/Quantum%20Computing/A%20concept%20image%20of%20a%20neon%20pink%20circuit%20board_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)

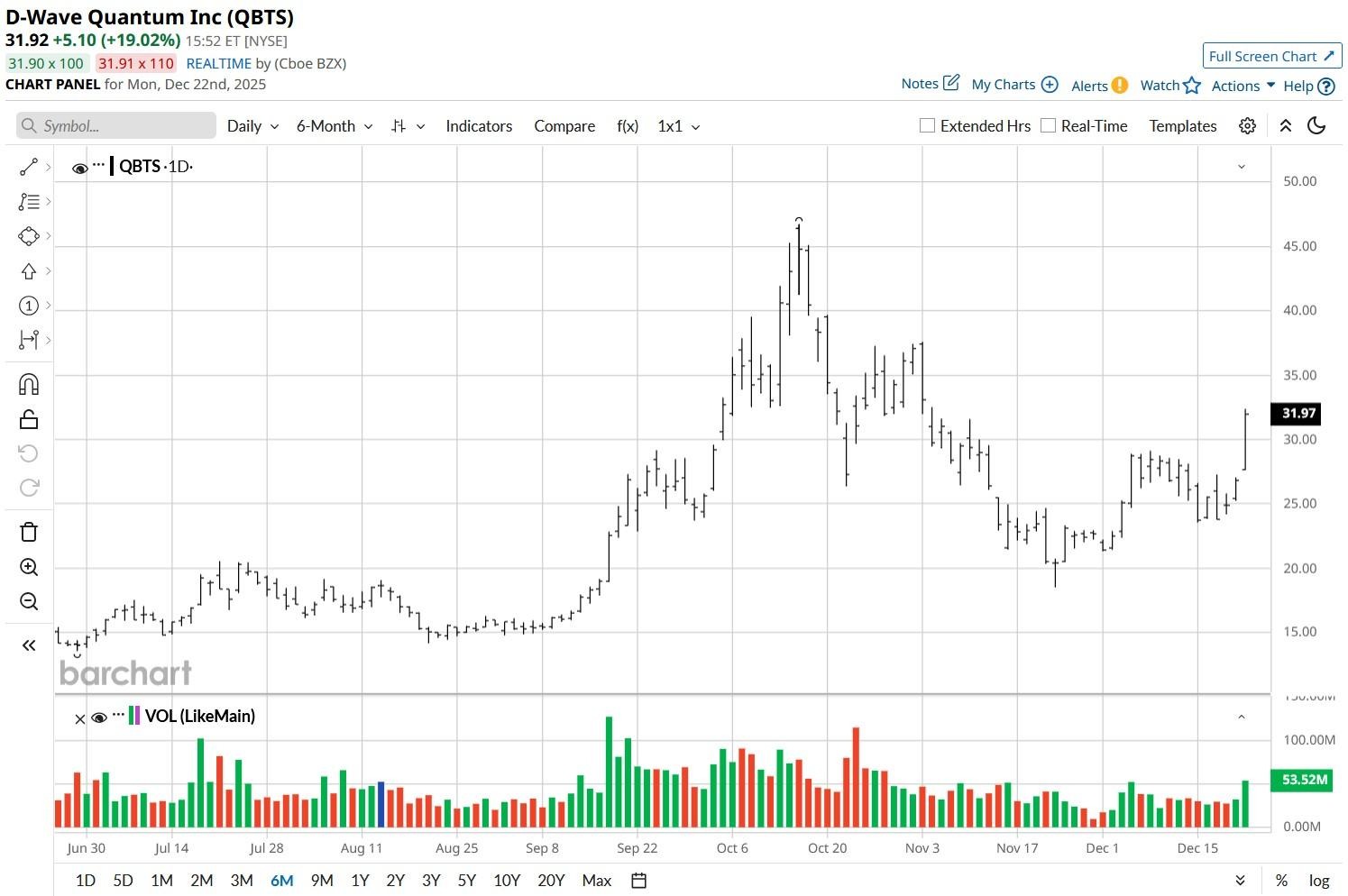

D-Wave (QBTS) shares rallied as much as 20% on Monday after the quantum computing company announced plans of participating in the CES 2026 scheduled for Jan. 7.

According to its press release, QBTS will showcase “its award-winning technology and real-world customer success stories” at the world’s largest annual technology trade show.

Additionally, a vice president of the NYSE-listed firm – Murray Thom – will discuss “potential for synergy between quantum computing, artificial intelligence (AI), and blockchain” at the event.

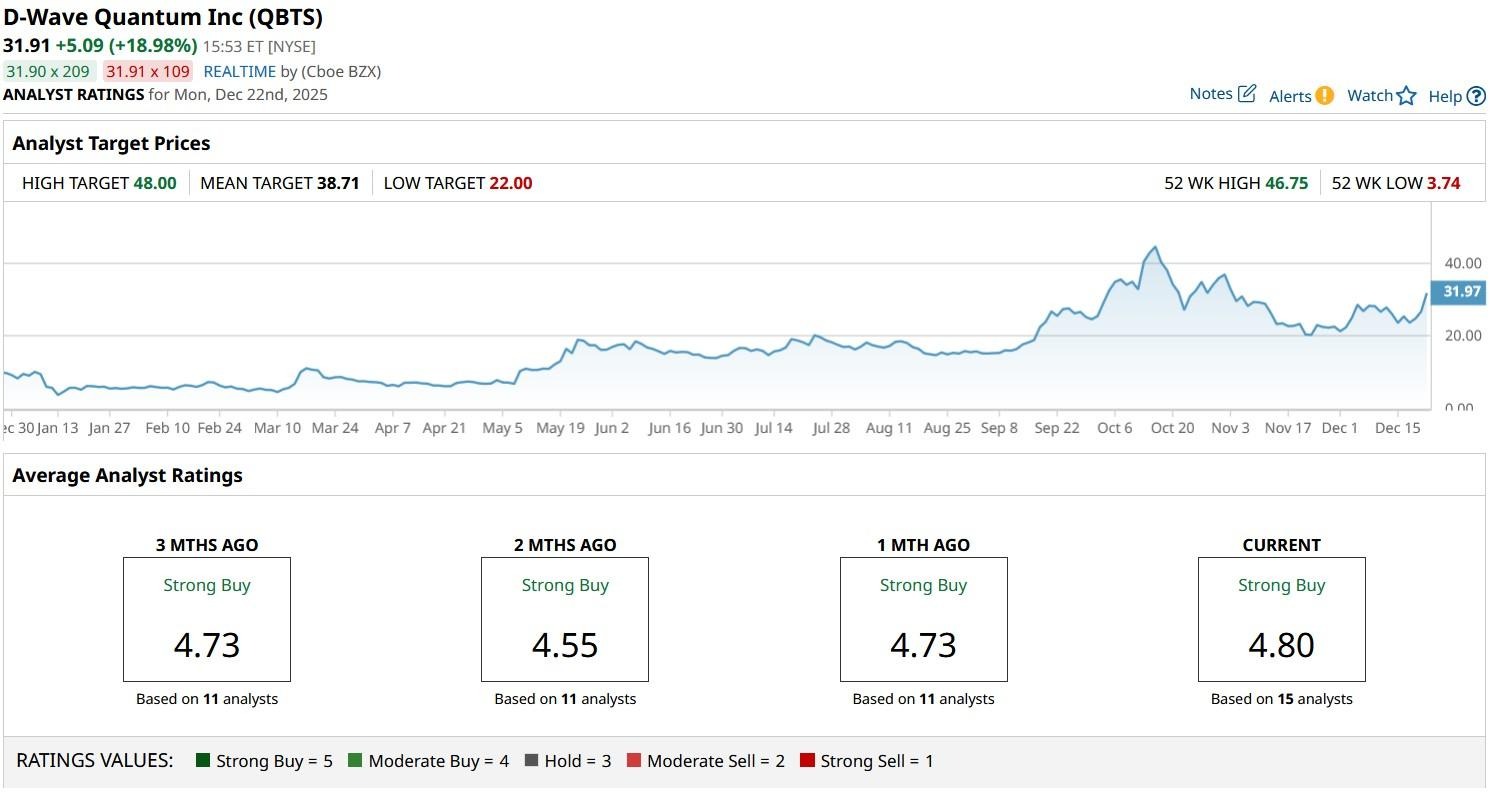

Despite Monday’s surge, D-Wave stock is down more than 35% versus its year-to-date high in mid-October.

Why CES Participation Is Positive for D-Wave Stock

The annual CES conference is a massive opportunity for D-Wave to spotlight its quantum tech on a global stage, boosting visibility with both investors and potential customers.

Showcasing real-world success stories will validate commercial traction, while Thom’s discussion will highlight growth opportunities in high-demand sectors like AI and blockchain.

All in all, the company’s participation in the trade show on Jan. 7 could boost market confidence, positioning QBTS stock as a leader in next-gen computing.

Heading into 2026, Jefferies analysts have a “Buy” rating on D-Wave with a price target of $45, indicating potential upside of another 41% from here.

Why Is Jefferies’ Bullish on QBTS Shares for 2026?

Jefferies remains constructive on D-Wave shares mostly because the Palo Alto-headquartered firm is the only pure-play that’s publicly claimed quantum supremacy.

QBTS’ technology (quantum annealing) is already commercially mature and the over $800 million it has in cash offers meaningful leeway for growth and innovation.

Plus, continued adoption in quantum computing more broadly could serve as a significant tailwind for D-Wave as well.

According to Jefferies’ analysts, the company will grow its revenue at a compound annualized rate of 73% through the end of this decade.

What’s the Consensus Rating on D-Wave Quantum?

Other Wall Street analysts seem to agree with Jefferies’ bullish stance on QBTS shares as well.

According to Barchart, the consensus rating on D-Wave stock remains at “Strong Buy” with price targets going as high as $48, indicating potential for a more than 65% rally in the coming year.