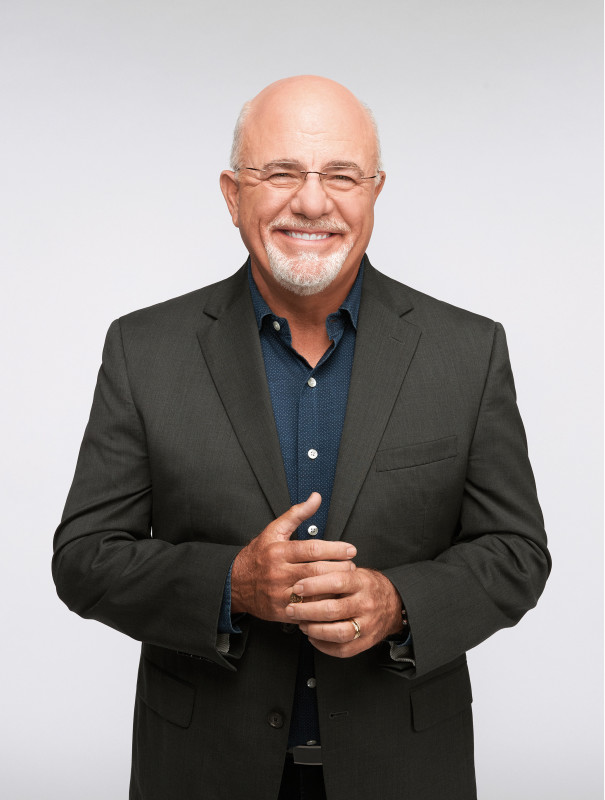

The real estate market is still a mess to navigate, especially if you’re a first-time homebuyer. Ramsey Solutions CEO Dave Ramsey joined The Street to dish out some advice to Gen Z-ers looking to get into the housing market.

Related: Dave Ramsey has blunt words about a huge real estate mistake

Full Video Transcript Below:

CONWAY GITTENS: Let me first start, big picture. What's the thing right now in personal finance that's driving you crazy. The most.

DAVE RAMSEY: Wow Gen Z trying to buy a house. It's really tough. They have these huge increases in prices, particularly in the markets in the South where people have moved to, not from. The prices have gone up, the interest rates have gone up and Gen Z is having a duck fit. Man they are. Drama, drama, drama. They are having a because they think it's going to be this way forever and they think they're never going to get a house and it's freaking them out and they're going to get a house. It's going to be OK. Things will change. But man, it's tough out there right now for that group.

CONWAY GITTENS: So what sort of advice do you have for that group.

DAVE RAMSEY: Just hold tight. Hold your nose. Life is not a snapshot. Life is a film strip. And so when I was 22 years old, it was 1982. Interest rates were 17% on homes. It was crazy. It was the end of the Jimmy Carter era. Before Reagan came into office. And Wow. But life's not that was not defining my whole life. It's not you can't project that and say that's the way it always is. Life's a film strip. The only thing you're 100% sure of is things are going to change tomorrow, so you're going to be OK. Gen z, you're going to get a house, but probably not right now. No w you're sidelined and it's sad.

Watch More Videos:

- New dyslexia treatment aims to overcome biggest hurdle in cognitive healthcare

- How this YouTuber built a huge audience by playing slots

- Yes, there are fewer chips in the bag: Shrinkflation, explained

CONWAY GITTENS: So what do you think in terms of timeline. Is it like five years away for them, 10 years away for them.

DAVE RAMSEY: I have no idea. There's a couple of things going on. We've got inventory shortages and a lot of these markets. So supply demand is driving the price up. And we've also got these interest rates ticking up and we've got this general malaise, this semi, I don't know, bad mood in the economy. Certain areas are booming. Individuals are doing very well in some areas, but there's just not a lot of hope out there everywhere. And so I think when those three things start to heal, then they're going to see we get some inventory up, we see the interest rates maybe tick back down a little bit and people start smiling and are hopeful again and moving around out here in the economy, making decisions to purchase and to take risks again and those kinds of things, instead of sitting with her bottom lip stuck out, then I think then the Gen Z is going to be freed up, but it's going to be OK. It always is.

So, I mean, what do you think is going to make it OK. Is it that the interest rates are going to come down or the prices are going to come down or their incomes are going to go up. I don't see prices coming down. Not with an inventory shortage. Generally, again, basic econ. When you've got a supply that is, you know, you've got a demand higher than a supply, you don't see prices go down, you see prices go up. And so this inventory shortage is going to probably persist. So homeownership is a great thing. We're going to see incomes adjust. People will continue to live their lives. They'll get in a different position. They'll also adjust some of their expectations. The house they thought they were going to live in three years ago, they may not be living in that house as their first one. They may be living a little bit further out of town where prices are a little cheaper. In most markets, they may be making a decision in their career to do something completely different. But it's always been unrealistic to buy a home when you're brand new out of college and an entry level job and you don't have any money.

Related: Veteran fund manager picks favorite stocks for 2024