Across the recent three months, 5 analysts have shared their insights on Glacier Bancorp (NYSE:GBCI), expressing a variety of opinions spanning from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 2 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 0 | 0 |

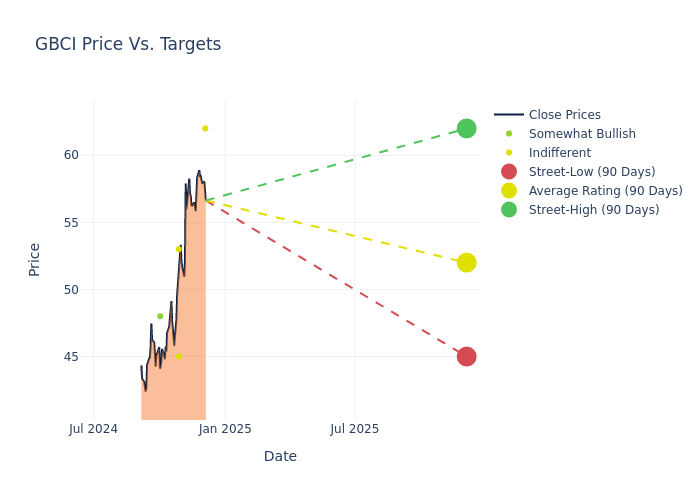

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $51.6, with a high estimate of $62.00 and a low estimate of $45.00. Witnessing a positive shift, the current average has risen by 10.73% from the previous average price target of $46.60.

Deciphering Analyst Ratings: An In-Depth Analysis

The standing of Glacier Bancorp among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kelly Motta | Keefe, Bruyette & Woods | Raises | Market Perform | $62.00 | $50.00 |

| Matthew Clark | Piper Sandler | Raises | Neutral | $45.00 | $42.00 |

| Brandon King | Truist Securities | Raises | Hold | $53.00 | $50.00 |

| David Feaster | Raymond James | Raises | Outperform | $48.00 | $45.00 |

| Brandon King | Truist Securities | Raises | Hold | $50.00 | $46.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Glacier Bancorp. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Glacier Bancorp compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Glacier Bancorp's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Glacier Bancorp's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Glacier Bancorp analyst ratings.

Unveiling the Story Behind Glacier Bancorp

Glacier Bancorp Inc is a regional bank holding company providing commercial banking services to scores of communities through its wholly-owned bank subsidiary, Glacier Bank. The bank operates a multitude of banking offices in Montana, Idaho, Colorado, Utah, Washington, and Wyoming. The bank's various products and services include deposit, loans, and mortgage origination services, among others. The bank predominantly serves individuals, small- to medium-sized businesses, community organizations, and public entities. Glacier emphasizes both internal growth and growth through selective acquisitions. A majority of the bank's loan portfolio is in commercial real estate, while a majority of its net revenue is net interest income.

Glacier Bancorp: Financial Performance Dissected

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Glacier Bancorp's remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 8.71%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Financials sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 24.42%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Glacier Bancorp's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.6%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.18%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Glacier Bancorp's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.62, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

How Are Analyst Ratings Determined?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.