Dollar General (DG) investors must be disappointed with the stock’s reaction on Thursday.

The retailer's shares are down about 8% at last check and were down as much as 9.9% following the disappointing report.

The company beat on revenue expectations but missed on earnings estimates despite growing its bottom line 12% year over year.

Further, management said the cost pressures that weighed on it last quarter — although temporary — would persist into this quarter as well.

Regardless, investors are voting with their dollars and it’s clear they didn’t like the quarter.

For what it’s worth, shares of Dollar Tree (DLTR) suffered a 7.8% decline on Nov. 22 following its earnings results.

Let’s take a fresh look at Dollar General stock.

Trading Dollar General Stock

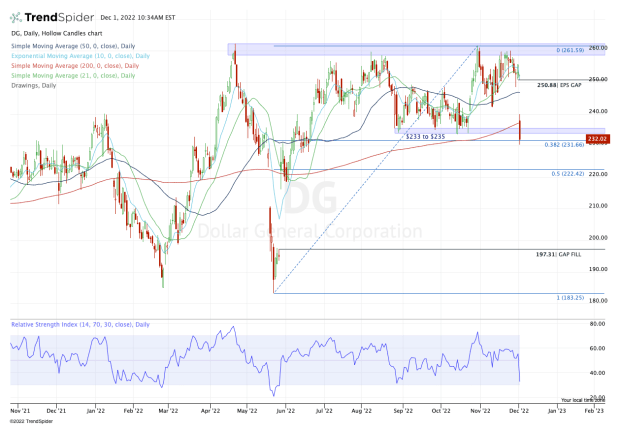

Chart courtesy of TrendSpider.com

Shares of Dollar General gapped down to the 200-day moving average and knifed right through this measure. Worse, they cut through prior support in the $233 to $235 area as well.

While the stock is finding some buyers in the $230 area — and at the 38.2% retracement — it’s very discouraging to see it lose those prior levels.

This is what I call “deliberate price action,” meaning the stock is deliberately cutting through major support zones. It could have held support but opted not to. That’s sending a message.

Now, this can go two ways.

This could simply be a shakeout, where the stock breaks below key support and then bounces and reclaims these levels. If that’s the case, the bulls can be long and use the recent low as their stop-loss.

The flip side is the shares could remain below the $233 to $235 zone and, absent a wave of new buyers, could continue to trickle lower.

The dollar stores clearly aren’t doing all that well. At the same time, Walmart (WMT) stock is doing quite well, as are a few other retailers we looked at this week. So perhaps traders should be looking at these names instead of Dollar General or Dollar Tree.

For Dollar General stock, keep an eye on $233 to $235. Back above this zone and the 200-day moving average opens the door up back to $240, then the 50-day moving average and the gap-fill near $250.

Below $230 opens the door down to the $220 to $222.50 zone.

Cyber Week Deal

Get Action Alerts PLUS for our lowest price of the year! The markets are tough right now, but this is the best time to have professional guidance to help navigate the volatility. Unlock portfolio guidance, stock ratings, access to portfolio managers, and market analysis every trading day. Claim this deal now!