Homeowners paying off their mortgages face many challenges, stresses and concerns. Suddenly being presented with a simple way to pay off a big piece of the money owed can be tempting.

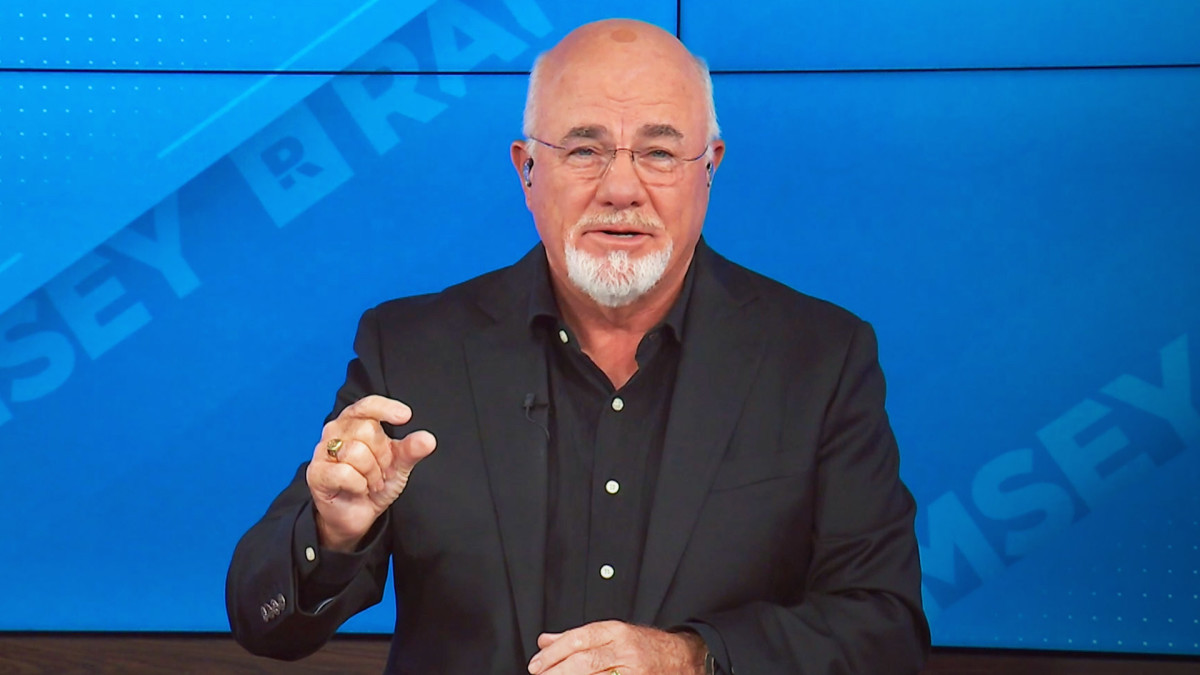

Bestselling author and radio host Dave Ramsey suggests caution when confronting these decisions, should they arise.

Related: Another company files for bankruptcy and Dave Ramsey has words

Already concerned about rising interest rates that can increase monthly payments and the fear of financial hardship such as job loss, homeowners have enough to worry about as it is.

One married couple recently received an offer from a family member to loan them a substantial amount of money to completely pay off their mortgage. They asked Dave Ramsey for his advice.

"My wife and I owe about $40,000 on our mortgage," wrote a man identifying himself as Seth, according to an email sent to TheStreet from Ramsey Solutions. "My father-in-law, who is a very nice and generous man, said he wants to pay off the house for us, then let us pay him back over time."

"We've borrowed much smaller amounts of money from him in the past, and we were always able to repay it with no issues and no pressure," he added. "How do you feel about us taking him up on his offer?"

David McNew/Getty Images

Dave Ramsey expresses concern about paying mortgages with family help

Ramsey offered his initial thoughts, suggesting that it seems the couple had been fortunate in these types of situations in the past.

"I know your father-in-law would probably be a lot easier to work with than a mortgage company when it comes to the size and frequency of payments," Ramsey wrote. "But I still think you're playing with fire if you take him up on the offer."

"I assume your father-in-law is doing pretty well financially, since he can afford to make this offer," he continued. "But the downside is just too risky. If I were him, I might offer to pay off the mortgage as a gift to my daughter and son-in-law. But a loan? No way. There are no strings attached to a gift that comes from the heart."

Ramsey expressed unease about the family dynamics involved in such a financial arrangement.

"Don't get me wrong, Seth. I'm not bad-mouthing your father-in-law. What he's making is a very generous offer, and it's an incredibly nice thing to do," Ramsey wrote. "But in my mind, a very important consideration is being left out of the equation, and it's a spiritual issue. The borrower is always slave to the lender. Always. And sadly enough, nowhere is that more true than within a family."

Getty Images

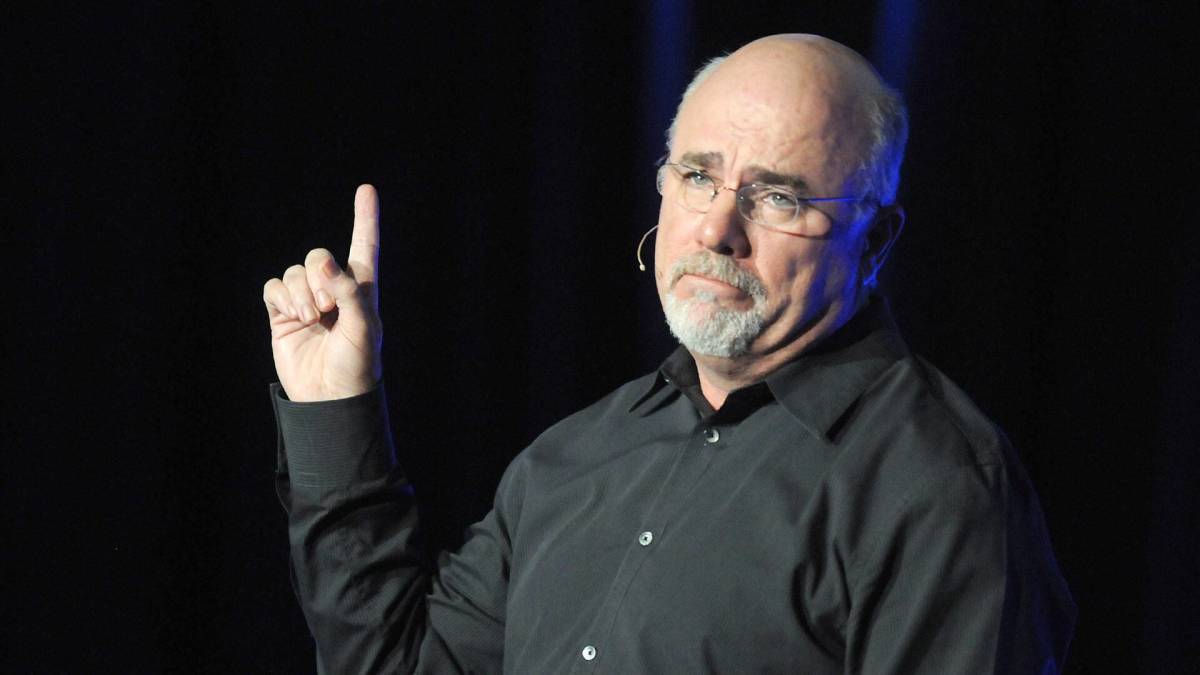

Ramsey discusses how money concerns can stress relationships

Ramsey talked about what he believes are potential unintended effects of a financial arrangement such as this one.

"Accepting this offer could bring instant discomfort into the relationship for you and your wife," Ramsey wrote. "This money situation is likely to hang over things like a dark cloud. Thanksgiving, Christmas and other special occasions will feel different — and kind of weird — when you're suddenly celebrating with your mortgage lender instead of just good, old dad."

"Even if you come from a reasonable, stable family, and it sounds to me like your in-laws are very good-hearted folks, this debt will always be in the back of your mind," he added. "But if you're involved with a dysfunctional or controlling family, that tension is going to be right there — constantly."

So Ramsey suggested a simple approach for the couple to put the offer behind them.

"I'd thank your father-in-law for his generosity and for the offer," he wrote. "But in my mind, it's just not worth the risk."

Related: Veteran fund manager picks favorite stocks for 2024