/Eaton%20Corporation%20plc%20logo%20on%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Eaton Corporation plc (ETN) is a global power management and industrial technology company headquartered in Dublin, Ireland. Valued at $127.1 billion by market cap, it designs and manufactures a wide range of products, including electrical distribution systems, circuit protection and wiring devices, hydraulic systems and pumps, aerospace components, and vehicle powertrain/electric mobility solutions, helping customers manage electrical, mechanical, and hydraulic power efficiently and safely.

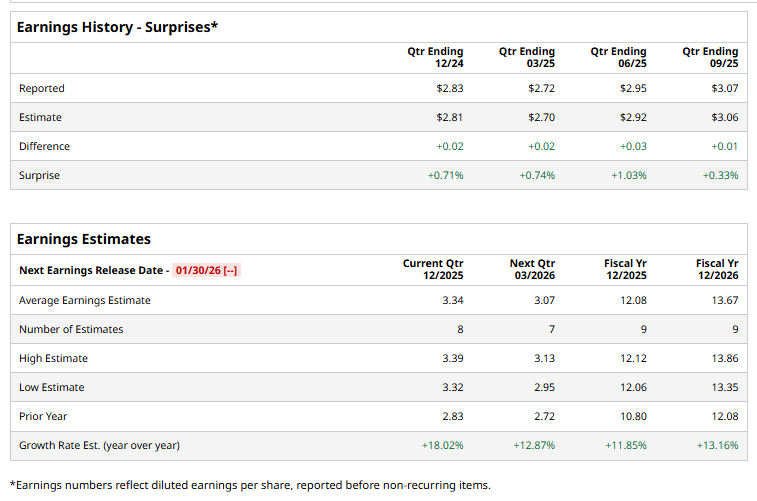

Eaton is expected to announce its fiscal fourth-quarter earnings for 2025 in the near term. Ahead of the event, analysts expect the Intelligent power management company to report a profit of $3.34 per share on a diluted basis, up 18% from $2.83 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the current year, analysts expect ETN to report EPS of $12.08, up 11.9% from $10.80 in fiscal 2024. Its EPS is expected to rise 13.2% year over year to $13.67 in fiscal 2026.

ETN stock has declined 1.4% over the past year, underperforming the S&P 500 Index’s ($SPX) 16.9% gains and the Industrial Select Sector SPDR Fund’s (XLI) 20.3% gains over the same time frame.

ETN shares popped over 3% on Dec. 10, after the company announced plans to open a new manufacturing campus in Henrico County, Virginia, to support surging demand from data center customers. The power management titan will more than double its Richmond-area footprint with a 350,000-square-foot facility, expanding capacity and capabilities for critical power distribution technologies such as static transfer switches, power distribution units, and remote power panels. The investment reflects Eaton’s push to localize manufacturing in response to rapid data center growth in Virginia, where over 50 new data centers have already been permitted this year, with production at the new facility expected to begin in 2027.

Analysts’ consensus opinion on ETN stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 23 analysts covering the stock, 15 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and six give a “Hold.” ETN’s average analyst price target is $411.64, indicating a potential upside of 25.8% from the current levels.