People thinking about buying a car in the near future have a number of very important financial decisions to make.

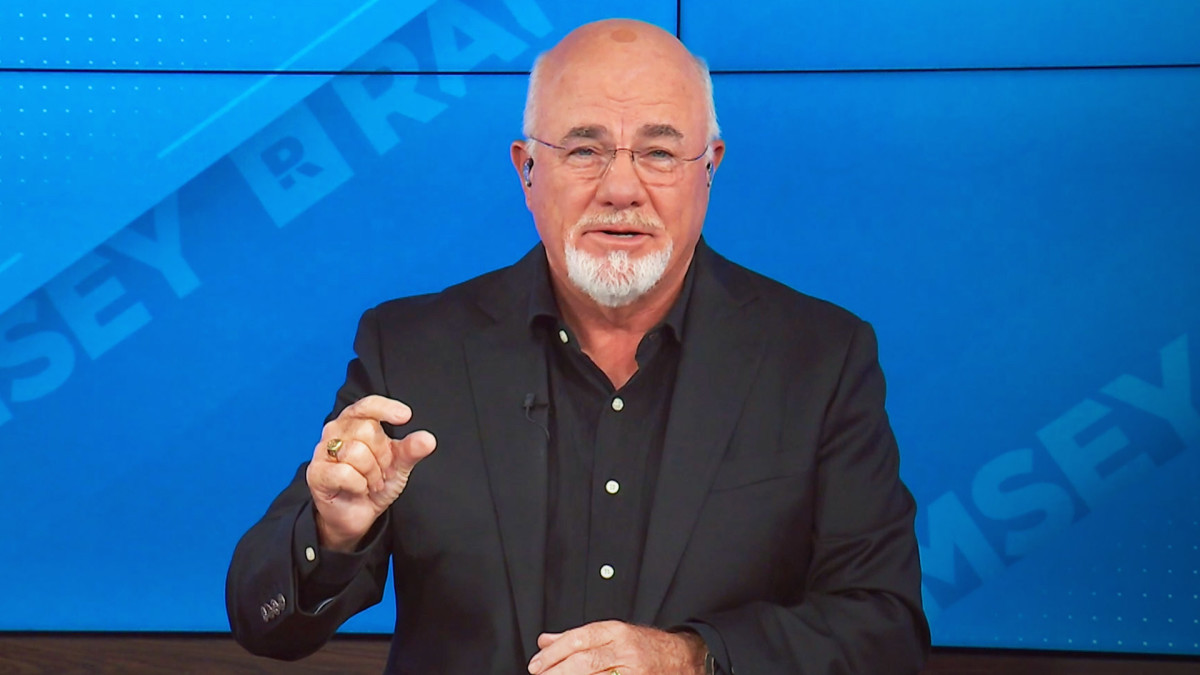

Bestselling author and radio host Dave Ramsey offers his advice on making the move.

Related: GM says goodbye to a popular model after 57 years

If you want to buy a car, one consideration has to be understood.

"Let's start with a bit of a reality check," Ramsey wrote. "Cars drop in value like a bag of rocks, losing 60% of their value in the first five years! This isn’t a smart investment. You really should only consider buying new if you have plenty of money to burn."

With this in mind, Ramsey urges potential car buyers to understand what dollar amount they are capable of spending.

"Your first step is deciding what you can afford to pay for a car," he wrote. "Leasing a car and going into debt to buy one are both bad ideas, so what you can afford is based on the amount of cash you can pay up front."

"If you don't have the funds for a used or certified pre-owned car right away, you'll have to make room in your budget to set money aside each month," Ramsey continued. "Figure out where you can get by on less and how much you can afford to put toward your car fund."

Ramsey also addresses the question many in the car-buying market consider: whether leasing or financing is a viable option.

"Remember, leasing or financing a car will not help you build wealth," Ramsey wrote. "It's much easier to save around $500 a month (the average car payment) for 10 months and buy a used car with no strings attached. Do you really want to sign up for a payment plan and pay thousands of extra dollars for several years?"

Image source: Shutterstock

It's a smart move to find the right used car

The personal finance personality advises most people to forget about buying a new car and to pay as much in cash as possible.

"There are plenty of places to find used cars in your area," Ramsey wrote. "Your local dealership likely has a website for you to view the cars they have in stock. And you can check sites like Craigslist to see what other cars are on the market."

"Narrow down your options to a few cars that fit your price range and needs," he added. "Consider factors such as safety, speed, gas mileage, comfort, and how it handles in bad weather. Just because something is a good fit for your wallet doesn’t mean it will work for your lifestyle."

Before buying a used vehicle, Ramsey explains a few important details to take care of.

"When you find a car you like, it's time to do some research," he wrote. "Look up the Kelley Blue Book value of the vehicle to make sure the price is fair for that year and model."

"You should also check each vehicle's history report," Ramsey said. "This will tell you the accident history, repair information, potential recalls, and other important information about the car."

Get the feel of the car and understand its health

Ramsey then moved to what he calls the fun part: taking a car for a test drive.

"Once you're ready to get behind the wheel for your test drive, choose a route that allows you to experience different types of driving," he explained. "The way a car handles on the highway will be different than how it drives in the city. Pay attention to anything that seems odd. Does the car rattle when you go over a bump? Are there any weird noises?"

The next step, Ramsey wrote, is to get the car fully inspected.

"Before you spend a dollar on a used car, take it to a mechanic for a full inspection," he advised. "Sellers can lie when there's money on the line. While the car might look and feel fine when you take it around the block, you never know what could be going on under the hood."

"Don't feel awkward about asking for an inspection," Ramsey wrote. "This is a routine part of the car-buying process. If the seller is hesitant or gets upset about your request, they probably have something to hide."

Ramsey offered some practical advice for car purchasers about being realistic on the reasons to buy.

"Remember, the purpose of a vehicle is to get you from point A to point B, not to prove your social status to the world," he wrote. "As tempting as it is to hit the road in a car you can't afford, it's more likely to be a burden than a blessing — especially if it's not in your budget."

"Chances are, your car isn't the first thing you think about in the morning or when you go to bed at night. The key to happiness is not a new car, so don't pay for it like it is!"

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.