Madison, Wisconsin-based Alliant Energy Corporation (LNT) operates as a utility holding company that provides regulated electricity and natural gas services. Valued at $17.2 billion by market cap, the company supplies electricity, natural gas, and water to residential and commercial customers.

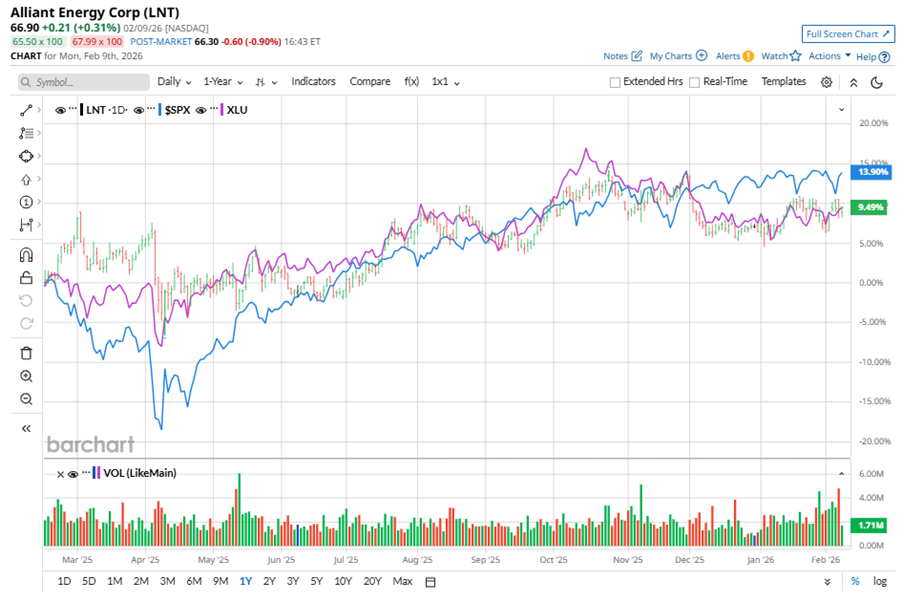

Shares of this utility holding company have underperformed the broader market over the past year. LNT has gained 12.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.6%. However, in 2026, LNT stock is up 2.9%, surpassing the SPX’s 1.7% rise on a YTD basis.

Zooming in further, LNT’s outperformance is apparent compared to the Utilities Select Sector SPDR Fund (XLU). The exchange-traded fund has gained about 11.3% over the past year. Moreover, the stock’s gains on a YTD basis outshine the ETF’s 1.9% returns over the same time frame.

LNT's underperformance is mainly due to increased operating and maintenance expenses, depreciation, and financing costs.

On Nov. 6, 2025, LNT shares closed down marginally after reporting its Q3 results. Its adjusted EPS came in at $1.12, down 2.6% from the year-ago quarter. The company’s revenue stood at $1.2 billion, up 11.9% year over year. LNT expects full-year adjusted EPS in the range of $3.17 to $3.23.

For the current fiscal year, ended in December 2025, analysts expect LNT’s EPS to grow 5.6% to $3.21 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

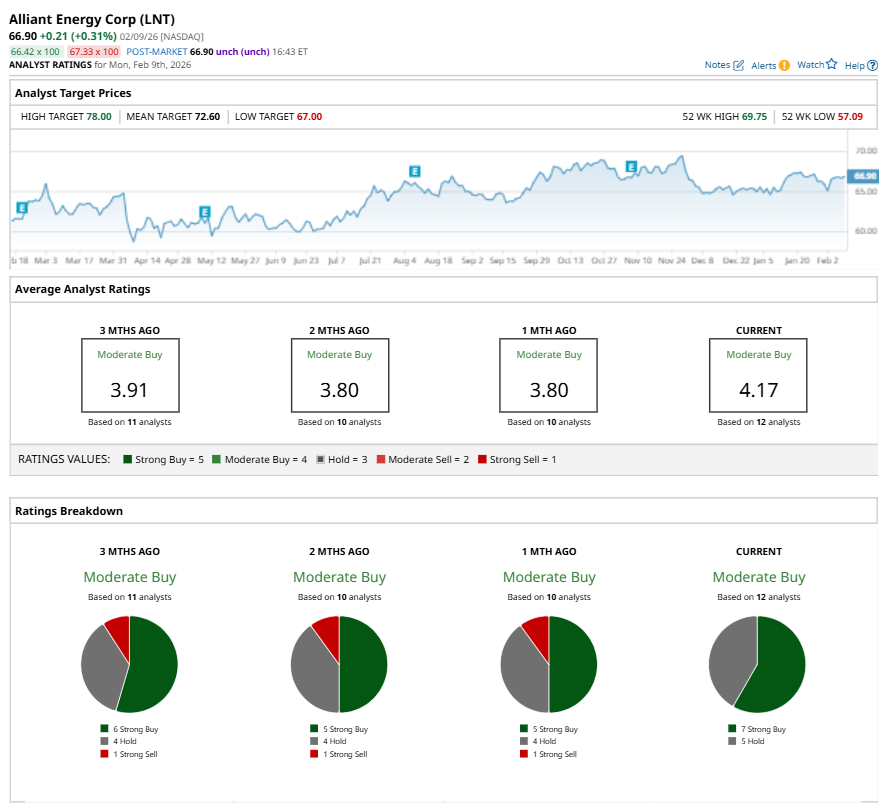

Among the 12 analysts covering LNT stock, the consensus is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, and five “Holds.”

This configuration is more bullish than a month ago, with five analysts suggesting a “Strong Buy,” and one recommending a “Strong Sell.”

On Jan. 21, Barclays PLC (BCS) upgraded LNT to an “Equal Weight” rating with a price target of $67, implying a marginal potential upside from current levels.

The mean price target of $72.60 represents an 8.5% premium to LNT’s current price levels. The Street-high price target of $78 suggests an upside potential of 16.6%.