Ooma (NYSE:OOMA) is set to give its latest quarterly earnings report on Wednesday, 2024-12-04. Here's what investors need to know before the announcement.

Analysts estimate that Ooma will report an earnings per share (EPS) of $0.15.

The market awaits Ooma's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

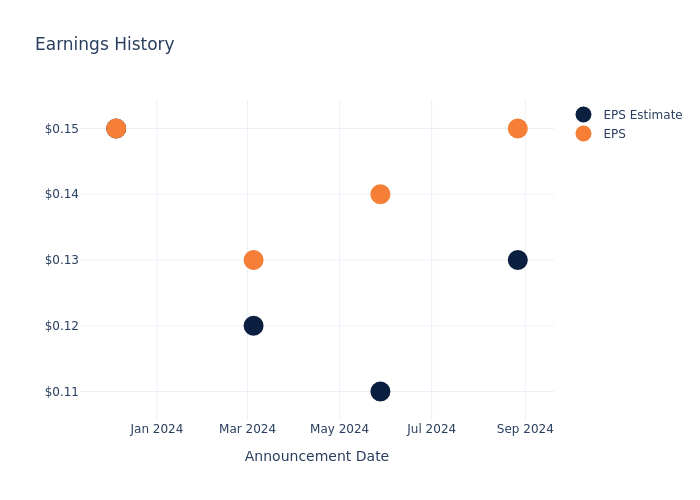

Overview of Past Earnings

In the previous earnings release, the company beat EPS by $0.02, leading to a 24.94% increase in the share price the following trading session.

Here's a look at Ooma's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.13 | 0.11 | 0.12 | 0.15 |

| EPS Actual | 0.15 | 0.14 | 0.13 | 0.15 |

| Price Change % | 25.0% | 8.0% | -12.0% | -9.0% |

Market Performance of Ooma's Stock

Shares of Ooma were trading at $14.75 as of December 02. Over the last 52-week period, shares are up 37.67%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Opinions on Ooma

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Ooma.

Ooma has received a total of 2 ratings from analysts, with the consensus rating as Buy. With an average one-year price target of $16.25, the consensus suggests a potential 10.17% upside.

Understanding Analyst Ratings Among Peers

This comparison focuses on the analyst ratings and average 1-year price targets of 8x8, CS Disco and Mitek Systems, three major players in the industry, shedding light on their relative performance expectations and market positioning.

- 8x8 is maintaining an Buy status according to analysts, with an average 1-year price target of $2.95, indicating a potential 80.0% downside.

- The consensus outlook from analysts is an Buy trajectory for CS Disco, with an average 1-year price target of $7.0, indicating a potential 52.54% downside.

- The consensus outlook from analysts is an Neutral trajectory for Mitek Systems, with an average 1-year price target of $9.5, indicating a potential 35.59% downside.

Peers Comparative Analysis Summary

The peer analysis summary offers a detailed examination of key metrics for 8x8, CS Disco and Mitek Systems, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ooma | Buy | 9.90% | $38.70M | -2.62% |

| 8x8 | Buy | -2.16% | $123.17M | -13.57% |

| CS Disco | Buy | 3.79% | $26.53M | -5.42% |

| Mitek Systems | Neutral | 4.43% | $38.49M | 0.10% |

Key Takeaway:

Ooma ranks at the bottom for Revenue Growth among its peers. It is in the middle for Gross Profit. Ooma is at the bottom for Return on Equity.

About Ooma

Ooma Inc is a communications services company. It is a smart software-as-a-service ("SaaS") and unified communications platform that deliver voice and collaboration features including messaging, intelligent virtual attendants and video conferencing, and residential phone service provides PureVoice high-definition voice quality, advanced functionality and integration with mobile devices. Its services rely upon the following main elements: multi-tenant cloud service, on-premise devices, desktop and mobile applications, and calling platforms. Ooma generates revenues from the sale of subscriptions and other services.

Understanding the Numbers: Ooma's Finances

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Ooma displayed positive results in 3 months. As of 31 July, 2024, the company achieved a solid revenue growth rate of approximately 9.9%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: Ooma's net margin excels beyond industry benchmarks, reaching -3.33%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of -2.62%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Ooma's ROA stands out, surpassing industry averages. With an impressive ROA of -1.39%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Ooma's debt-to-equity ratio is below the industry average at 0.3, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Ooma visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.