The market is volatile and worried, much of it having to do with interest rates and bank stocks, domestically and abroad.

This month has featured all sorts of negative headlines -- but some stocks continue to power higher.

Don't Miss: GameStop Stock Slams Into Resistance. Can It Overcome?

Broadly speaking, technology stocks continue to trade well despite rising interest rates and multiple bank failures this month.

More specifically, cybersecurity firms have continued to chug higher as business remains strong.

Stocks like Palo Alto Networks (PANW) and Fortinet (FTNT) are hitting multiquarter highs as investors continue to scoop up businesses that have momentum.

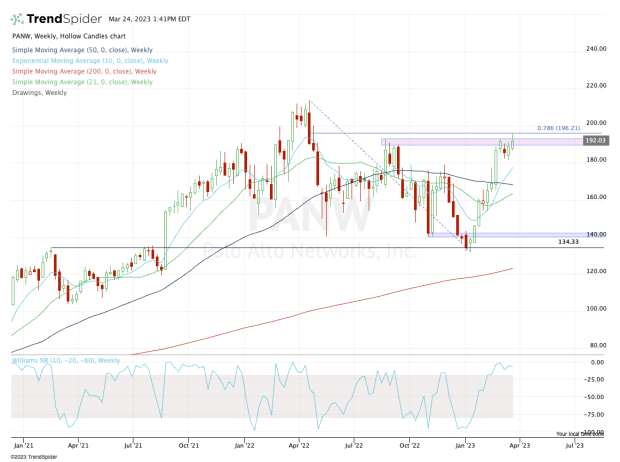

Trading Palo Alto Networks Stock

Chart courtesy of TrendSpider.com

Considered by many the go-to cybersecurity stock, Palo Alto Networks continues to trade incredibly well.

Palo Alto Networks has rallied in nine of the past 11 weeks, marking a stellar rally off the $130 to $135 breakout area.

Don't Miss: Realty Income Pays a 5.1% Dividend Yield; Here's When to Buy the Dip

The stock pushed through $175, but has struggled with the $190 level, perfectly tagging the 78.6% retracement around $196.

Ultimately, the bulls want to see a breakout over this area, opening the door to the $210 region and the all-time high up near $214.

On the downside, a larger correction could put the 10-week moving average and $175 area in play. The bulls will want to see this zone act as support and if it holds, it could set up a buy-the-dip scenario.

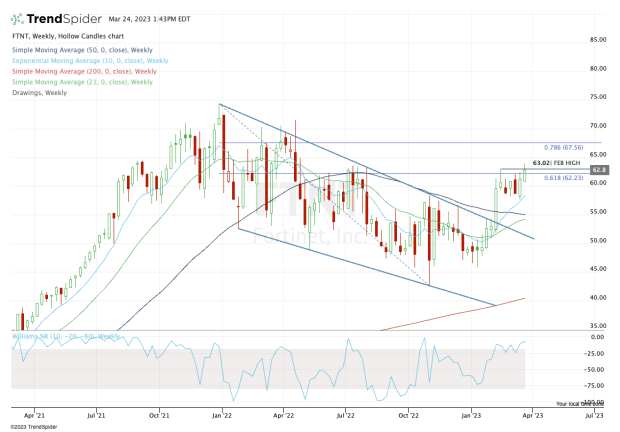

Fortinet

Chart courtesy of TrendSpider.com

Like PANW, Fortinet has traded well lately. The shares broke out of a large downside trend/consolidation pattern by clearing the $55 area and all its major weekly moving averages.

The shares recently rallied off the 10-week moving average after a slight pullback, but are struggling to clear the $62 to $63 region. For what it’s worth, that’s the 61.8% retracement and the February high.

If the stock can clear this zone, it opens the door up to the $67.50 area, followed by a move into the low-$70s.

On the downside, the bulls want to see the 10-week moving average continue to act as support, followed by the $55 area. The latter is particularly attractive if the 21-week and 50-week moving averages converge near this mark.