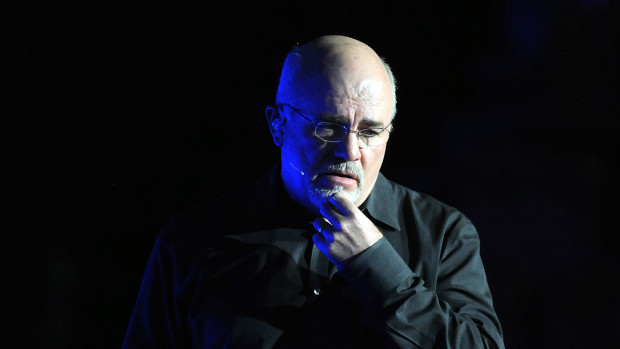

Looking at Dave Ramsey's financial empire now -- not to mention his estimated $200 million net worth -- it's hard to imagine the financial expert ever struggling with finances or living paycheck to paycheck.

And yet once he did both those things. On Aug. 8, he shared a thread on X (formerly known as Twitter) about an unpleasant experience he remembers from an earlier part of his life, and all the anxiety that came along with that experience before he learned to budget.

DON'T MISS: Dave Ramsey explains why one golden rule of money is completely wrong

Ramsey starts off the thread by relating a personal story about he and his wife Sharon buying groceries one day when they were, as he describes it, "flat broke."

I remember standing in the grocery store one day when Sharon and I were flat broke. I wrote a check for food and immediately got this sick feeling in the pit of my stomach, wondering if I had just spent the money that we needed to pay the electric bill.

— Dave Ramsey (@DaveRamsey) August 8, 2023

Sharon got that same feeling whenever she wrote a check for clothes that she or the kids needed. We felt like buying something we needed kept us from buying something else we needed, and it was a black cloud that followed us everywhere, every time we spent money.

— Dave Ramsey (@DaveRamsey) August 8, 2023

The experience Ramsey relates is a relatable one for many. As of Nov. 2022, 63% of Americans said they were still living paycheck to paycheck.

Luckily, Ramsey and his wife found their way to a solution in a simple tool: a budget.

You'll never have that feeling again once you start living on a written plan (a budget), because you'll know exactly how much money you have for food, and you'll know that the electric bill money is already budgeted. Everything is laid out in order, and you know precisely what's…

— Dave Ramsey (@DaveRamsey) August 8, 2023

A budget will also remove the overdrafts, bounced checks, and overspending from your life. When you know how much you have to spend in each area and when you actually live on that plan, all these things become nonissues. As a result, your stress level goes way down, because you…

— Dave Ramsey (@DaveRamsey) August 8, 2023

While having a budget is certainly a great way to better understand your spending habits and avoid overspending, it hardly makes one exempt from it. While 74% of Americans budget, according to a recent NerdWallet study, 84% still overspend, usually using a credit card to do so.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.