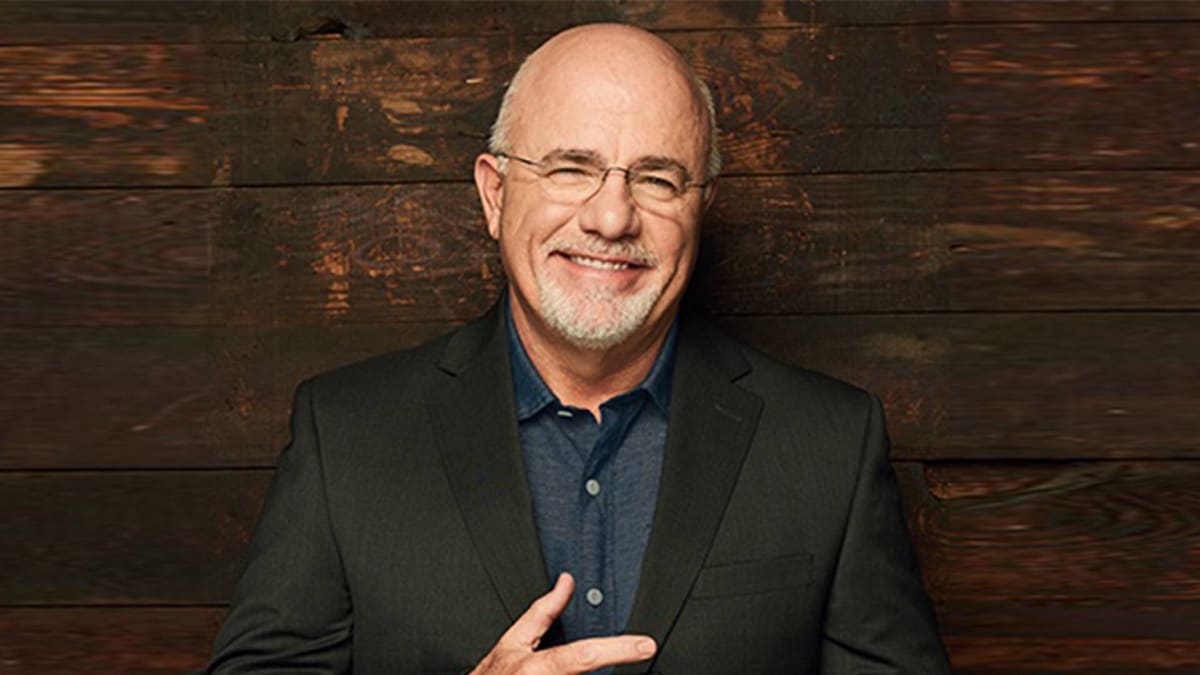

Radio host and author Dave Ramsey says people can react in unnecessarily negative ways to short-term financial losses.

He attributes this to a human tendency to be more dramatic than warranted when facing some challenging circumstances.

DON'T MISS: Dave Ramsey Shares a Blunt Warning With Homeowners

In fact, Ramsey goes as far as to call this impulse a "drama queen" inclination.

A man, identifying himself as Jesse, recently asked the personal finance personality a question.

"Dear Dave," he wrote, according to KTAR News in Phoenix. "I'm 61, and I hope to be able to retire soon, but I'm watching my retirement savings completely eroding away day after day. The only place I’m not losing money is the $180,000 I have sitting in the bank earning almost zero interest. What should I do?"

Ramsey responded, seemingly unimpressed with the advice-seeker's perception of his own financial reality.

"Come on, man. 'Completely eroding away day after day?' That’s a little dramatic," Ramsey wrote. "One of the things you have to understand, and coming to grips with it has helped me since I began doing research on things like this 30 years ago, is we all have a drama queen living in our brain that exaggerates things -- especially when it comes to investing. So, take a deep breath and calm down. Everything’s going to be okay."

Ramsey gets into the psychology of how money losses affect people more than wins.

"Studies have shown us it takes $3 of gain in an investment to emotionally offset $1 of loss," he wrote. "Our brains record negative things at a much greater rate than they do positive things, and it takes a lot of emotion to recover from that.

"Your investments may be down a little," Ramsey continued. "If you’ve got $1 million in there, it may be worth $900,000 right now. Next year, it’s liable to bounce up to $1.1 million. In other words, your entire retirement savings is not 'eroding away.'"

Ramsey closed out his advice for Jesse with three questions and brief statements on each of them. All three have to do with the difference between things people say or believe about their investments and the actual reality of the stock market.

Have you ever heard people say they lost all their money in the stock market? Well, that’s mathematically impossible, unless you put all your money into one company, and that company completely closed and was worth zero.

Remember Enron? What most people really mean when they say that is they lost a bunch of money because they freaked out and went into hyper-drama mode, then pulled all their money out while the market was down.

Jesse, did you know that in the last 20 years, every down year in the stock market was followed by two years of record gains? Facts and mathematics are your two best friends when it comes to telling your inner drama queen, "Shut up, we’re going to continue to invest!"

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.