/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)

CoreWeave (CRWV) is a specialized AI cloud provider delivering high-performance GPU infrastructure for training massive AI models. Unlike general clouds like AWS, it focuses solely on Nvidia (NVDA) GPUs with custom bare-metal servers, liquid cooling, Kubernetes orchestration, and AI-optimized storage/networking. Serving OpenAI, Meta (META), and AI labs, CoreWeave powers foundation models at unprecedented scale through 33+ data centers offering flexible public/dedicated deployments.

Founded in 2017, CoreWeave is headquartered in Weehawken, New Jersey.

About CoreWeave Stock

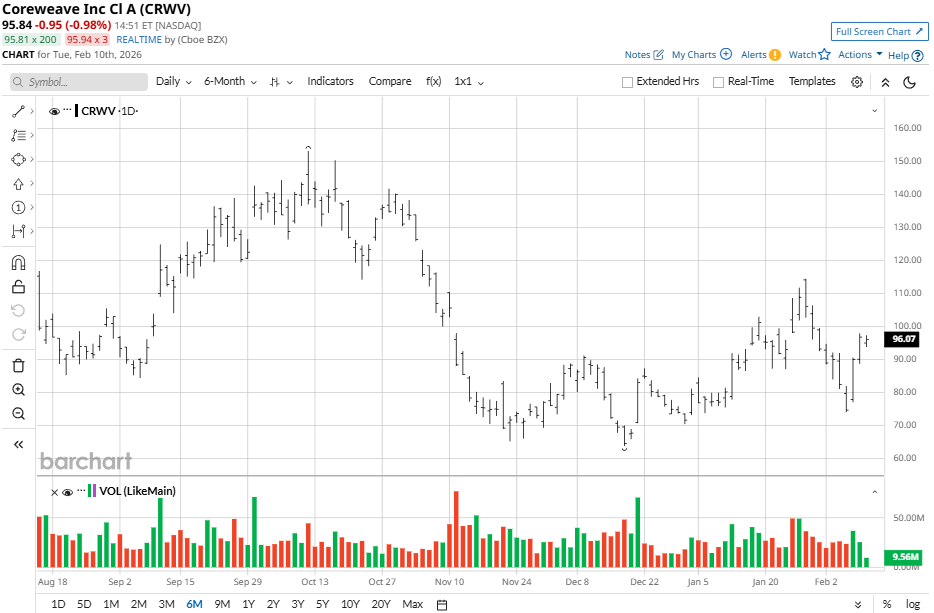

CoreWeave's stock has been volatile amid AI hype, gaining over 8% in the past week and 11% in the past month. Year-to-date (YTD), it's soared 25% from $73 lows while being 22% off its high of $114 set in late January. Despite this, CRWV stock lags in the medium term as it is flat in three months but down 36% in six months time.

Versus the Nasdaq Composite ($NASX), CoreWeave massively outperformed in YTD performance (32% vs. Nasdaq's flat report), riding AI infrastructure demand. Overall, its dips mirror Nasdaq pullbacks, but the monthly 18% gain edges the index amid sector rotation.

CoreWeave's Results Beat Estimates

CoreWeave announced third-quarter 2025 results on Oct. 30, 2025, showcasing explosive growth in its AI cloud infrastructure business. Revenue rocketed 200% year-over-year (YoY) to $1.36 billion from $453 million, handily beating Wall Street estimates of $1.28 billion by 6.25%, thanks to surging demand for Nvidia GPU clusters from AI hyperscalers. Adjusted EPS posted a loss of $0.08 per share, dramatically outperforming consensus forecasts of a $0.39 loss (79.5% beat), reflecting efficient scaling despite heavy investments.

Financially, GAAP net loss widened to $110.1 million ($0.22 per share) from $52 million prior, driven by $1.2 billion in capex for data center expansions. Revenue per GPU improved 15% YoY amid higher utilization rates (92%), with data center bookings up 250%. Operating cash flow turned positive at $45 million, signaling maturing operations.

Q4 guidance disappointed, projecting revenue below expectations and prompting a 51%+ stock plunge into oversold territory.

Upcoming Earnings Preview

CoreWeave is set to report its fourth-quarter results on Feb. 26. The AI company is estimated to post earnings of -$0.61 per share, a 100% decrease from the same quarter last year. Analysts also estimate Q1 2026 earnings at -$0.65 per share, with an 8.33% slip from the previous year.

For the full year 2025, analysts have bet on -$2.46 per share, while the fiscal year 2026 is estimated at -$0.08 with a growth of 96% YoY.

Should You Buy CRWV Stock?

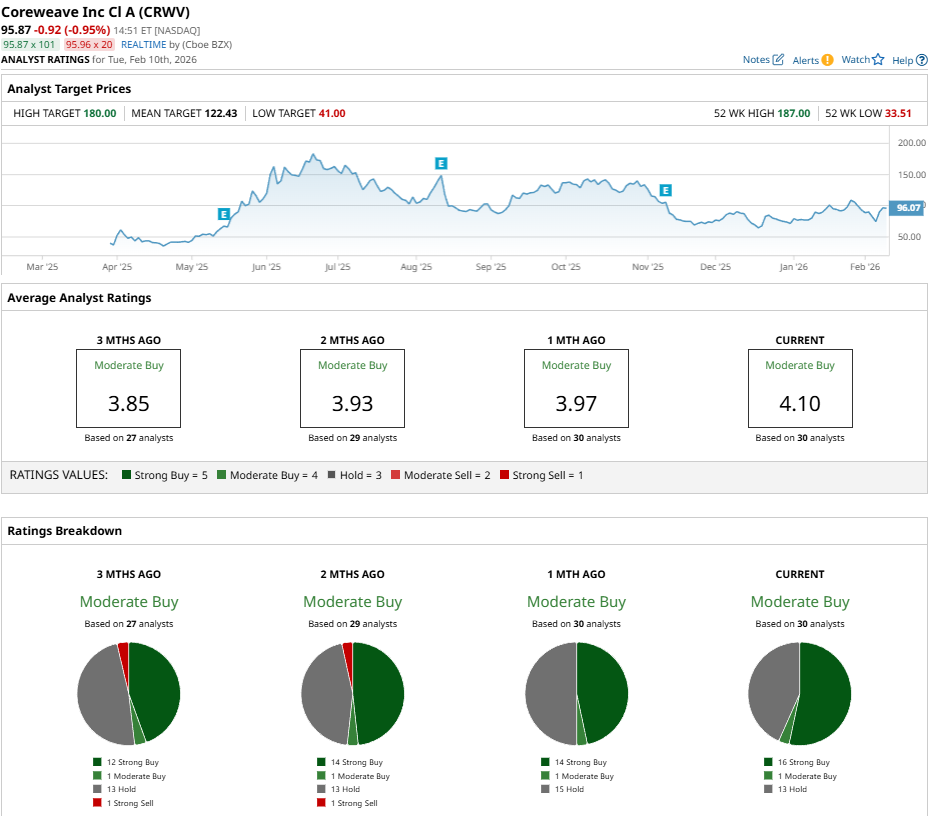

Amid the upcoming results, analysts have a consensus “Moderate Buy” rating on CRWV stock with a mean price target of $122.43, reflecting an upside potential of 28% from the market rate. The stock has been rated by 30 analysts, receiving 16 “Strong Buy” ratings, one “Moderate Buy” rating, and 13 “Hold” ratings.