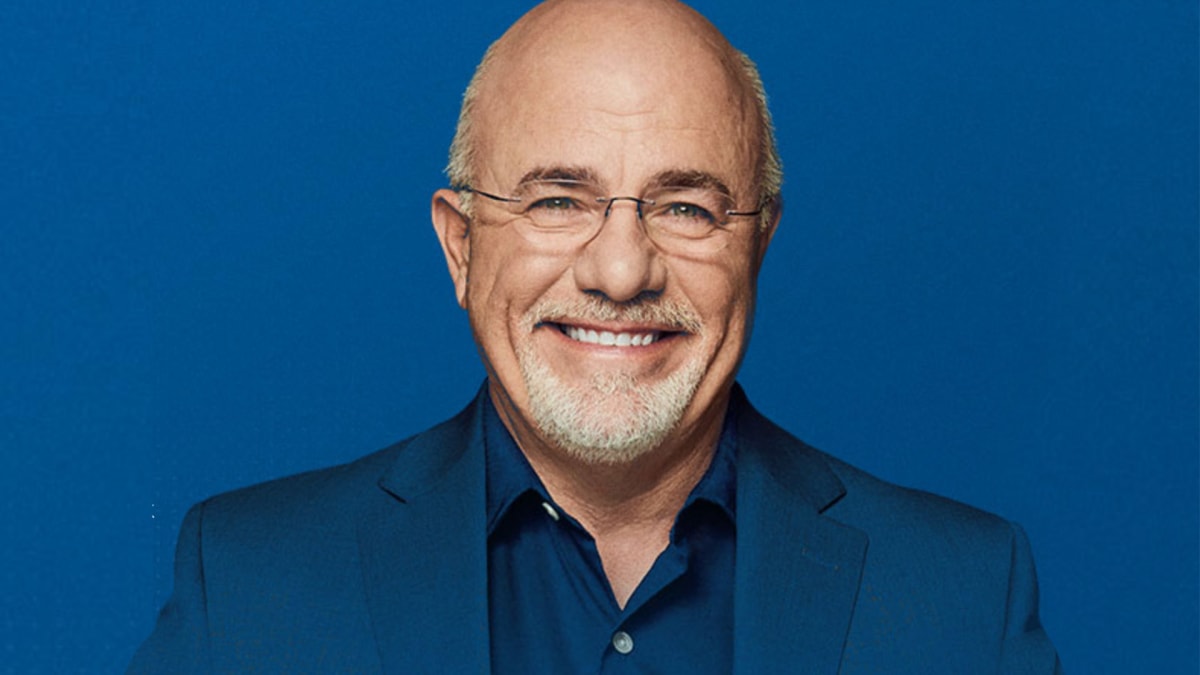

Dave Ramsey, the author and radio show host, often extols the virtues of eliminating debt.

It's one of the very first steps, he teaches, in getting a handle on money and achieving financial peace.

DON'T MISS: Dave Ramsey Shares a Blunt Warning With Homeowners

He applies this way of thinking to just about every form of debt, with the possible exception of paying for a home -- which is a form of debt that, at least, allows one to build equity.

"You are not 'simple' or 'emotional' if you believe in being debt-free," Ramsey tweeted on June 2. "What we have been taught about 'good debt' is what brings us to the pathetic financial state that this economy is in."

Ramsey takes a look, in this spirit, at when it may be a good idea to make a major decision such as selling a home to pay down other debt.

It turns out, he believes, there are a couple circumstances when selling a home to achieve this end may be the right move.

The Practicality of the Mortgage Payment Size

One reason to sell one's home to pay off debt, Ramsey explains, is if a homeowner's mortgage payment is too big.

"There’s really only one must-sell situation in Dave's eyes," writes Ramsey Solutions. "That's if your mortgage payment eats up so much of your paycheck there's nothing left to throw at debt."

The personal finance personality regularly discusses the specific percentage of salary a mortgage payment should make up.

"Your mortgage payment should be no more than 25% of your monthly take-home pay," Ramsey Solutions suggests. "If half of your income gets swallowed up by your mortgage every month, it's a no-brainer. Cutting your housing budget down to size is the only way you'll ever make progress."

When the Homeowner is Already Considering a Change

The other situation where it makes sense to sell your home to pay off debt is -- and maybe this seems obvious -- if you are thinking about moving anyway, Ramsey says.

He offers a little math to help guide thinking on this one.

First, figure out whether your home is worth more than you owe. You can do that by subtracting your mortgage balance from your home’s market value. For instance, if you owe $175,000 on your home and it’s worth $275,000, you’d have $100,000 in equity.

Next, estimate your closing costs. These cover fees like agent commission, title insurance, and prorated interest and taxes. According to Realtor.com, they can total 6–10% of your home’s sale price. For our example, we’ll deduct $25,000 for potential closing costs. That leaves you $75,000 to work with.

Before you go out and spring for a new home, make sure you can afford it. Dave recommends putting at least 10-20% down on a 15-year fixed-rate mortgage. Remember not to spend more than a quarter of your income on your mortgage each month. Now let’s see how far $75,000 could go if you owe $20,000 in debt and downsize your home. Why not use that chunk of change to power through the first three Baby Steps in one fell swoop? You could:

- Knock consumer debt down to zero

- Add $10,000 to your emergency fund

- And put 20% down on a $225,000 home -- paying less than $1,350 a month on a 15-year mortgage.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.