People buying a new car or truck tend, understandably, to get excited about the cosmetic traits of a vehicle.

These include things such as brand name, color, make, model, horsepower and acceleration.

DON'T MISS: Dave Ramsey Explains Why It's a Great Time To Buy a House

Its no wonder. These features, including the new car smell, any salesperson will tell you, are among the seductive attributes that lure car buyers in.

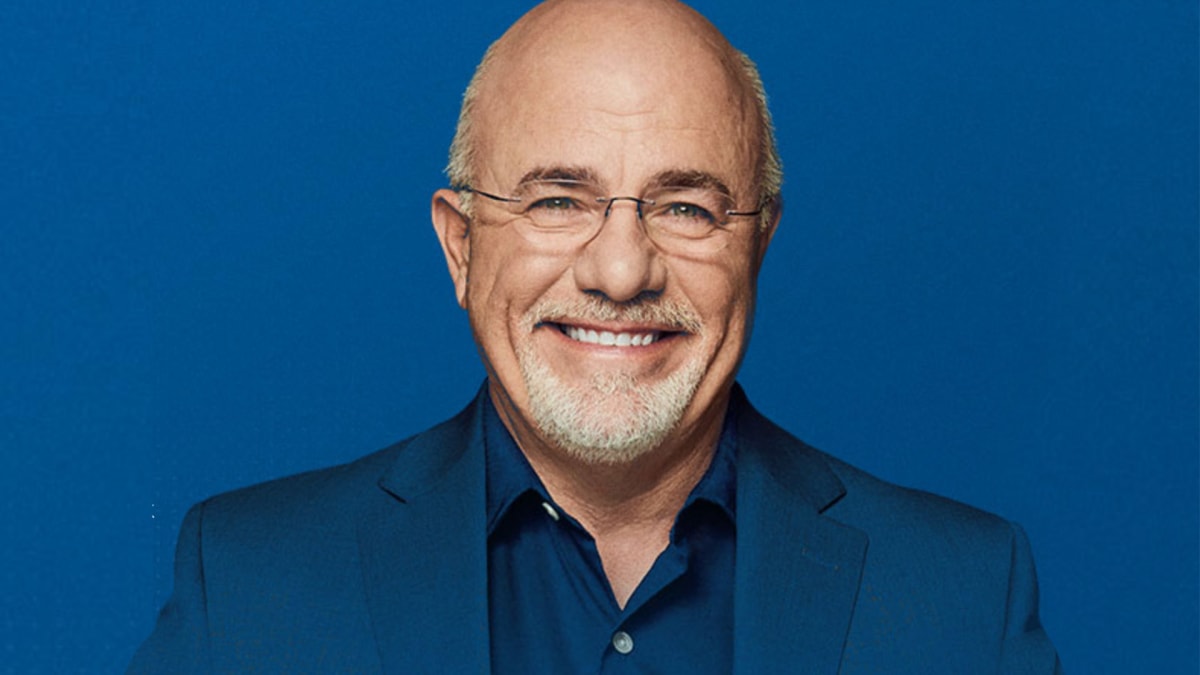

Radio host and author Dave Ramsey, however, says there are more important things to consider for people looking to buy a vehicle now.

First, as no new car salesperson will advise, you should consider buying a used car, Ramsey says.

"You can find plenty of reliable used vehicles that don’t look like junkers," explains Ramsey's website Ramsey Solutions. "So you can still look good on the road while you save money. Instead of a brand-new car, consider buying a used vehicle that’s four to 10 years old."

Autoweek previously reported that the most-sold used cars for 2022 in the U.S. were Ford's (F) F-150 truck, GM's (GM) Chevrolet Silverado and Equinox, Fiat Chrysler's Dodge Ram and the Honda (HNDAF) Civic.

Consider Insurance-Friendly Vehicles

Importantly, the personal finance personality says, potential car purchasers should prioritize low insurance payments.

"Since new cars are more expensive to repair and replace, they’ll make your insurance premiums skyrocket," Ramsey Solutions explains.

Ramsey says smaller vehicles, for example, tend to save more on insurance costs.

"Buying a smaller vehicle? You’ll see even bigger savings because smaller cars are simpler and cheaper to repair than big hulking vehicles," the website writes. "So if your SUV or pickup truck is just a gas-guzzling status symbol you don’t actually need, swap it out for a small SUV. Small SUVs like the Honda CR-V or Toyota RAV4 are usually the cheapest vehicles to insure. They often even beat out small cars and sedans!"

"But before you buy, call your insurance company," it continues. "They can tell you how the car you're considering will affect your rates. If you don’t like what you hear, you can choose a different vehicle."

Honda

How You Pay For Your Insurance

Ramsey also suggests a few ways that how you pay for car insurance can help reduce costs.

For example, he suggests paying in a lump sum, as opposed to monthly payments.

"Instead of paying monthly premiums, pay for your insurance six months or a year at a time," the website adds. "It's almost always cheaper this way since it doesn't cost the insurance company money to process your payments every month."

Ramsey is also a big advocate of setting up automatic payments.

"Some insurers will give you a discount for going paperless," Ramsey Solutions writes. "Plus, you won’t miss payments and you’ll have one less piece of mail to go through. Win-win!"

"Again, make sure you save a little each month so your automatic payment doesn’t accidentally overdraft your bank account."

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.