Across the recent three months, 10 analysts have shared their insights on Paycom Software (NYSE:PAYC), expressing a variety of opinions spanning from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 10 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 8 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

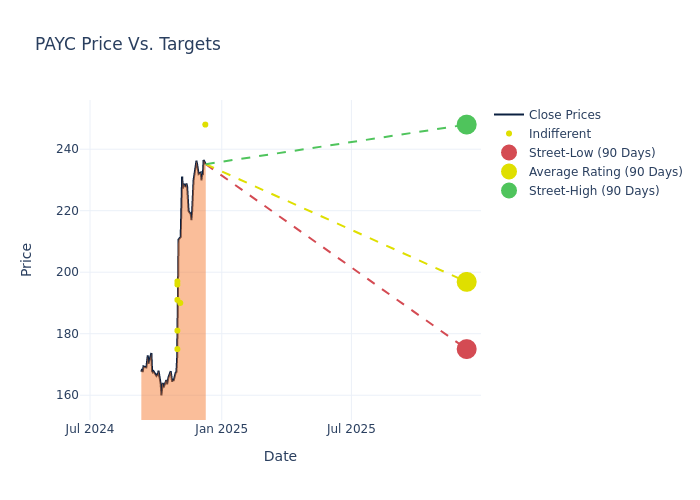

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $190.8, along with a high estimate of $248.00 and a low estimate of $170.00. Marking an increase of 11.38%, the current average surpasses the previous average price target of $171.30.

Decoding Analyst Ratings: A Detailed Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Paycom Software. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jared Levine | TD Cowen | Raises | Hold | $248.00 | $193.00 |

| Siti Panigrahi | Mizuho | Raises | Neutral | $190.00 | $170.00 |

| Steven Enders | Citigroup | Raises | Neutral | $196.00 | $172.00 |

| Raimo Lenschow | Barclays | Raises | Equal-Weight | $181.00 | $172.00 |

| Samad Samana | Jefferies | Raises | Hold | $175.00 | $170.00 |

| Daniel Jester | BMO Capital | Raises | Market Perform | $197.00 | $183.00 |

| Arvind Ramnani | Piper Sandler | Raises | Neutral | $191.00 | $160.00 |

| Samad Samana | Jefferies | Raises | Hold | $170.00 | $155.00 |

| Raimo Lenschow | Barclays | Raises | Equal-Weight | $172.00 | $167.00 |

| Jared Levine | TD Cowen | Raises | Hold | $188.00 | $171.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Paycom Software. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Paycom Software compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Paycom Software's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Paycom Software analyst ratings.

About Paycom Software

Paycom is a fast-growing provider of payroll and human capital management software primarily targeting clients with 50-10,000 employees in the United States. Paycom was established in 1998 and services about 19,500 clients as of 2023, based on parent company grouping. Alongside its core payroll software, Paycom offers various HCM add-on modules, including time and attendance, talent management, and benefits administration.

A Deep Dive into Paycom Software's Financials

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Paycom Software's remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 11.23%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Paycom Software's net margin excels beyond industry benchmarks, reaching 16.21%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Paycom Software's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.07% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Paycom Software's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.88%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.06.

The Basics of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.