When it comes to the rules of money, there are many nuggets of wisdom you'll hear passed around on a regular basis, from "don't spend more than you make" to "make sure you have an emergency fund."

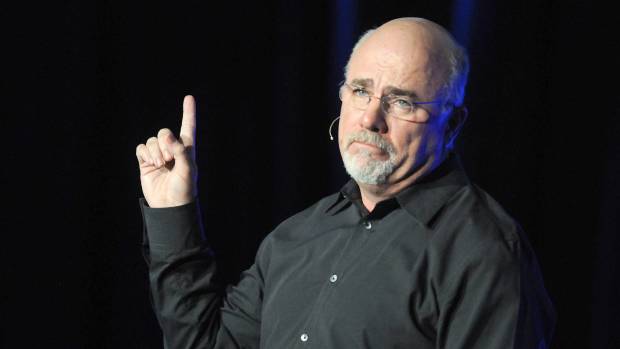

However, another you may hear is "you have to spend money to make money" -- and while many may still swear by it, financial pundit Dave Ramsey believes it is not true.

During a call-in to The Dave Ramsey Show posted on Twitter July 24, Ramsey talked to a 25-year-old named Nathan who was calling to seek financial advice about an inheritance. The guest has $200,000 and asked Ramsey how to invest the money so he can become a millionaire by his 30's.

Nathan is 25 and is receiving $200,000 in an inheritance. He wants to know how to invest that money to become a millionaire in his 30s. pic.twitter.com/kHsF7yDt64

— Dave Ramsey (@DaveRamsey) July 24, 2023

"I'll start with 'it takes money to make money' is not a true statement -- that's a statement broke people say," Ramsey said with his trademark candor. "Can you make money making money? Sure. But actually, the vast majority of people build wealth do not build it because someone handed them $200,00. They build it because of their habits and their character."

Compare the Best Savings Rates

Ramsey then advises his caller to "slow way down," saying his job is to manage this money as if it was someone's else, making it his job not to lose it and to maximize it.

"Most people when they get handed the keys to the car, step on the gas," Ramsey said. "Meaning they think their job is to maximize it and they end up losing it. So people that end up in your situation get money, lose it very often because they make the mistake of thinking it has to be exciting, it has to be sexy, it has to be wild, it has to be crazy, because if I don't maximize it I'm doing something wrong."

Ramsey wrapped up his advice with a solid nugget of truth.

"Don't put money in something you don't understand," he said.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.