For those looking to buy a home, timing is crucial. Peak house hunting season is usually in the spring and summer before the school year begins.

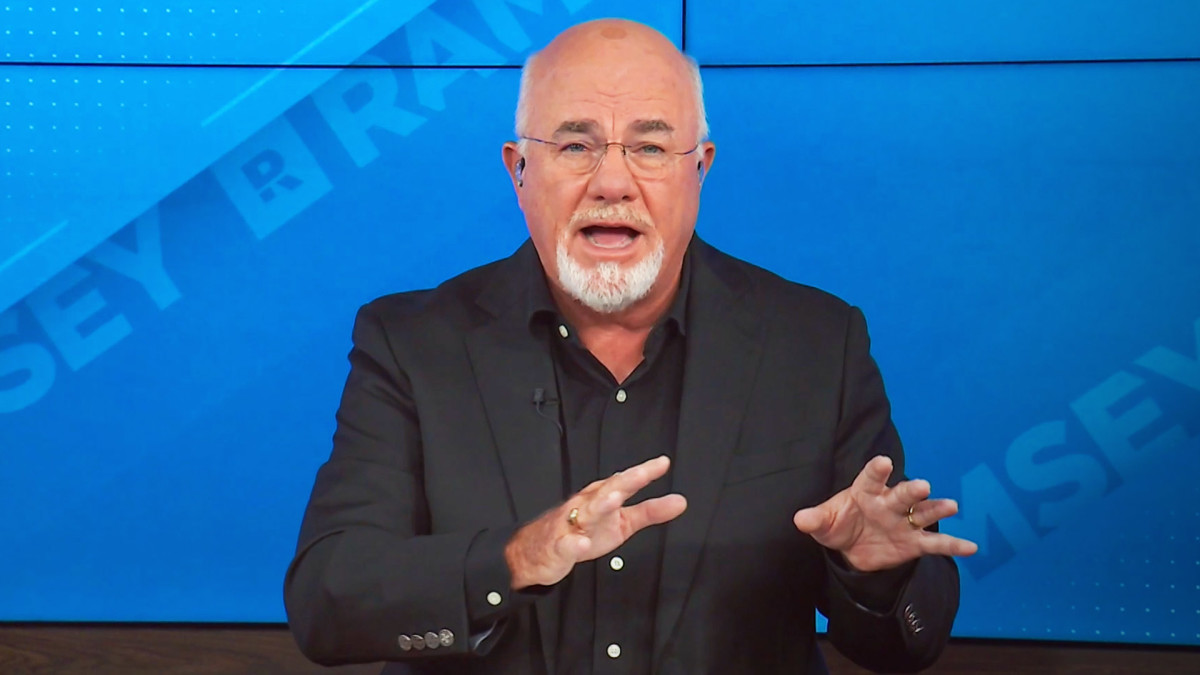

But personal finance expert Dave Ramsey highlights why the colder months don’t have to mean a frigid housing market — and he offers a few key tips on important ways buyers can get their finances in order before making the big financial move.

Don't miss the move: SIGN UP for TheStreet's FREE daily newsletter

First, it's important to note that while the housing market typically slows in the winter, the lower competition can benefit buyers. That's often because sellers are motivated to get their houses off the market and may be more willing to offer deals.

Also, the reduced competition can give buyers more wiggle room to negotiate, and allows lenders and real estate agents to close sales faster than in high-traffic summer months.

However, Ramsey notes that there are a few major things consumers can get in place even before scouting properties.

Getty Images

Dave Ramsey says good financial standing is the key to a housing deal

Although buying a home is often a gateway for building wealth, it’s a multi-decade financial commitment that must be planned thoroughly.

Related: Mortgage rate changes loom amid Fed rate cuts & Trump presidency

Ramsey suggests that prospective home buyers should first pay off any credit card debt, student loans, or auto loans and build up their emergency savings reserve.

Having all debt paid off can also make saving for a substantial down payment easier, which is another essential part of the house pricing equation.

More on Dave Ramsey

- Ramsey reveals blunt new Social Security payment warning

- Dave Ramsey discusses one big money mistake to avoid

- The surprising way your mortgage is key to early retirement

“You need to make a strong down payment when you buy a home because a bigger down payment means smaller monthly payments and less debt overall,” Ramsey wrote. He suggests that all homebuyers aim for 20% down as a general rule but that a 5-10% down payment is acceptable for first-time buyers.

The evidence agrees: Studies show that improving your credit score, paying off debts, and increasing your down payment can reduce your mortgage rate by up to 2%.

Ramsey underscores that the price has to be right: making sure monthly housing payments don’t exceed 25% of your take-home pay will set buyers up for financial success.

Ramsey: Buying a home in the winter can have a significant financial payoff

Though mortgage rates have yet to fall following the Fed's recent interest rate cuts, they are down year-over-year, which shows that the market is headed in the right direction.

Related: Dave Ramsey explains how your mortgage is key to early retirement

Experts anticipate mortgage rates gradually falling early next year, which may make this winter the perfect time to buy a home.

Ramsey highlights that buying a home during a less competitive winter housing market can mean major savings.

The National Association of Realtors estimates that average housing prices in January 2024 were $70,000 lower than in June 2024. Winter housing sales can equate to substantially cheaper monthly mortgage payments, which may be a big selling point for budget-conscious buyers.

Housing sales are estimated to increase 9% year-over-year in 2025, indicating that the market is on the cusp of heating up. Buyers waiting on the sidelines for mortgage rates to taper may want to act soon before consumer demand skyrockets.

Related: Veteran fund manager sees world of pain coming for stocks