No matter their age, most American workers spend some time contemplating the financial pressures associated with the reality that retirement planning is necessary.

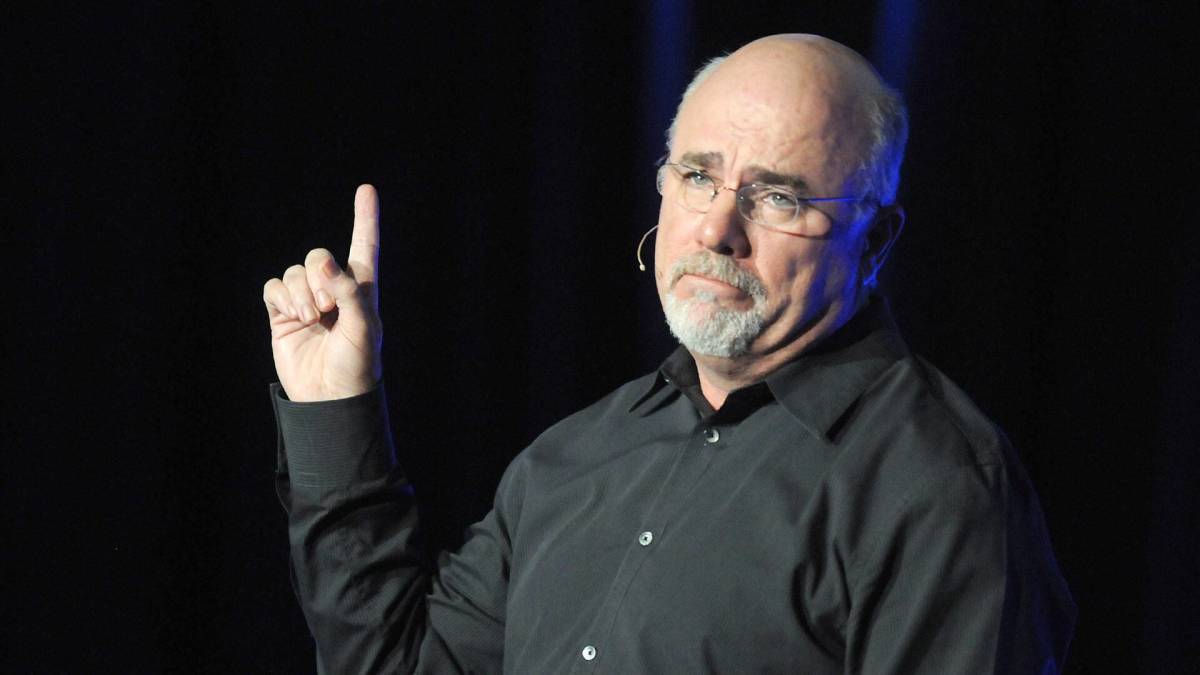

Personal finance bestselling author Dave Ramsey offers some advice on the subject — and has some blunt words for people about Social Security and their 401(k)s.

Don't miss the move: SIGN UP for TheStreet's FREE daily newsletter

A major concern for most people is making sure they have enough money saved, including investments, to last them throughout their retirement years.

Health care costs are another big priority, as potential retirees contemplate being able to afford Medicare premiums, co-pays, and possible long-term care expenses.

Related: Household debt is rising and it's causing psychological stress

Adding to the stress are concerns about the effect of inflation on their purchasing power and expenses such as unexpected home repairs and medical emergencies.

And that's not to mention the fact that many people want to have their finances in good enough shape so they will be able to leave some meaningful resources behind for their loved ones.

Ramsey steps in and explains his views on some important things to consider for people confronting these retirement challenges.

Shutterstock

Dave Ramsey has straight talk on Social Security payments and 401(k)s

Ramsey makes a very clear point about the importance of having enough money and investments saved so Social Security payments are not an individual's primary source of income in retirement.

"Relying on the government to take care of you in retirement is dumb with a capital D," Ramsey wrote.

Ramsey suggests an important investment strategy people should engage in during their working years to save enough so they don't rely solely on the federal program.

More on Dave Ramsey

- Ramsey reveals blunt new Social Security payment warning

- Dave Ramsey discusses one big money mistake to avoid

- The surprising way your mortgage is key to early retirement

The personal finance coach recommends that working people invest 15% of their income in retirement. They should start with their company's 401(k) match amount and then invest more in a Roth IRA.

The Roth IRA investment is important because those contributions are made with after-tax dollars and any earnings will grow free of taxes.

Then Ramsey brings up one more warning on Social Security about which workers and retired people should be aware.

Related: Dave Ramsey warns Americans on Social Security, Medicare

Dave Ramsey discusses the future of Social Security solvency

Ramsey also reminds current U.S. workers that there are upcoming concerns about Social Security solvency, which refers to the ability of the Social Security trust funds to pay all scheduled benefits on time.

According to a Social Security Administration (SSA) report, the Old-Age and Survivors Insurance (OASI) Trust Fund will be able to pay 100 percent of total scheduled benefits until 2033.

At that point, the report continues, without legislative action the fund's reserves will be depleted and continuing income from the program will only be enough to pay 79 percent of scheduled benefits.

But a report written in October by the Committee for a Responsible Federal Budget (CRFB) showed reworked numbers with respect to a possible win by Donald Trump in the November election.

Now that reality is here, and it's worth looking at those data again, particularly with a focus on Trump's proposals to eliminate taxation of Social Security benefits, to end taxes on tips and overtime, to impose tariffs and to expand deportations.

"We find President Trump’s campaign proposals would dramatically worsen Social Security’s finances," the CRFB had written.

Among the think tank's findings include estimates that President Trump's agenda would increase Social Security's ten-year cash shortfall by $2.3 trillion through 2035.

If that turns out to be true, the CRFB says insolvency would occur earlier, in 2031.

Related: Veteran fund manager sees world of pain coming for stocks