/Analog%20Devices%20Inc_%20HQ%20photo-by%20Sundry%20Photography%20via%20iStock.jpg)

With a market cap of $156.6 billion, Analog Devices, Inc. (ADI) is a global semiconductor company that designs, manufactures, and markets integrated circuits, software, and subsystems used to convert, manage, and process real-world signals. Its products serve a wide range of industries including industrial, automotive, communications, aerospace, defense, and healthcare across markets worldwide.

Shares of the Wilmington, Massachusetts-based company have surpassed the broader market over the past 52 weeks. ADI stock has surged 54.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14%. Moreover, shares of Analog Devices are up 18.2% on a YTD basis, compared to SPX's 1.3% gain.

In addition, shares of the semiconductor maker has also outpaced the State Street Technology Select Sector SPDR ETF's (XLK) 20.2% return over the past 52 weeks.

Shares of Analog Devices climbed 5.3% on Nov. 25, 2025, after the company reported strong Q4 2025 results, with adjusted EPS of $2.26 and revenue of $3.08 billion, both exceeding expectations. The rally was further driven by an upbeat Q1 2026 outlook, with the company forecasting revenue of $3.1 billion (±$100 million) and adjusted EPS of $2.29, both above Wall Street estimates. Investors were also encouraged by signs of a broad recovery, including 34% year-over-year growth in the industrial segment to $1.43 billion and stronger-than-expected communications revenue of $389.8 million.

For the fiscal year ending in October 2026, analysts expect ADI's adjusted EPS to increase nearly 28% year-over-year to $9.97. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

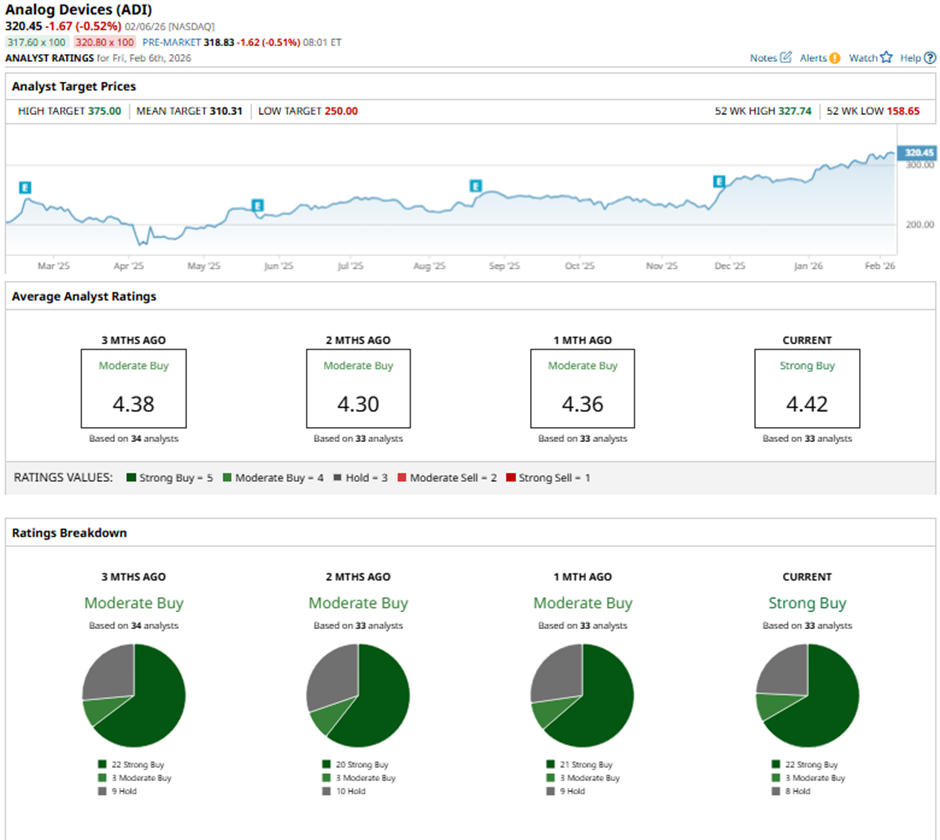

Among the 33 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 22 “Strong Buy” ratings, three “Moderate Buys,” and eight “Holds.”

On Jan. 16, Morgan Stanley analyst Joseph Moore raised Analog Devices’ price target to $314 and maintained an “Overweight” rating.

As of writing, the stock is trading above the mean price target of $310.31. The Street-high price target of $375 implies a potential upside of 17% from the current price levels.