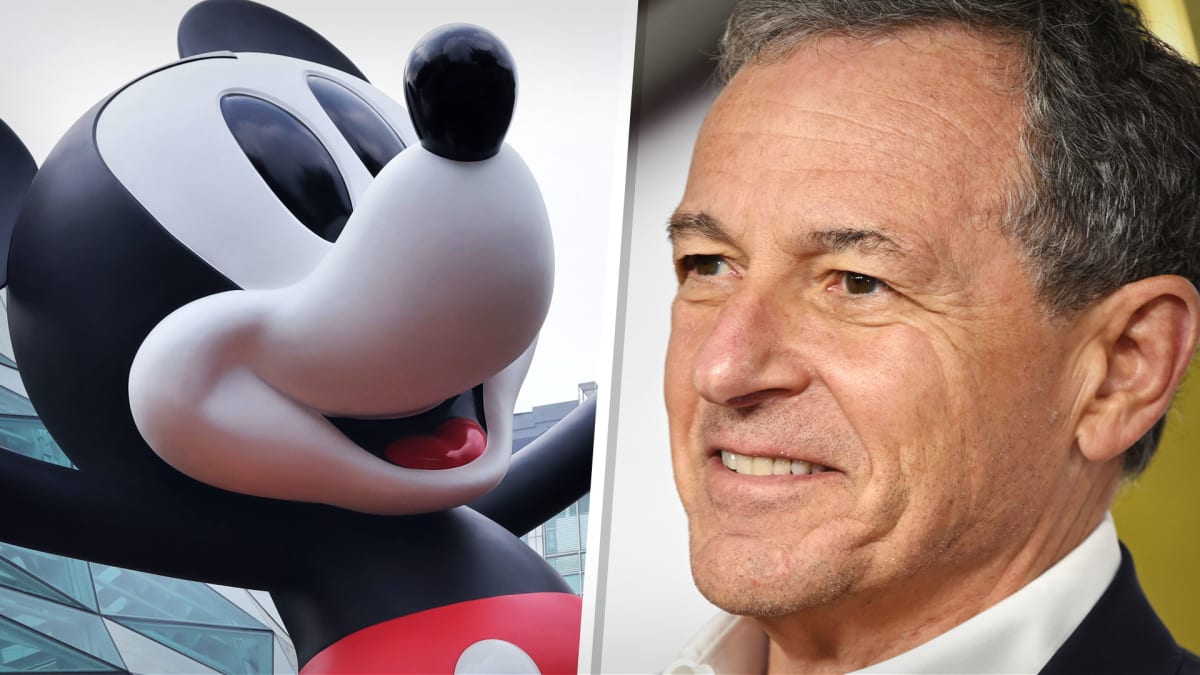

Walt Disney (DIS) shares surged higher Thursday after returning CEO Bob Iger unveiled a raft of changes at the media and entertainment group as it fends off an activist challenge from billionaire investor Nelson Peltz.

Iger detailed sweeping changes within the group's operating structure, including 7,000 layoffs, $5.5 billion in cost cuts and a new three-part organizational structure focused on Parks, Entertainment and ESPN.

He also said Disney would restore its regular dividend, which it suspended during the peak of the pandemic in 2020, by the end of the calendar year.

The moves followed a stronger-than-expected first quarter earnings report that included narrowing losses for its direct-to-consumer streaming business that were offset by another surge in profits at its Parks division.

Disney said adjusted diluted earnings for the three months ended in December, the group's fiscal first quarter, came in at 99 cents per share -- well ahead of the Street forecast of 78 cents per share -- as revenues rose 7.7% to $23.51 billion.

Iger, who underscored the need to focus on creativity -- a stark contrast to the leadership of ousted CEO Bob Chapek -- said content spending would remain in the low-$30 billion range this year. But he trimmed capital-spending projections by around 10%, to $6 billion, while keeping guidance for segment operating income to grow at a 'high single-digit percentage range' over the whole of the fiscal year.

"We must also return creativity to the center of the company, increase accountability, improve results, and ensure the quality of our content and experiences," Iger told investors on a conference call late Wednesday. "Our company is fueled by storytelling and creativity. And virtually every dollar we earn, every transaction, every interaction with our consumers emanates from something creative."

"Our new structure is aimed at returning greater authority to our creative leaders and making them accountable for how their content performs financially," he added. "Our former structure severed that link, and it must be restored. Moving forward, our creative teams will determine what content we're making, how it is distributed and monetized, and how it gets marketed."

Disney shares were marked 1.5% in early Thursday trading and changing hands at $113.46 per share, a move that would extend the stock's year-to-date gain to around 27.5%.

Still, Disney lost 2.4 million subscribers over the whole of the quarter, although ESPN+ subs rose 2% to 24.9 million and was Hulu up 2% to 48 million, following a 37.5% price increase for an annual Disney+ account put in place late last year.

The Direct-to-Consumer division, however, saw its operating loss narrow to around $1.05 billion from the $1.5 billion loss recorded over the three months ending in September.

"We were, as a company, in a global arms race for subscribers," Iger said. "And in our zeal to go after subscribers, I think we might have gotten a bit too aggressive in terms of our promotion, and we are going to take a look at that."

Parks and Experiences revenues came in at $8.74 billion, topping the Street's estimate and rising more than 21% from last year as visitors returned to re-open resorts and cruises around the world, particularly in China. Operating income for the division was $3.1 billion, Disney said.

"We got better results than we previewed, but commentary and restructuring were relatively in line," said KeyBanc Capital Markets analyst Brandon Nispel, who lifted his price target on Disney by $11, to $130, following last night's earnings.

" We left with more questions than we started; ultimately, we would not be surprised to see the stock fade tomorrow, as the big picture questions remain unanswered," he added. :However, we're fairly confident Disney's Media future profitability will be greater in three years than it ever was, and feel Parks value is underappreciated."

One of the larger questions might be whether Iger was able to keep Peltz, who is lobby for a seat on the board, from pressing his case for more changes at the company's annual meeting in April.

Peltz has said he wants to work with Iger, who returned to the group on a temporary basis in November, on a CEO succession plan, improving operating margins at the group's direct-to-consumer business, accelerating cost cuts and reinstating the company's dividend by 2025.

Iger's dividend vow may placate at least one of those concerns, but profitability may still remain elusive in the newly-created 'entertainment' division if ad spending continues to contract, consumer baulk at price hikes and content spending remains unchanged.

There was also no mention of any plans to purchase the remaining one-third stake of Hulu, the streaming service it shares with Comcast (CMCSA), prior to the January 2024 deadline - a move Peltz has pushed for.

"We are focused on the success of our streaming business and the return it generates for our shareholders long into the future," Iger said.

Make sense of the market. Get daily analysis of market conditions and economic trends from our portfolio managers.