Core & Main (NYSE:CNM) will release its quarterly earnings report on Tuesday, 2024-12-03. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Core & Main to report an earnings per share (EPS) of $0.65.

The announcement from Core & Main is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

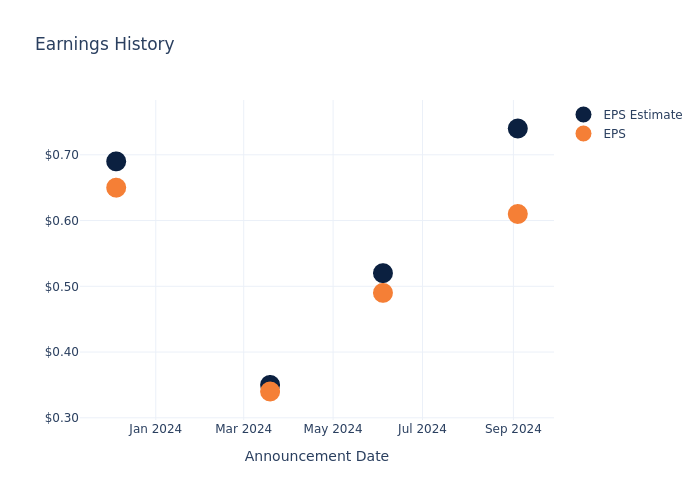

Overview of Past Earnings

The company's EPS missed by $0.13 in the last quarter, leading to a 3.55% drop in the share price on the following day.

Here's a look at Core & Main's past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.74 | 0.52 | 0.35 | 0.69 |

| EPS Actual | 0.61 | 0.49 | 0.34 | 0.65 |

| Price Change % | -4.0% | 3.0% | 2.0% | 2.0% |

Tracking Core & Main's Stock Performance

Shares of Core & Main were trading at $48.55 as of November 29. Over the last 52-week period, shares are up 33.16%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Take on Core & Main

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Core & Main.

Analysts have provided Core & Main with 11 ratings, resulting in a consensus rating of Outperform. The average one-year price target stands at $49.55, suggesting a potential 2.06% upside.

Analyzing Analyst Ratings Among Peers

This comparison focuses on the analyst ratings and average 1-year price targets of WESCO Intl, Applied Industrial Techs and Beacon Roofing Supply, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- The consensus among analysts is an Outperform trajectory for WESCO Intl, with an average 1-year price target of $210.57, indicating a potential 333.72% upside.

- The consensus among analysts is an Outperform trajectory for Applied Industrial Techs, with an average 1-year price target of $262.67, indicating a potential 441.03% upside.

- The prevailing sentiment among analysts is an Outperform trajectory for Beacon Roofing Supply, with an average 1-year price target of $122.0, implying a potential 151.29% upside.

Summary of Peers Analysis

The peer analysis summary presents essential metrics for WESCO Intl, Applied Industrial Techs and Beacon Roofing Supply, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Core & Main | Outperform | 5.53% | $518M | 7.41% |

| WESCO Intl | Outperform | -2.75% | $1.21B | 3.84% |

| Applied Industrial Techs | Outperform | 0.34% | $325.08M | 5.35% |

| Beacon Roofing Supply | Outperform | 7.29% | $730.40M | 7.96% |

Key Takeaway:

Core & Main ranks at the top for Revenue Growth with 5.53%. It is in the middle for Gross Profit at $518M. Core & Main is at the top for Return on Equity with 7.41%.

Get to Know Core & Main Better

Core & Main Inc is a specialty distributor focusing on water, wastewater, storm drainage, and fire protection products and services. Catering to municipalities, private water companies, and contractors, it serves municipal, non-residential, and residential markets nationwide. Its diverse product line includes pipes, valves, fittings, storm drainage products, fire protection products, and meter products. Revenue is primarily generated from pipes, valves, and fittings. The company operates across three construction sectors: municipal, non-residential, and residential, contributing to reliable infrastructure development nationwide.

Unraveling the Financial Story of Core & Main

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Core & Main displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 5.53%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Core & Main's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 6.06%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Core & Main's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 7.41%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Core & Main's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.96%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Core & Main's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.6.

To track all earnings releases for Core & Main visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.