As Americans approach retirement age, they usually have some compelling interests in mind.

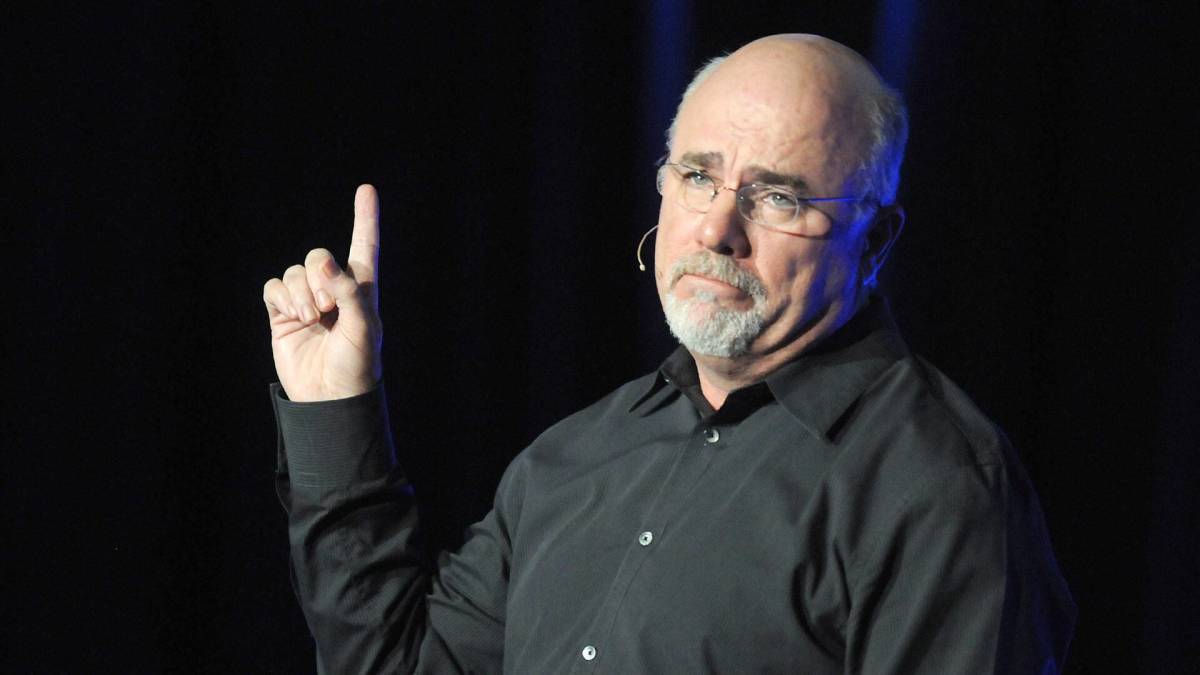

Personal finance bestselling author Dave Ramsey offers some thoughts about one big health care decision that he says people need to understand — and the consequences of not making a timely Medicare move.

🚨Don’t miss this amazing Cyber Week Move! Get 60% off TheStreet Pro. Act now before it’s gone.😲

Retirees become eligible to enroll in Medicare at age 65. As a first step, people begin the process by assessing their needs for health insurance coverage, including doctor visits, coverage for prescription drugs and hospital stays.

Medicare Part A covers hospital costs without a required premium, provided that enrollees have paid the relevant taxes during their working years.

Outpatient and preventive costs are covered by Medicare Part B, which involves a monthly premium of $185 in 2025.

Medicare Part C (also called Medicare Advantage) is an additional option that is offered by private insurance companies and covers benefits that are included in both Part A and Part B.

Prescription drugs are insured by Medicare Part D. Those costs can vary widely depending on a retiree's health needs.

With these thoughts in mind, Ramsey focuses on one major emphasis about the timing of enrolling in the Medicare program.

Shutterstock

Dave Ramsey explains when to enroll in Medicare

Medicare enrollment is a complicated process, Ramsey says.

"The rules, options and dates around Medicare are crazy," he wrote. "But it’s important to know this stuff. Seriously, understanding and getting enrollment right is super important because if you get it wrong, you could end up paying penalties the rest of your life. Yeah, the stakes are that high."

The Ramsey Show host explains that there are three enrollment periods for first-time enrollees. Retirees who are already getting Social Security benefits before age 65 are automatically enrolled in parts A and B.

The initial enrollment period to sign up begins three months before one's 65th birthday month and during the three months after it.

More on Dave Ramsey

- Dave Ramsey sounds alarm on Social Security for retired Americans

- Ramsey explains Medicare for retirees on health care needs

- Dave Ramsey has a warning for people buying a home now

If one misses this opportunity, there is a general enrollment period from January 1 through March 31 that is still available. But waiting for this option often involves a higher premium that they might be forced to pay for the rest of their life.

Medicare parts A and B can be enrolled in through the Social Security website. For prescription drugs and Medicare Advantage, the insurance company offering coverage needs to be contacted.

Related: Suze Orman has blunt words on Social Security for retired Americans

Dave Ramsey explains how Medicare works

Medicare manages to keep costs down for retired people by offering an approved price for services. People enrolled in Medicare pay less than they would with regular health insurance.

But not all providers and doctors accept the Medicare payment amounts, which means people need to find those who do.

As previously mentioned, Americans 65 years of age and older are eligible for Medicare. People are also eligible if they have disabilities, end-stage renal disease and Lou Gehrig's disease.

"Let’s just say if Medicare were an outfit, it’d be a bikini," Ramsey wrote.

The personal finance author explains that there are many things Medicare does not cover. These include long-term care, vision and dental coverage, hearing aids, annual physicals and cosmetic surgery.

It also does not cover overseas health care costs, while some regular health insurance plans do.

Ramsey explains that people who do not desire to to enroll in Medicare at age 65 are required to prove to the government that they have comparable health insurance through their employer are the marketplace.

This proof can be taken care of in a fairly simple way, with an insurance card that has both one's employer's name and the recipient's name on it.

Related: Veteran fund manager sees world of pain coming for stocks