Akash Systems has signed a non-binding preliminary memorandum of terms with the U.S. Department of Commerce for $18.2 million in direct funding and $50 million in federal and state tax credits through the CHIPS Act. Although this isn’t yet a binding contract that will give the company the promised funds, it’s an important first step in the negotiation process for the Oakland-based startup, which shows that both the company and the U.S. government are gradually moving towards a formal agreement. According to Akash Systems (h/t Axios), it will use the funds to ramp up its operations for producing diamond-cooled semiconductors for AI, data centers, space applications, and defense markets.

Diamond-cooling technology goes deeper than just thermal paste with nano-diamond technology. For example, some use synthetic diamonds as the chip substrate, utilizing the material’s thermal conductivity to more efficiently move heat away from the processor. So, let's look closer at Akash's solution.

Akash does not detail exactly how its diamond cooling technology works, but it says that it has fused synthetic diamond with conductive materials like Gallium Nitride to use it as a semiconductor. So, for starters, it could be that the company buys a GPU chip from a supplier and then mounts it on its own GaN-on-diamond PCB. Thus, in the long run, the company could produce its own synthetic diamond wafers for use in chip fabrication by manufacturers like Nvidia and Qualcomm.

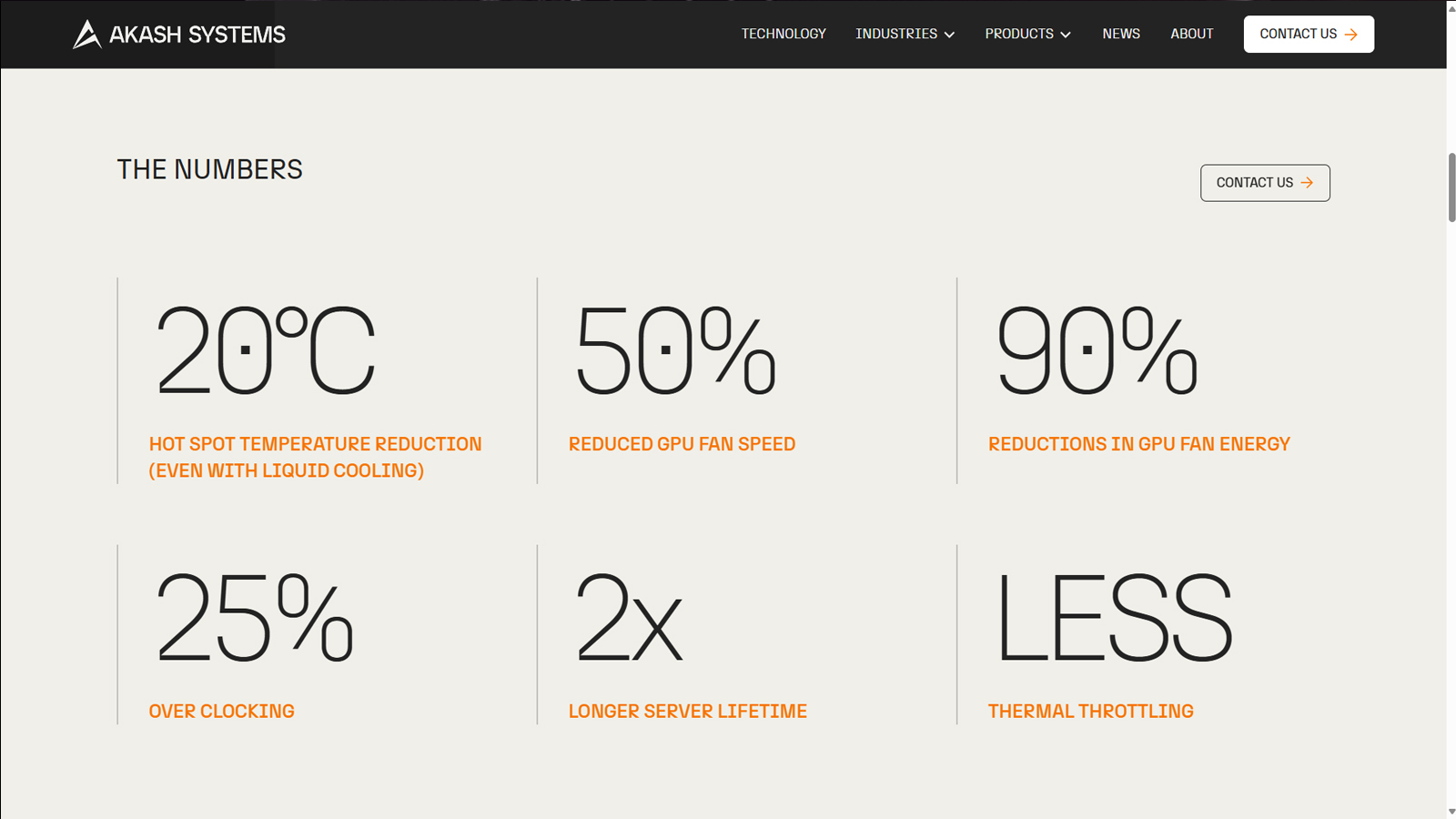

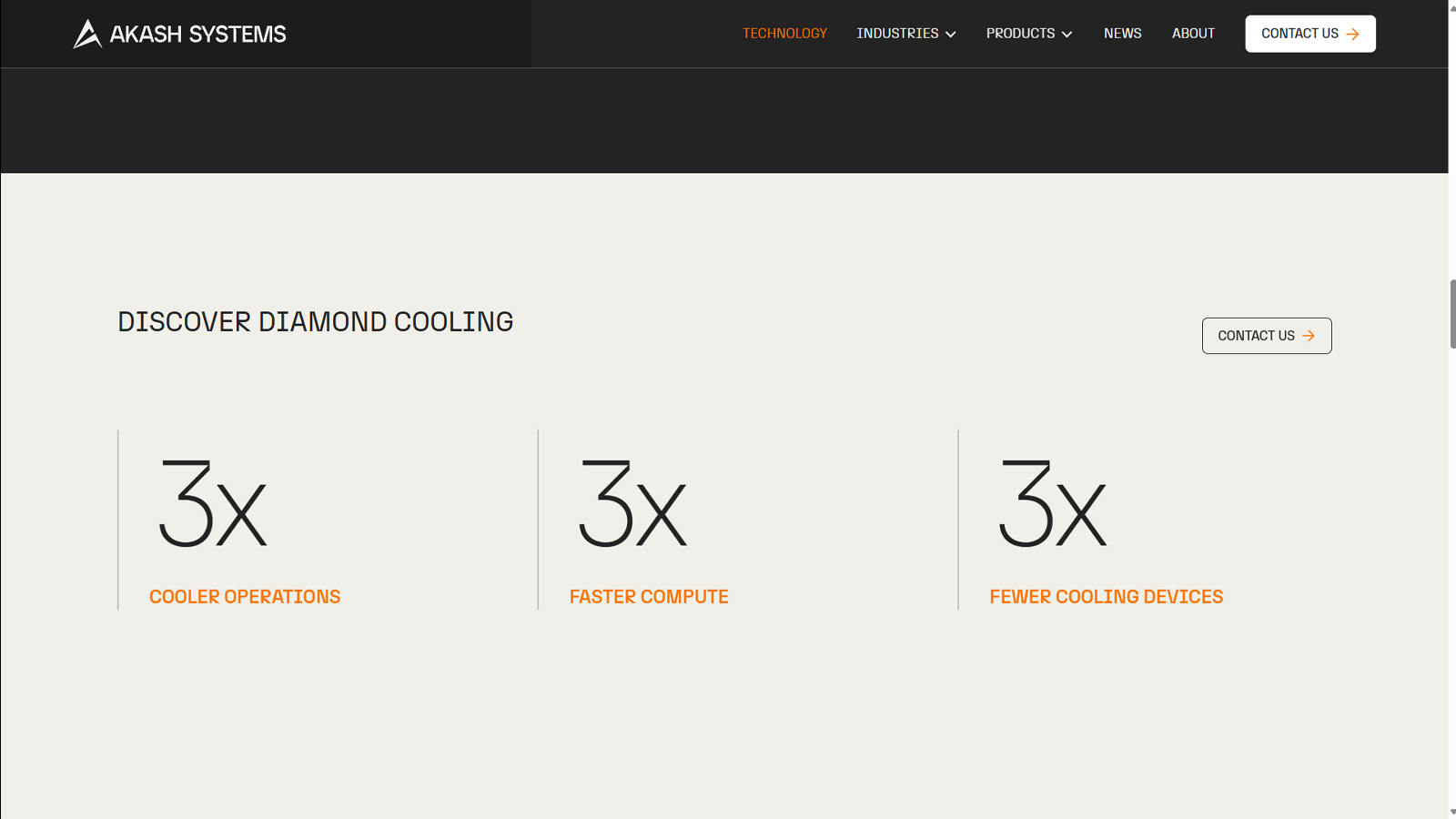

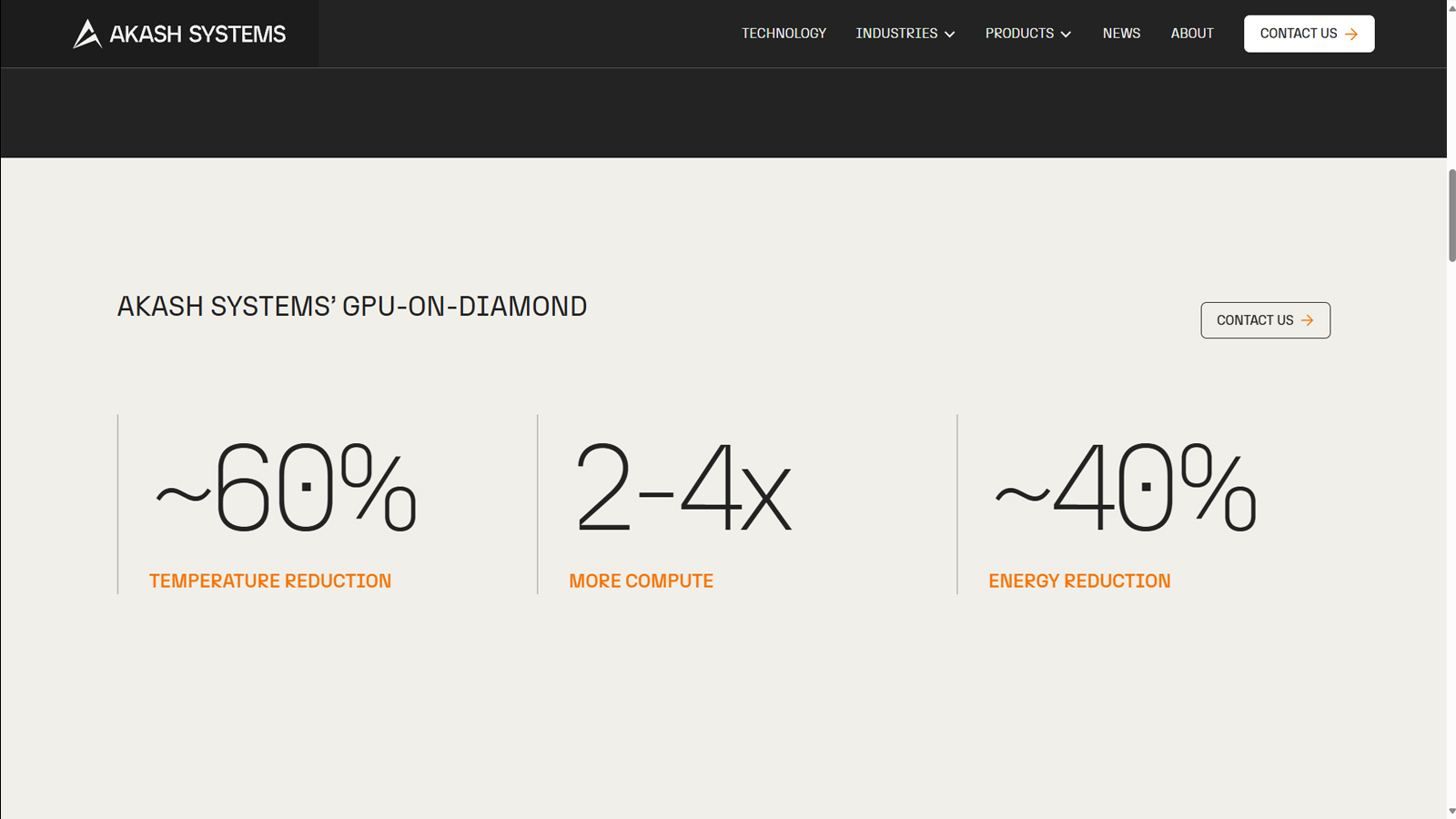

Akash claims its technology can reduce a GPU’s hot spot temperature by 10 to 20 degrees Celsius, saving data centers “millions of dollars in cooling costs” while preventing thermal throttling. In the GPU-on-diamond specific slide, you can also see claims of up to a 60% temperature reduction using Akash tech, for a 40% reduction in energy consumption. For now, we have to take the numbers at face value, but its claims are quite eyebrow-raising. However, the firm's tech must have passed some scrutiny from CHIPS Act officials.

Akash Systems is also working on GaN-on-Diamond tech for radios and power amplifiers for deployment in satellites that will increase reliability and speed while reducing size.

Most CHIPS Act funding recipients are tech giants—like Intel, Samsung, and TSMC—and established semiconductor companies. Unfortunately, smaller companies and tech startups aren’t often on the list, probably because of the extensive requirements even before a company could begin an application for funding.

Axios says that Akash Systems has already secured $18 million from venture capitalists, but its CEO, Felix Ejeckam, says that the company applied for a CHIPS Act grant because the venture capital industry hasn’t always been supportive of semiconductor startups. “The CHIPS Act got started because [private investors] decided hardware wasn’t worthy enough to back, and the pandemic laid bare the problems with that,” Ejeckam told Axios. “Plus, the U.S. is trying to compete with countries like China that do lots of direct grants to build out their semiconductor and infrastructure sectors.”

The CHIPS and Science Act is indeed a massive investment push by Washington, D.C. to bolster the American semiconductor industry, with the country spending more money on chip fabs and related infrastructure in 2024 than the past 28 years combined. However, many chipmakers are getting the jitters with the upcoming change in U.S. administration, with the TSMC and GlobalFoundries racing to finalize applications and facilitate payouts. Even Akash Systems wants to fast track its progress as it hopes to break ground on its expansion activities before the year ends.