As working Americans think about retirement, they have several factors to consider. Among those is the sometimes daunting prospect of being sure they are adequately prepared for future Social Security and Medicare benefits.

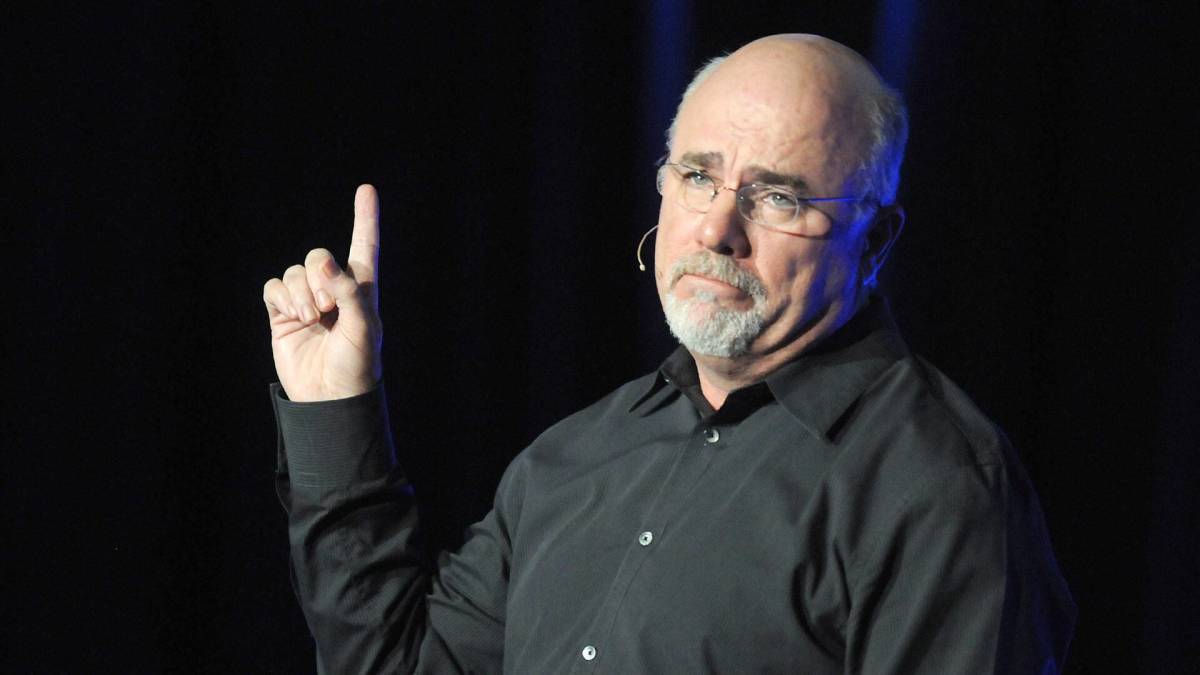

Personal finance bestselling author and radio host Dave Ramsey has some advice for Americans — and some cautionary words — particularly about one major approach that is likely to cause them problems.

Don't miss the move: SIGN UP for TheStreet's FREE daily newsletter

When engaged in retirement planning, working people often calculate their anticipated Social Security benefits and begin to contemplate the best age for them to begin receiving them.

Broadly speaking, the earlier people retire, their monthly Social Security paychecks will be a smaller amount. The later they retire, the more money they will receive in those monthly payments.

Another major consideration is health-care costs and how enrolling in Medicare will help them cover their medical needs.

Related: Medicare costs are about to change for many Americans

They begin to explore Medicare Part A, which covers hospitals stays. Medicare Part B, covering outpatient and preventive care, is another important consideration.

Others look into Medicare Advantage (also known as Part C), involving private companies that offer plans that offer similar coverage as Part A and Part B.

Medicare Part D covers drug costs, which vary widely between individuals and their various states of health as they grow toward retirement age.

That's where Dave Ramsey weighs in on one big action many people take that ends up hurting them in the long run when planning for Medicare and Social Security.

Blunt words on one Social Security mistake

Ramsey refers to a common saying people repeat about how what they don't know isn't going to hurt them. When it comes to planning for retirement, the personal finance coach warns people not to fall into that line of thinking.

Related: Dave Ramsey has blunt words about Social Security 'bunch of bull'

"While 62% of current retirees report Social Security as a major source of income, only 35% of today’s workers expect the same when they retire," he wrote. "These 35% of folks are going to learn the hard way that what they don’t know can and definitely will hurt them when they retire. Don’t let that be you!"

More on Dave Ramsey

- Dave Ramsey discusses one big money mistake to avoid

- Ramsey has major warning on retirement, 401(k), Social Security

- Ramsey reveals blunt new Social Security payment warning

Ramsey emphasizes the importance of investing in 401(k)s and Roth IRAs in addition to planning for anticipated monthly Social Security paychecks.

The radio host has a specific, but simple, formula he recommends people follow. Working Americans should save 15% of their income in their retirement savings in those investment accounts.

In this fashion, most people can ensure that those investments are their main source of retirement finances. Their Social Security payments should only be thought of as supplemental to those funds.

Shutterstock

Ramsey offers a warning about Medicare

While Medicare does a good job at providing people in retirement with affordable health care coverage for doctor visits, prescription drugs and hospitalization, Ramsey points out what he believes are the federal program's shortcomings.

Medicare does not cover deductibles, copays or long-term care in assisted facilities that persist for 100 days or longer, Ramsey says.

And that's vital to know, because long-term care is often a person's largest expense in retirement.

Related: Dave Ramsey has words on a popular mortgage and interest rate move not to miss

Ramsey recommends purchasing one's own personal insurance for long-term care by age 60.

One good way to do this is with a Health Savings Account (HSA). When a person invests in an HSA, the money grows tax free. And once one retires, there are no taxes to pay for withdrawing money from these accounts for medical costs.

Related: Veteran fund manager sees world of pain coming for stocks