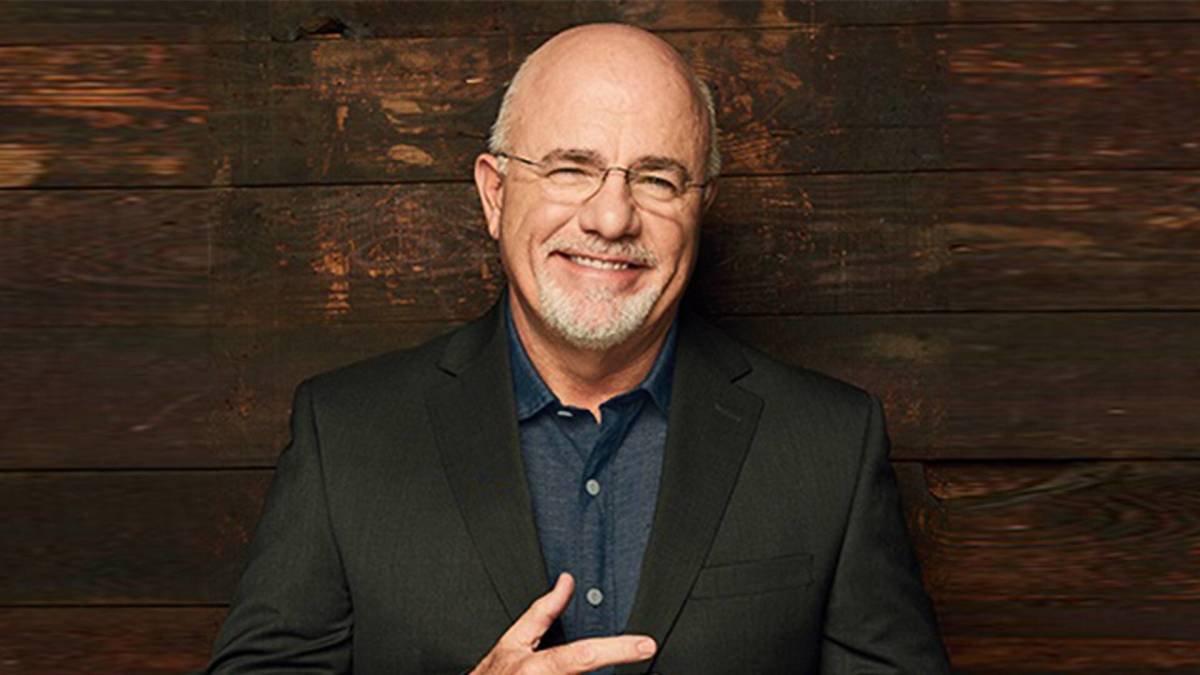

Personal finance personality Dave Ramsey is a big supporter of people who are trying to free themselves of debt.

No matter what type it is, with the exception of mortgage payments, Ramsey believes paying off all debt is vitally important before taking on other big financial challenges.

Related: Walmart's anti-theft technology creates a new set of problems

This includes car loans, student loans and credit card debt.

A caller to the Ramsey show who was experiencing financial difficulties asked the radio host on Nov. 20 if her problems could be solved by filing for bankruptcy.

Rashina has $80,000 in debt and she only makes $19,000 a year. She called in to The Ramsey Show to ask if she should file bankruptcy. pic.twitter.com/0QNRUQvdnq

— Dave Ramsey (@DaveRamsey) November 20, 2023

'I just honestly don't know what to do right now'

The advice-seeker, named Rashina, said she had recently been trying to find a way to solve her money problems.

"I hate to use this term, but I'm drowning. I've been reading your books and your program for the last couple months — what I can get at the library and watching your videos online," she said. "Everything's kind of come to a head and I'm not sure what to do. I'm considering bankruptcy at this point. I'm not sure if I'm supposed to go back to school. I just honestly don't know what to do right now."

The caller said she was 28 years old and makes around $19,000 as a substitute teacher.

Ramsey asked her if she had a teaching certificate.

"No, I owe a debt that's actually preventing me from getting a certificate," Rashina said. "I owe a college. In order to do the teaching program in Texas, you have to have all your transcripts. But because I owe a school, they won't release it and they won’t let me go with the transcripts I have. I owe them about $1,300."

Ramsey then asked her how quickly she would get a job if she could get a transcript.

"Pretty quickly," she said. "I've been subbing for about four years. The thing is, the money’s not constant. I'm not working during the summers. I don't work during major holidays."

She added that she lives on her own and said she is "barely making it."

She also said she has $62,000 in student loan debt and some other difficulties.

"I have consumer debt. I've taken out — I know, some stupid decisions — I've taken out payday loans," she said. "I have a car that got repossessed last year. They want $12,000 on it. And I have a new car loan because I couldn't pay cash. So I'm paying that, too."

She said she owes $5,000 on the new car and is paying about $200 per month for it. She also owes $1,700 from the payday loans, largely due to their high interest rates.

TheStreet

Beginning to tackle the problem

Ramsey tried to summarize the issues at hand.

"Alright. Let's walk through this for a second, ok? If you were to file bankruptcy, a Chapter 7 bankruptcy is the type of bankruptcy that cleans off all your debts," he explained. "Student loan debt is not bankrupt-able. So a bankruptcy would not clean off the $62,000. It might clean off the $1,300 when, I don't know, that sounds like that's a private debt and that one might be cleaned. It would clean off your old repossession. It would clean off the payday loans."

"It would not clean up the $5,000 debt on the car unless you turn the car in," he added. "You don't get to get rid of the debt and keep the car. You follow me? So you either keep the debt and keep the car or you turn the car in and can get rid of that debt. If you want my opinion, I don't think you have a debt problem as much as you have a huge income problem."

Ramsey suggested that Rashina view her situation from that perspective.

"If we could increase your income ten, fifteen thousand dollars a year, you still wouldn't be making a ton of money, but it would change your life right now," he said. "Thirteen hundred dollars changes your income because you get the transcripts back. Five thousand gets rid of the car debt."

Ramsey added the $1,700 from the payday loans and came up with $8,000 worth of debt separate from the student loans.

"And you've got an old repo of $12,000 that you probably could settle for a couple grand. So ten grand cleans up your entire life and makes it awesome, not counting the fact you've got to fight through $62,000 worth of student loans."

Ramsey offered what he thought was the caller's best way out of trouble.

If I woke up in your shoes knowing what I know — and see I don't have all the emotions of being overwhelmed and scared — I'm just looking at the math. So I've got an advantage right now. You've got the emotions of being overwhelmed and scared. I'm just looking at the math. And that gives me an advantage. I'm outside the forest so I can see all the trees. You're following me? I get that you're overwhelmed and scared, but I can tell you how to fix it.

I mean, if I were you, I’d start working about 80 hours a week, 90 hours a week. I'd be delivering pizzas and waiting tables and whatever else you come up with to make money. Tutoring. I'd be tutoring my butt off.

A lady was on here last hour making 30 bucks an hour in Charlotte, tutoring as a teacher and that's how she got out of debt. Thirty bucks an hour would change your life. Pick up three or four kids, pick up three or four places you can wait tables, pick up odd jobs doing whatever. I don't know what you can do that's legal and moral, but I want you to go make an extra two or three thousand dollars a month. You need to work your butt off, your fingers to the bone, and go make you $10,000 in the next four months. I want you debt free except the student loans and the car repo. You get your transcripts back. You get the payday lenders out of your life. Don't you ever go in one of those places again. They're killing you. And get your car paid off and then you're gonna have a life. You feel it?

You can do this. I'll walk with you. You call me back while you're working on it, and you and I will do this together.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.