Many Americans living paycheck to paycheck find it difficult to regularly put money aside to save and invest for retirement.

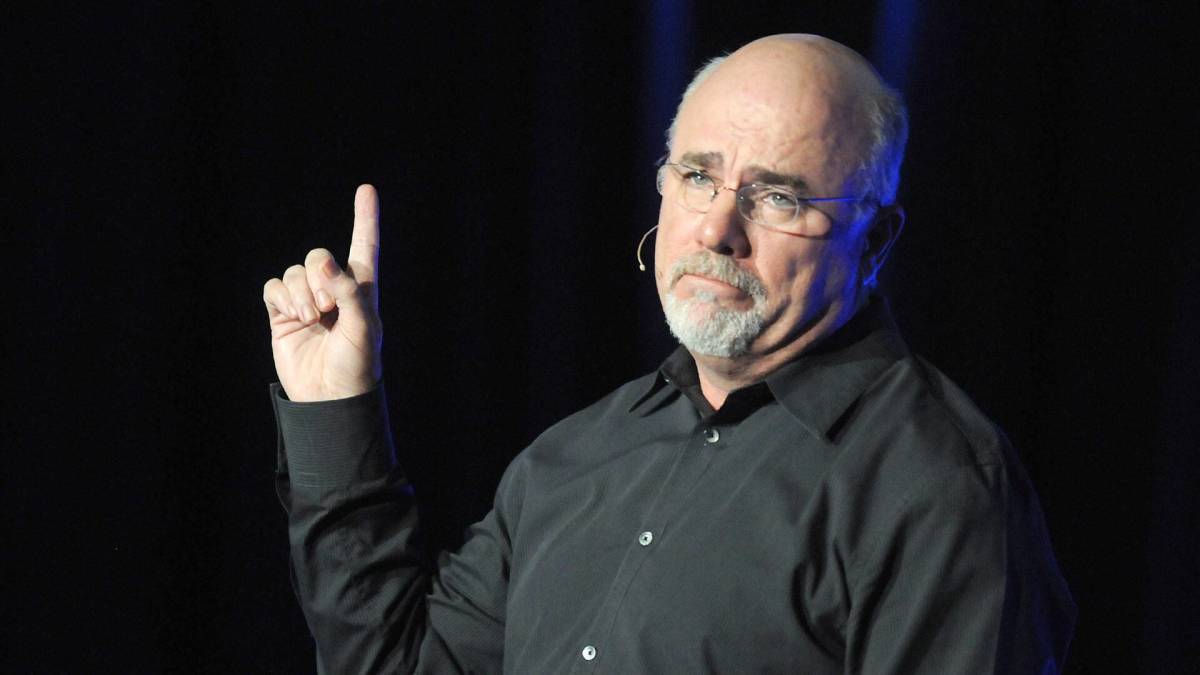

Personal finance author and radio host Dave Ramsey has identified a major cause of this predicament common to a large number of people: car payments.

Related: Dave Ramsey explains the average American's retirement, 401(k) savings

Ramsey believes that a big reason Americans are struggling with paying off their car loans is that they are buying new cars instead of used ones.

The personal finance coach cites data from Experian Automotive showing that 8 out of 10 new cars are bought with a lease, while the average new car loan is more than $40,000 with monthly payments of $738. The data also says new car loans are averaging 68 months in length, or more than five and a half years.

By then, Ramsey says, owners are already thinking about buying a new car and starting the process all over again. And all this money is being spent on new cars that lose 60% of their value after five years.

So Ramsey did some math and looked at how that money could be better spent by purchasing a used car for cash. And the money that would otherwise be geared toward car payments could be used for saving and investing in retirement.

Dave Ramsey says car payments destroy your retirement

Ramsey suggests that not having a $725 per month car payment would allow Americans to invest that money in a 401(k) or Roth IRA. Based on a 12% average annual rate of return, he says, one could retire with more than $8.5 million after 40 years.

Spending that money on car loans instead destroys a person's ability to take advantage of that important opportunity for a financially healthy retirement.

With some sacrifice and discipline, Ramsey says accomplishing this is possible, and he emphasizes that dramatically changing your financial future is worth it in the end.

More on Dave Ramsey

- Ramsey explains one major key to early retirement

- Dave Ramsey discusses one big money mistake to avoid

- Ramsey shares important advice on mortgages

Ramsey imagines a scenario where a person's car is worth $15,000. Rather than buying another new car with a new car loan, the person could keep the car a while longer and put the $725 per month into a money market account.

In two years, that person would have more than $17,000 plus the trade-in value of the car to buy a good used car without owing a cent to a bank.

Jackson Laizure/Getty

Dave Ramsey offers other suggestions for the money not spent on car payments

Once a person begins to understand how good life is without a car payment, Ramsey says, they might even drive the current car a bit longer than two years.

"What if you really get into the spirit of saving and add $725 a month to your fund for five years?" Ramsey asked. "Then — in less time than it would've taken you to pay off a new car loan — you could have $43,500 plus your trade-in to buy a new ride in cash."

Related: Dave Ramsey has new blunt words on workers taking vacation time

Of course, Ramsey does not recommend spending all that saved money on a new-to-you car. Once you've saved enough money for your next car, you would be wise to put that $725 per month toward your retirement savings.

"Getting rid of car payments isn't a fairy tale," Ramsey wrote. "It just takes planning and patience. And isn't your future worth it?"

"No car — no matter how fancy — can give you peace of mind in retirement. That kind of security comes from having a plan and following through with it."

Related: Veteran fund manager picks favorite stocks for 2024