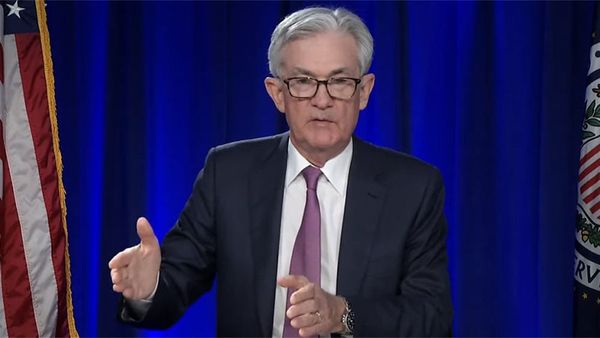

Dow Jones futures, along with S&P 500 futures and Nasdaq 100 futures, were higher ahead of Tuesday's stock market open, as Wall Street digested Federal Reserve Chairman Jerome Powell's speech.

"Overall, the economy is in solid shape; we intend to use our tools to keep it there," Fed chief Powell said in remarks at a National Association for Business Economics Annual Meeting. "This is not a committee that feels like it's in a hurry to cut rates quickly."

Powell promised that the Federal Open Market Committee will continue to make decisions on rate cuts on a "meeting by meeting" basis due to the fact that risks are "two sided." This was a reference to the Fed's dual mandate to both promote price stability while also targeting maximum employment.

According to the CME FedWatch Tool, the odds of another 50 bps rate cut at the next FOMC meeting in November fell to 36.2% compared with yesterday's likelihood of 53.2%. Instead, Wall Street places a 63.8% chance of a smaller, 25-basis-point cut.

Elsewhere, Friday's U.S. employment report takes the economic spotlight this week. Nonfarm payrolls are seen rising by 142,000 while the unemployment rate is seen coming in at 4.2%, according to Econoday. And Wednesday's ADP jobs data is a precursor to that release.

Tesla Rolls Toward Buy Point

Further, Tesla stock is approaching a new buy point ahead of this week's potential third-quarter delivery report. If it sticks to its previous third-quarter delivery report schedule, Tesla should announce the data on Wednesday.

Analyst consensus has Tesla global Q3 deliveries totaling 462,000 units, up 6% vs. Q3 2023, according to FactSet. This total would represent the third-best quarterly delivery total ever for Tesla, behind Q2 2023's 466,140 and Q4 2023's record-setting 484,507 deliveries. Analysts project Tesla matching its record total in the fourth quarter, meaning unit sales would be flat compared to a year ago.

Finally, there are a few noteworthy earnings reports due over the next week, including cruise operator Carnival, Dow Jones giant Nike, Paychex and Levi Strauss.

Wall Street Wags Its Tail At This Stock's 301% Run, Sees More Coming

Stock Market Today

On Monday, the Dow Jones Industrial Average inched higher, while the S&P 500 gained 0.4%. The tech-heavy Nasdaq composite also rose 0.4%.

Among the best companies to watch on the stock market today are Arista Networks, Spotify, Texas Roadhouse and Wingstop.

Notable Dow Jones components are Amazon, Apple, Home Depot and Microsoft.

Amazon and Tesla featured in this Stocks Near A Buy Zone column.

Close, But No 'Perfect' Cigar For Nvidia, Broadcom. But Kudos To These 22 Gems.

Dow Jones Today: Oil Prices, Treasury Yields

Ahead of Tuesday's opening bell, Dow Jones futures inched higher, while S&P 500 futures rose 0.1% vs. fair value. Tech-heavy Nasdaq 100 futures climbed 0.2% vs. fair value. Remember that overnight action in Dow Jones futures and elsewhere doesn't necessarily translate into actual trading in the next regular stock market session.

On Monday, the 10-year U.S. Treasury yield ticked higher to 3.79%. And oil prices edged higher, as West Texas intermediate futures settled around $68.30 a barrel.

What To Do Now

Now is an important time to read IBD's The Big Picture column amid the ongoing stock market action. Following Monday's session, be sure to check out today's The Big Picture and today's updated exposure level.

On Monday's "IBD Live" show, the team discussed current trading conditions amid the ongoing stock market rebound.

An essential resource for daily breakouts is IBD MarketSurge's "Breaking Out Today" list. It shows MarketSurge Growth 250 stocks that are breaking out past buy points. Meanwhile, the MarketSurge "Near Pivot" list shows more stocks nearing buy points in bases.

To find more stock ideas, check IBD Stock Lists like IBD 50, Big Cap 20 and Stocks Near A Buy Zone. These features identify bullish patterns and buy points and are available to check every day.

Nvidia, Apple And Tesla Highlight How To Handle This Market

Dow Jones: Home Depot

Dow Jones retailer Home Depot is moving further out of buy range past a handle buy point at 378.58, according to MarketSurge pattern recognition.

Outside the Dow Jones index, Arista Networks is in a buy zone past a 376.50 buy point in a consolidation. Spotify shares are falling back into buy range above a consolidation's 359.38 entry.

Texas Roadhouse is attempting to break out past a 177.72 flat-base entry, but is under the buy trigger. Finally, Wingstop topped a 431.03 entry last week, but is below it.

Broadcom Pulls Past Tesla As Amazon Locks Heads With Google

Stock Market Today: Companies To Watch

These are four stocks in or near buy zones in today's stock market.

| Company Name | Symbol | Correct Buy Point | Type Of Buy Point |

|---|---|---|---|

| Ferrari | 442.80 | Flat base | |

| Taiwan Semiconductor | 175.45 | Cup with handle | |

| ServiceNow | 850.33 | Flat base | |

| Uber Technologies | 75.40 | Double bottom |

Source: IBD Data as of Sept. 30

Magnificent Seven Stocks: Alphabet, Meta, Nvidia

Among Magnificent Seven stocks, Alphabet, Meta Platforms and Nvidia all closed higher in Monday's trading.

Google parent Alphabet is getting above resistance at the 50-day line following a strong rebound in recent weeks.

Meta stock is moving further above a 544.23 alternate entry, while Nvidia shares continues to hold above its 50-day line, a key level to watch.

Dow Jones Leaders: Amazon, Apple, Microsoft

Among Dow Jones components in the Magnificent Seven, Amazon shares are approaching a 195.37 entry in a cup with handle.

Apple is right at a 232.92 buy point in a V-shaped cup with handle after Monday's 2.2% rally. And Microsoft shares show a 441.85 cup-with-handle entry.

Be sure to follow Scott Lehtonen on X/Twitter at @IBD_SLehtonen for more on growth stocks and the Dow Jones Industrial Average.