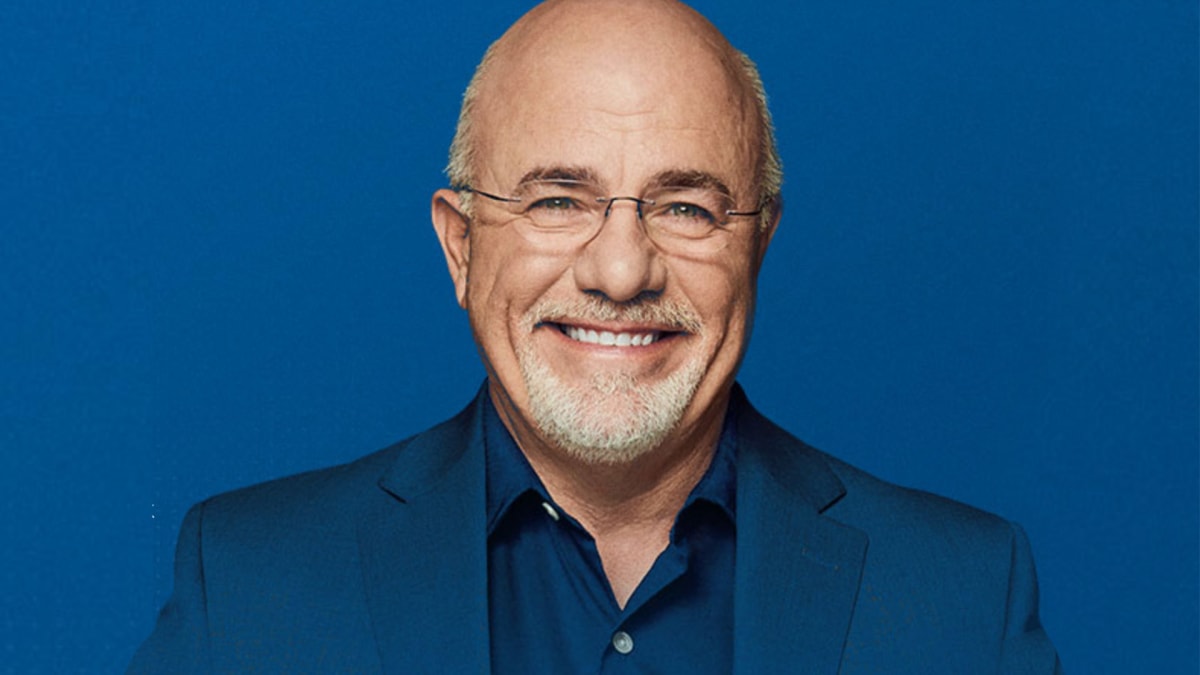

Radio host and author Dave Ramsey has a bold plan of action for getting out of debt.

The personal finance personality crunches the numbers on when it's the right time to sell a home.

DON'T MISS: Dave Ramsey Explains How to Make Money While You Sleep

An advice-seeker asked Ramsey about a home he owns and a large amount of credit card debt he had incurred.

"Dear Dave," he wrote, identifying himself as Jake, according to KTAR News in Arizona. "I’m an anesthesiologist, and I make between $260,000 and $270,000 a year. My wife is a stay-at-home mom who takes care of our preschool-age kids."

"We have about $50,000 in a retirement fund, $50,000 in consumer debt, $220,000 in student loan debt, and we owe $280,000 on our house, which is worth around $500,000," he explained. "We’re thinking about using our retirement fund to pay off credit cards and such, then selling the house and using the money to pay off the student loans."

Ramsey told Jake that he admires him, but also tried to steer him in a different direction to solve his problem.

"Dear Jake," wrote Ramsey. "Wow, I really appreciate your motivation, man. You’re willing to do whatever it takes, and that’s pretty cool. Not many people have the determination to do the kinds of things you’re talking about."

Ramsey explained some of his reasoning about the advice he usually gives people on home ownership.

"I almost never tell people to sell their homes," he wrote. "If you actually can’t afford it, that’s one thing -- and in that case, we'd sell the house. If it's the only way to avoid bankruptcy, we'd get rid of it in a heartbeat."

Ramsey then told Jake about how his circumstances differ from many others in such a position.

"But in your case, things are a little different," Ramsey said. "You’re in a pretty deep hole, but your income as an anesthesiologist gives you a really big shovel you can use to carve out some steps, get up out of that hole, and fill it in so you never fall in again."

Ramsey leveled with him about a behavioral reality he is about to face.

"Now, this is going to mean some real lifestyle changes for a few years," Ramsey said. "I’m talking about beans and rice, and no vacations. There’s no more living like a rich doctor, because you’re not a rich doctor -- you’re a broke doctor."

The radio host spelled out the following plan:

We’re going to temporarily stop adding to your retirement fund, not cash it out, and we’re going to start living on a written, monthly budget where every single dollar is given a name and a purpose.

Cleaning up $270,000 of debt sounds scary. But with a $260,000 income and the other changes we talked about, you could put $90,000 a year toward all this and have it completely cleaned up in just three years. That’s what I’d do if I woke up in your shoes. It will set you free for the rest of your lives to invest and save.

Get on it, doc. You can do this!

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.