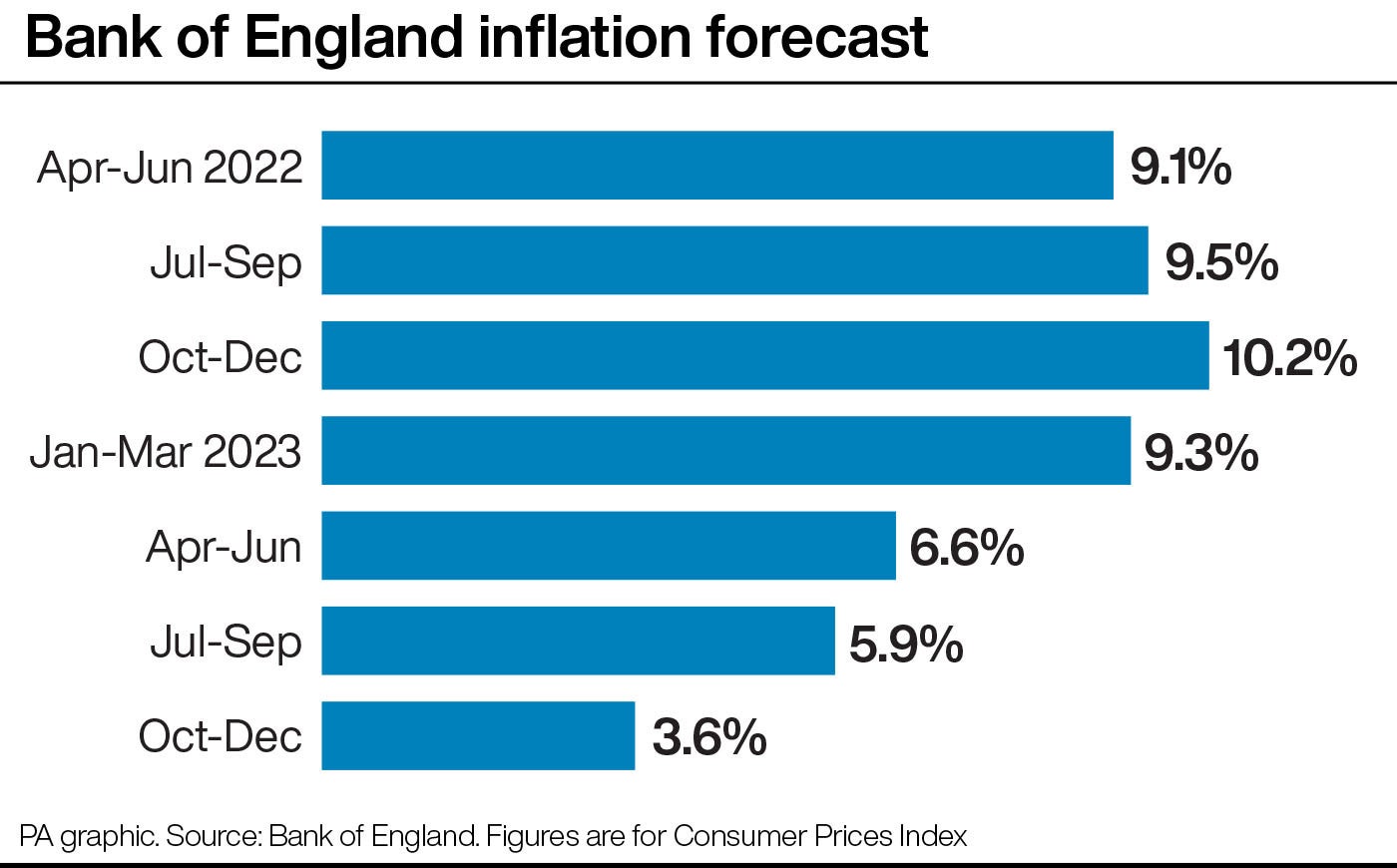

But Paul Dales, chief UK economist at Capital Economics, said he believed rates could hit as high as 3% by next year, as the Bank predicted inflation would hit more than 10% later this year.

He said: “We think that a tight labour market and sticky price/wage expectations will mean that domestic price pressures stay stronger for longer than the MPC expects.

“That’s why we think, despite weaker GDP growth, the MPC will raise rates by 25 basis points at each meeting this year and to 3.00% in 2023.”

George Lagarias, chief economist at Mazars Wealth Management, said: “Markets expect five more hikes until the end of the year.

“The British central bank is clearly on a path to reduce British aggregate demand, betting that this will bring inflation down.

“While hiking rates at a time of high inflation is a perfect textbook response, it is good to remember that those textbooks were written over 30 years ago.

“I have reservations as to how well past theory and practice hold in a much more globalised world, where most of inflation is imported.

“The UK central bank has control over just one aspect of inflation: British demand for goods and services.

“This will make little difference for the prices of goods where the UK market constitutes only a small fragment of sales.”

Overall, economists said they saw the Bank was walking a tightrope to avoid stagflation – a situation where inflation is high but economic growth is low.

Raising interest rates to combat inflation could mean the economy stalls, especially when inflationary pressures are coming from overseas with higher energy costs.

Laith Khalaf, head of investment analysis at AJ Bell, explained: “The Bank is now projecting a period of stagflation, with no growth in GDP expected over the next year, but inflation forecast to run at 6.6%.

“This suggests the monetary policy response in coming months may be more dovish than anticipated, because the UK economy is on the brink of toppling backwards, and too many nudges from the central bank could be the catalyst for a recession.

“This shows the Bank is stuck between a rock and a hard place, trying to act tough on inflation, while at the same time not doing too much damage to economic growth.

“This is a far cry from the transitory inflation mantra that was being chanted last year, but to be fair to the Bank, the Ukraine crisis has seismically shifted the economic landscape.”

Oliver Blackbourn, multi-asset portfolio manager at Janus Henderson Investors, added: “The range of views on the committee is indicative of the sort of Gordian knot that the current economic situation has created for central bankers.

Inflation hitting 10% on the back of energy price rises, just as we hit winter, will only serve to raise the political pressure on the Government to do something substantial to help households through a period of such exceptional pressure on everyday finances

“Stagflation is one of central bankers’ worst fears and the UK looks increasingly ensnared, more so than many other developed markets.”

There were also warnings that high inflation, rising energy bills and low economic growth could put pressure on the Government to provide more support to households.

Mr Khalaf added: “Inflation hitting 10% on the back of energy price rises, just as we hit winter, will only serve to raise the political pressure on the Government to do something substantial to help households through a period of such exceptional pressure on everyday finances.

“This won’t be easy, given how bare the Treasury coffers are following the tremendous cost of the pandemic response.”