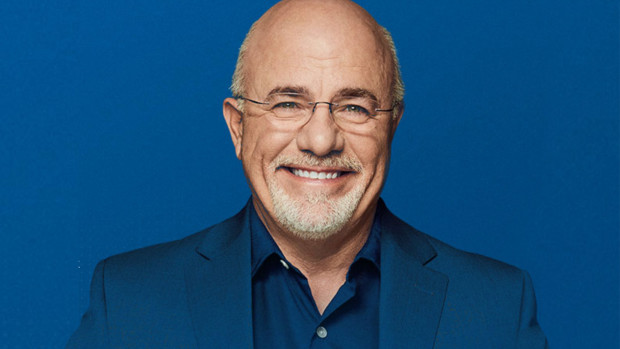

Radio host and author Dave Ramsey has a lot to say about creative ways of making money.

And much of that advice involves understanding that most ventures, no matter how profitable the potential can be, include some challenges.

DON'T MISS: Dave Ramsey Weighs In With Tough Words On Student Loans

For homeowners, there are several ways to supplement one's income, Ramsey says. Some of these are active methods, while others are passive. Sometimes they turn out to be both.

Ramsey uses the term "house hacking" to describe a category of ways for people to earn money on the real estate properties they already own.

"House hacking is when you use your own home to generate passive (or active) real estate income," his website, Ramsey Solutions, explains. "Maybe you convert your basement into a small apartment to rent out, or you rent out an extra bedroom. House hacking also includes buying a duplex and living in one side while renting out the other."

It's important to understand the advantages, as well as the drawbacks, to using these methods.

"The good news about house hacking is you don’t have to search very far for your tenant when the rent comes due," the website says. "The bad news? Your tenant knows exactly where to find you when something goes wrong. And when you're the landlord, something will eventually go wrong."

The Advantages (and Disadvantages) of Owning Rental Property

Ramsey suggests that renting out properties can be a way to generate income, but there are realities involved with doing that as well.

"A lot of people generate extra income by owning single-family homes, duplexes or condos and renting them out on a monthly or 12-month basis," his website says. "But renting out a house isn't for the faint of heart, even if you hire a property manager."

The personal finance personality also mentions a couple more things to consider.

"First of all, you have to pay for that house or condo up front. Do yourself a favor and never buy a rental unless you’re completely out of debt with a fully funded emergency fund and can pay cash for it. If you go into debt to buy a rental, you’re just begging for trouble," Ramsey advises.

"You'll also have the ongoing costs of repairs and maintenance (or the cost of hiring a managing company) to deal with," he adds. "Those fluctuating costs plus property taxes can really eat into your profit."

Deciding When It's the Right Time to Invest in Rental Property

Ramsey has a strict list of things to consider when making investment decisions regarding real estate.

We can’t stress this enough -- any real estate investment needs to wait until you can check off all these boxes:

- You’re completely debt-free -- including your mortgage.

- You have a fully funded emergency fund of 3–6 months of expenses.

- You’re investing 15% of your monthly income into retirement accounts such as 401(k)s and/or IRAs and buying the rental won’t affect your ability to keep that up.

- You have the cash to buy the property in full. No source of passive income is worth going into debt or slowing down progress toward any of your other financial goals!

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.